At Inukshuk Capital Management, our focus is on building lasting relationships rooted in trust and collaboration. By focusing on active risk management and long-term value creation, we help families and institutions achieve financial sustainability.

Stay up-to-date on the latest developments by following us on LinkedIn here.

In this issue:

- Global Equity Market Performance

- The Fed and the Market

- The Fed Now

- Oh Canada

- September So Far

- Wrapping Up

Global Equity Market Performance

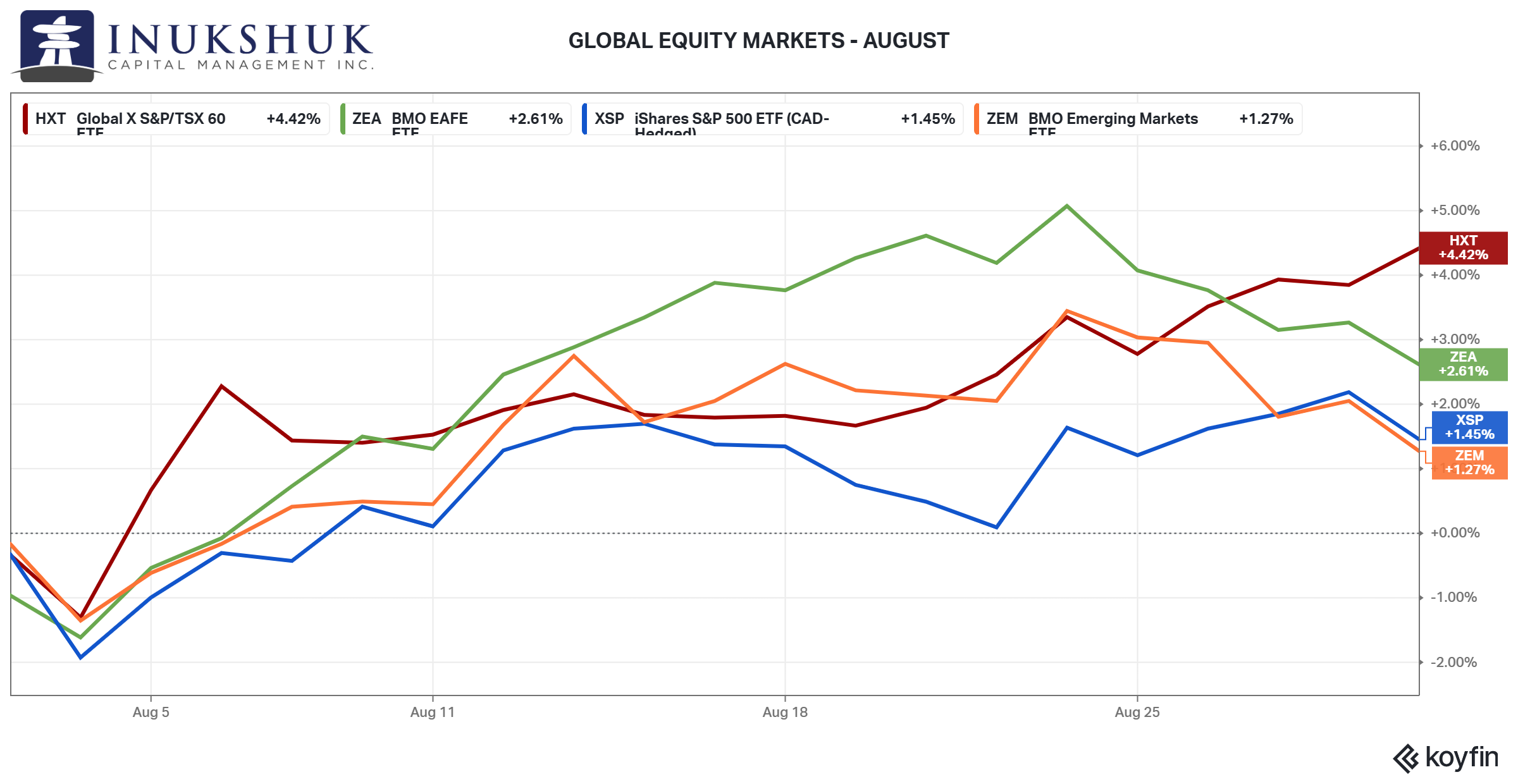

Stocks had a good month, particularly Canadian stocks. The S&P/TSX 60 was up 4.4% on the back of its two largest components, Shopify and Royal Bank rallying 14% and 11% respectively. MSCI EAFE was the second-best performer gaining 2.8%. The S&P 500 and MSCI Emerging Markets were third and fourth, up 1.4% and 1.2%.

As of this writing, the second week of September, our systems are indicating positive momentum in all four equity markets.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here.

This letter revisits the market impact of the Federal Reserve and current trends.

The Fed and the Market

When writing last year’s September letter, the Federal Reserve was anticipated to cut its target overnight interest rate. The odds of a cut from 5.50% to 5.25% or 5.00% were 100%. On September 18 they lowered rates by 50 basis points (bps) to 5.00%. They then cut another 25 bps in November, 25 bps in December and have remained at 4.50% since.

We looked at what happens to the S&P 500 after the Fed starts a rate-cutting cycle. Market pundits at the time were calling for this to boost equity indexes. It’s the same story today.

Here is the performance of the S&P 500 in the year after significant policy easing starts.

There have only been four of these cycles since 2000. In the 2000-2001 and 2007-2008 instances the market was lower a year later. In 2019-2020 and 2024-2025 it ended higher. In both, there were significant drawdowns – the 35% pandemic panic meltdown and the recent 21% tariff tantrum.

It’s a small sample. In all cases, however, an investor who bought the S&P 500 the day of the first cut would have experienced a loss at some point over the following 12 months. And some of those were significant.

Studying small samples to build a strategy is not a good idea. This is simply an illustration of testing popular narratives. As stated, in all four cases you would have been in a losing position at some point. On the other hand (says every economist) if you’re selling stories, you could claim that you were right at some random point over those 12 months.

We will follow up next year to see what the 2026 version of this narrative is. Right now, it’s a repeat of 2024.

The Fed Now

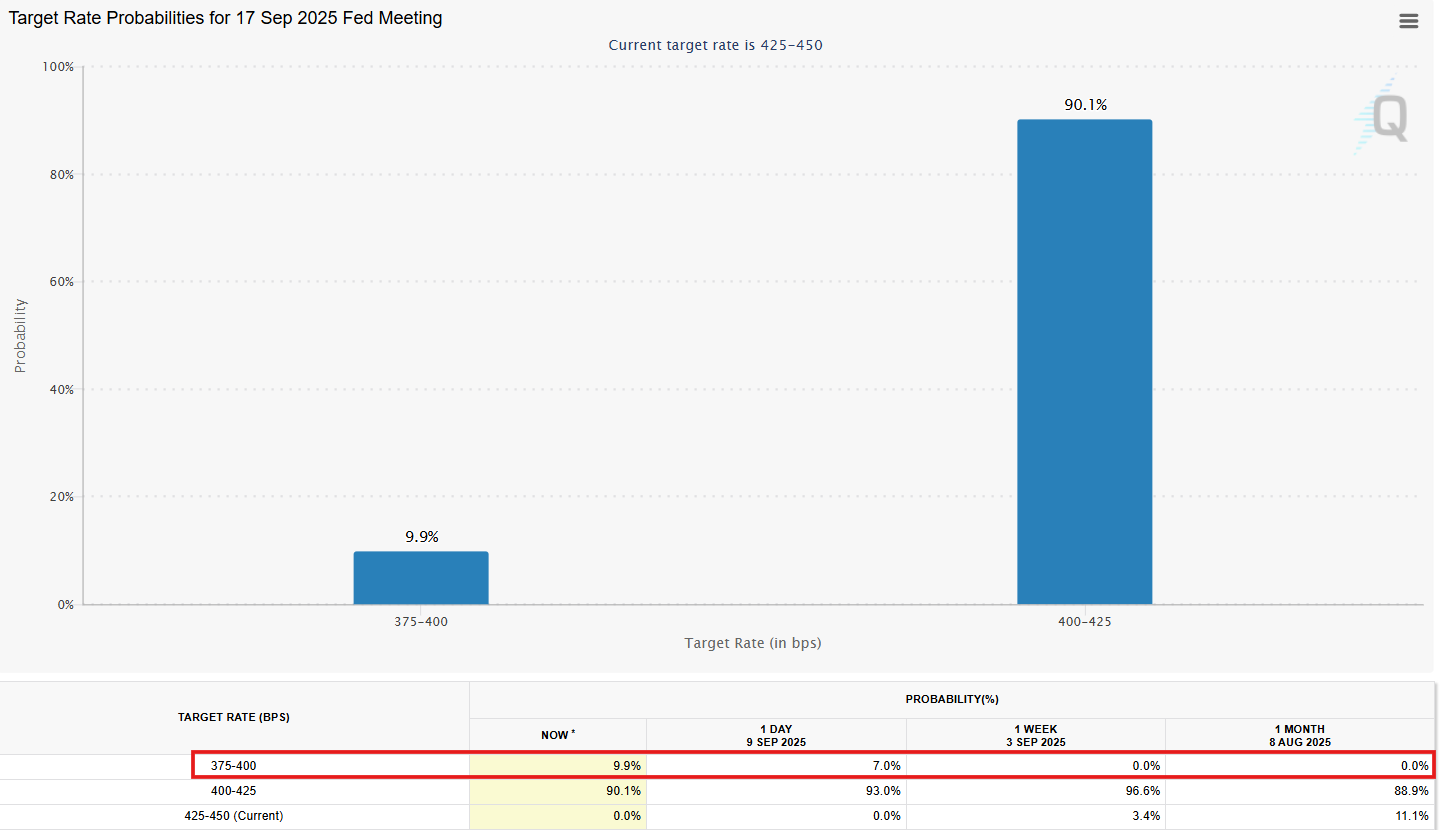

A month ago, the interest rate futures market was pricing zero expectation of a 50 bps rate cut in September. Specifically, the odds were around 11% they would not go at all and 89% they would cut 25 bps. As of this writing, the probabilities have shifted to a higher chance of easing. Now the expectation is 90.1% for 25 bps and 9.9% for 50 bps.

Source: CME Group FedWatch

This shift in expectations came after Fed Chair Powell signalled at the Kansas City Fed’s Jackson Hole Economic Symposium, August 22, that interest rates were going lower.

As we’ve seen, that may not mean much for the stock market over the next 12 months. What it may mean is Canadians will get some more interest rate relief. Central bankers tend to move as a group. What do you call a group of central bankers?

Oh Canada

The Bank of Canada will announce their interest rate decision on the same day as the Fed.

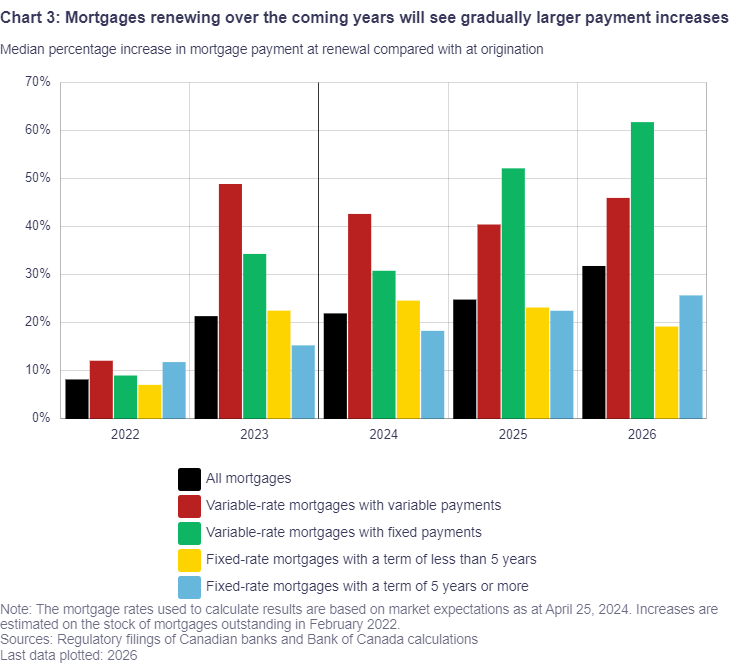

In our June 2024 letter, we wrote about the amount of mortgage rate resets that Canadians would face this year and into 2026.

In the Bank’s May 2024 Financial Stability Report they estimated that: About half of all outstanding mortgages are held by borrowers who have yet to face higher rates because their payments were fixed for five years…

They estimated that mortgage payments on all types of mortgages would increase by 25% to 32%. With the worst increase being variable rate mortgages at between 40% to 60%.

Source: Bank of Canada, Financial Stability Report, May 2024

At the time of that report the Bank’s target overnight interest rate was 5.00%. It now stands at 2.75%. Those interest rate cuts have offered some relief for those who had to renew their mortgage over the past year and a half. Looking at market expectations there’s a good chance more is to come.

September So Far

On September 5, the Canadian Labour Force Survey was released. It showed that the unemployment rate has risen to 7.1%. That’s the highest since the pandemic years. It’s estimated 66,000 jobs were lost in August after a loss of 41,000 in July. That should provide some motivation for a rate cut.

On September 8, Israel Defence Forces conducted air strikes targeting Hamas leadership in Qatar escalating the fight against the terrorist organization.

As of September 12, the S&P 500 and the S&P/TSX 60 have made new all-time highs and are both up more than 2% on the month.

Wrapping Up

Equity markets have rallied relentlessly since the April tariff tantrum. Bad news has had very little lasting effect.

We came across a National Bureau of Economic Research working paper, published on April Fool’s Day that studied browser data from a sample of individual investors to determine their research habits.

They found that:

The median individual investor spends approximately six minutes on research per trade on traded tickers, mostly just before the trade; the mean spends around half an hour. Individual investors spend the most time reviewing price charts, followed by analyst opinions, and exhibit little interest in traditional risk statistics.

As we wrote last month, retail investors are a growing and significant share of market participants. Buying every dip is being rewarded.

Our systems measure momentum in broad equity market indexes. That’s somewhat different than looking at stock charts. More importantly, we quantify the potential risk of loss in those markets. We focus on sticking to the process in a disciplined manner.

In a Financial Times interview in July 2007, Chuck Prince, then the CEO of Citigroup said: When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance. We’re still dancing.

Shortly after that, things got “complicated”.

No one knows how long equities will continue to trend higher, they will until they don’t. When the music stops, retail investors might have to take off their dancing shoes and go back to school.

Have a question? Contact us here

Challenging the status quo of the Canadian investment industry.