At Inukshuk Capital Management, our focus is on building lasting relationships rooted in trust and collaboration. By focusing on active risk management and long-term value creation, we help families and institutions achieve financial sustainability.

Stay up-to-date on the latest developments by following us on LinkedIn here.

In this issue:

- Global Equity Market Performance

- Tariffs

- Trade

- Tactics

- Strategy

- Wrapping Up

- Wealth Longevity – Sticking to a Plan

Global Equity Market Performance

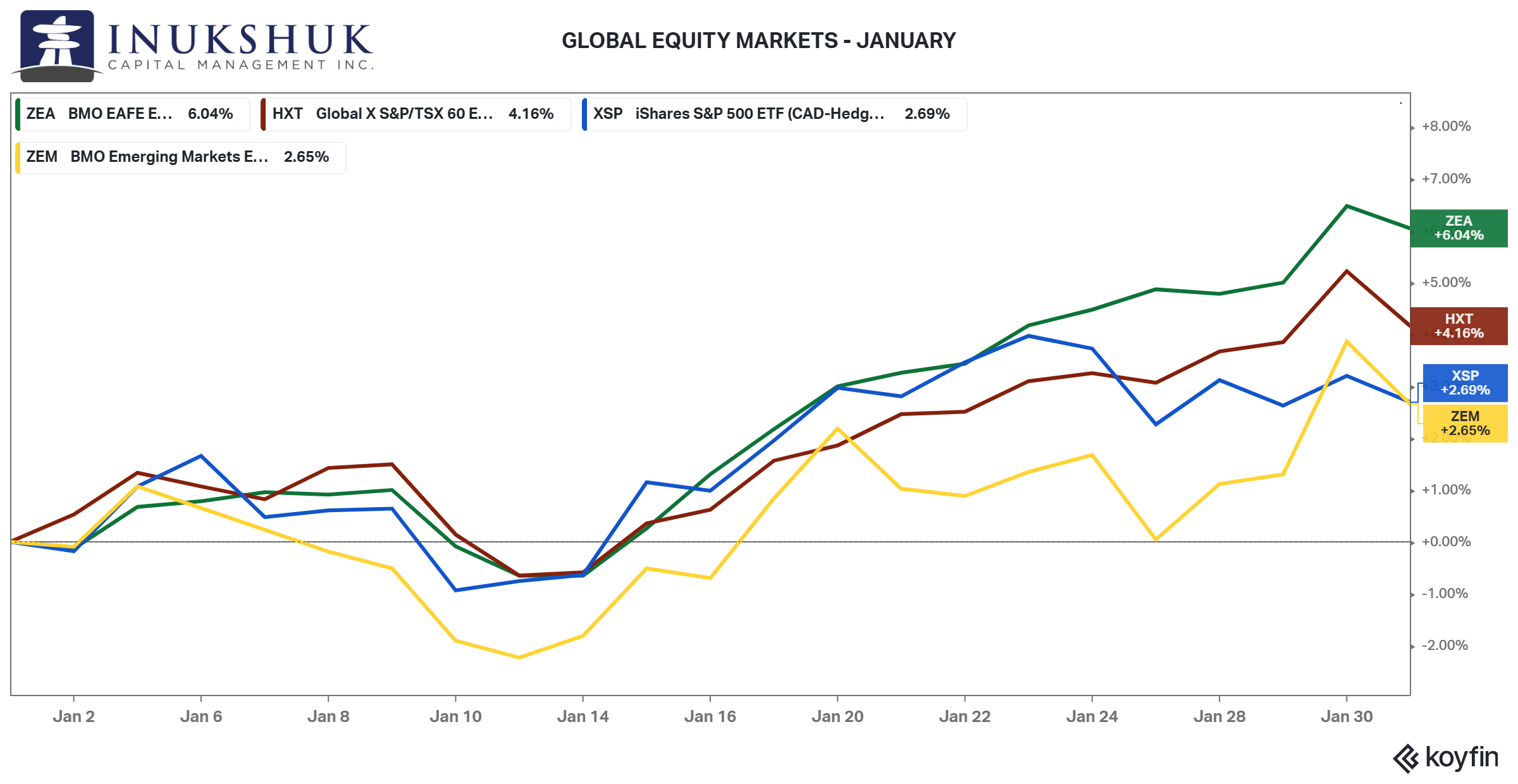

The beginning of 2025 was a good start for equity markets. For the second month in a row however, North America trailed the rest of the world. All four global market indexes were up with MSCI EAFE leading the way, gaining 6%, the S&P/TSX 60 4.1%, S&P 500 2.7% and Emerging Markets 2.6%.

That’s a good result considering the AI panic that erased $600 billion from Nvdia’s market cap on January 27. The biggest one-day loss in history.

Our systems remain fully long both the S&P 500 and the S&P/TSX 60.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here

Recently, our clients, the media and markets have been worrying about tariffs. While we offer no predictions, some facts could put things into context. This may help to navigate a complex issue and offer some guidance for what to do. If anything.

Tariffs

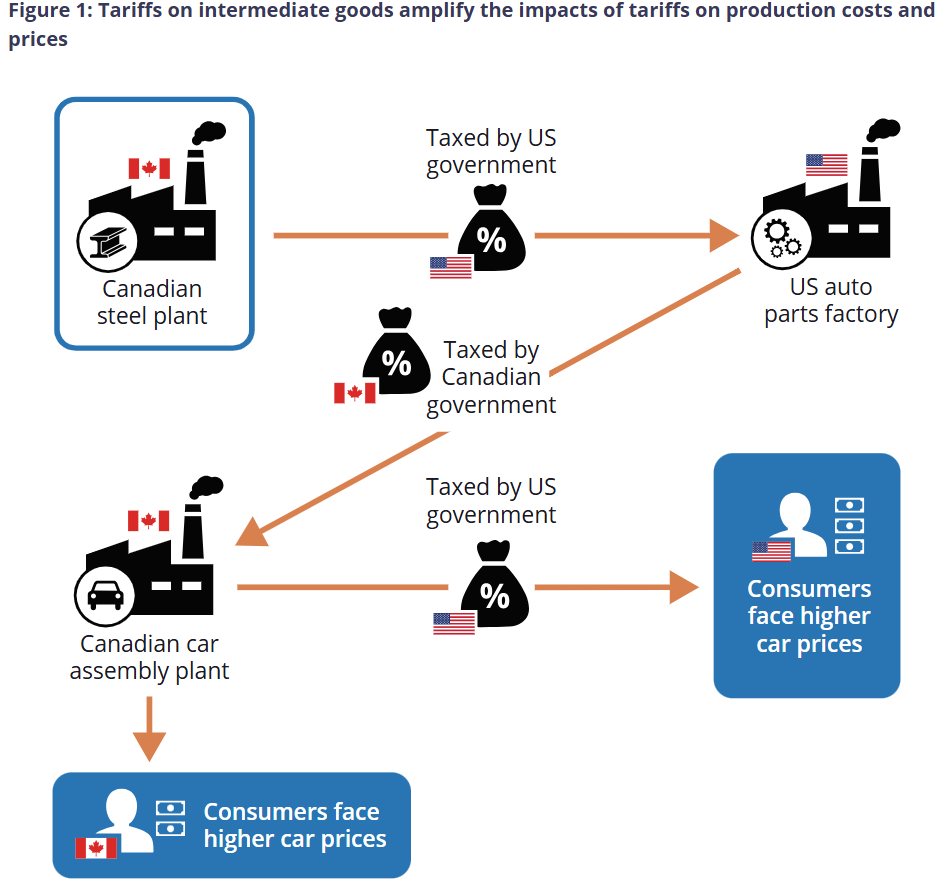

In the Bank of Canada’s January Monetary Policy Report the connections between Canada-U.S. automobile production were highlighted. It is a large component of both economies and is a tightly coupled system.

That is the simplest way to show that tariffs hurt consumers and industries in both countries.

Let’s look at the amount of trade Canada and the U.S. engage in.

Trade

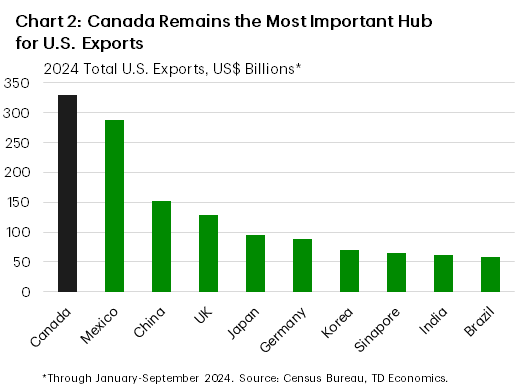

North America is the largest free trade region in the world. Our economy is highly integrated with the U.S. A recent TD Bank report noted that Canada is the U.S.’s largest export market.

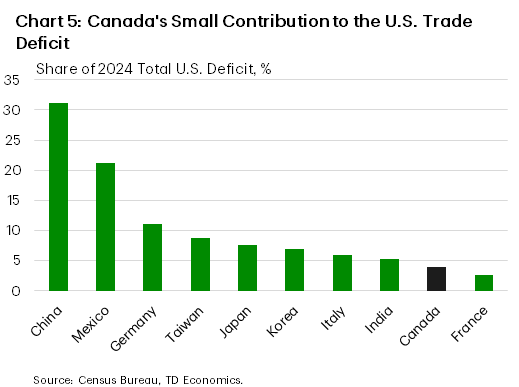

The same report also shows that we are the second lowest ranked contributor to the U.S. trade deficit.

According to TD, if you exclude energy, that flips to a surplus of around $45 billion U.S. dollars.

We may be the largest export market for the U.S., but small relative to its GDP of more than $27 trillion. They matter more to us than we do to them.

Something doesn’t make sense if this issue is viewed solely from a trade perspective.

To try and figure this out, maybe there are clues in the actions of Trump v1.0.

Tactics

The Tax Foundation, a U.S. policy organization, recently reported the history of tariff-related measures of the first Trump administration.

Here is the timeline on steel and aluminum.

- In March 2018, President Trump announced the administration would impose a 25 percent tariff on imported steel and a 10 percent tariff on imported aluminum.

- In May 2019, President Trump announced that the US was lifting tariffs on steel and aluminum from Canada and Mexico.

- In August 2020, President Trump announced that the US was reimposing tariffs on aluminum imports from Canada. About a month later, the US eliminated the 10 percent tariff on Canadian aluminum that had just been reimposed.

If anyone reading this is confused by recent announcements, they have not been paying attention. Or aren’t familiar with poker.

On Super Bowl Sunday Trump announced 25% tariffs on both metals. The U.S. imports 60% of its aluminum and 23% of its steel from Canada. From the Canadian perspective, roughly 90% of the steel and aluminum we produce is shipped to the U.S.

There is reason to be concerned. There is also reason to remain level-headed when attempting to handicap the economic effects of these policies. That’s difficult to do if you have no idea they will be implemented.

What to do from an investment standpoint?

Strategy

The Trump election campaign emphasized ‘America First’. There were hints of protectionism. If you believed you’re well informed and had some insight you might have thought – this could hurt markets, I’ll sell some stocks.

That would’ve been a bad decision. Since the election, the S&P/TSX 60 has outperformed the S&P 500 by almost 2%. And is up, outright, more than 6%.

There are media and analyst reports that tariffs are inflationary, and commodities are a good play to defend against that. Let’s see how that would have gone.

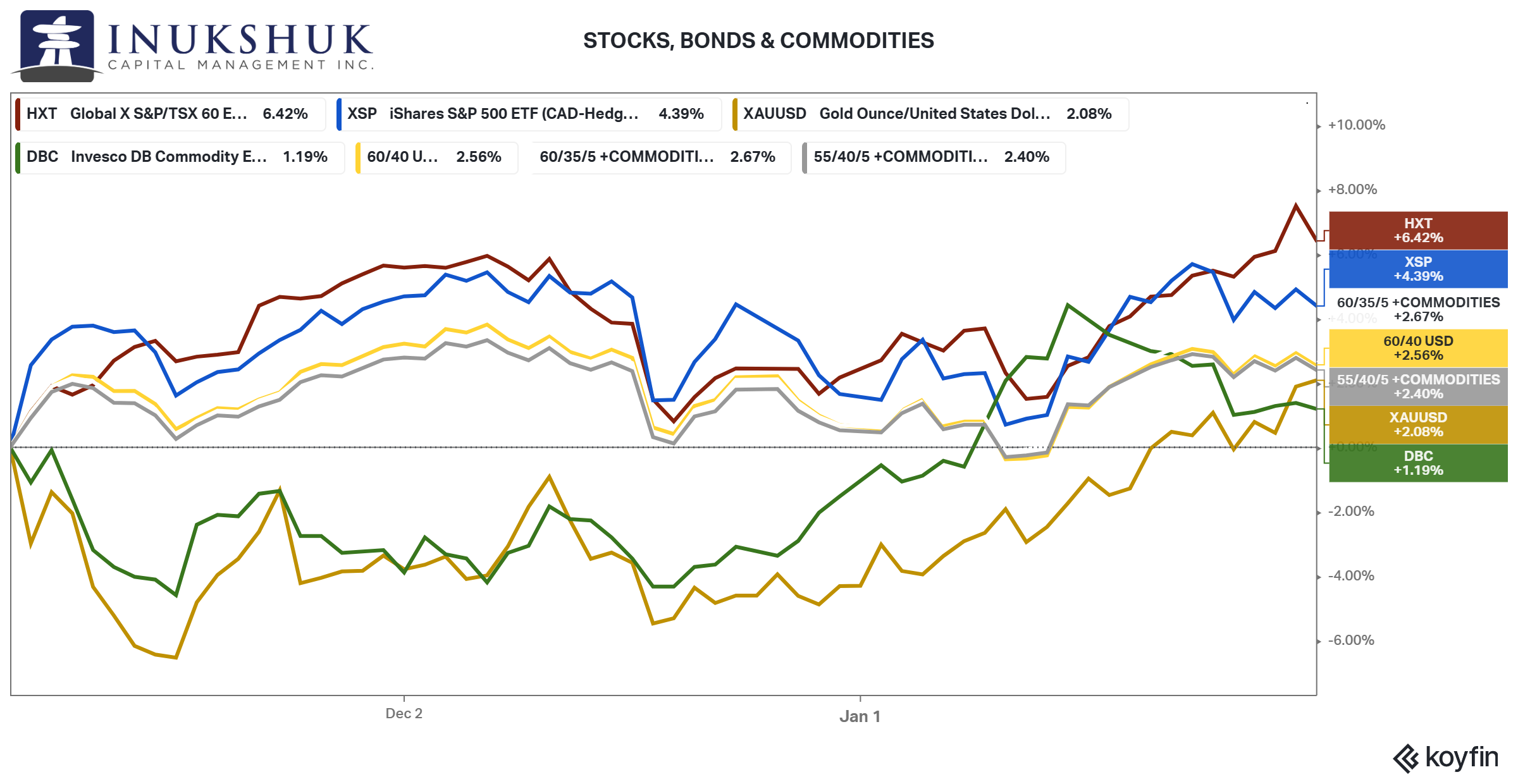

We did a simulation by comparing a traditional 60% equity 40% bond portfolio (60/40) with two alternatives. In the first, take 5% of your stock allocation and buy commodities (55/40/5). In the second, sell 5% of your bonds and buy commodities (60/35/5).

Since the election, neither move would have made much difference.

You would have faired nine basis points better if you switched that 5% from bonds and 16 basis points worse if you switched from stocks.

That’s a sample size of one, but it is what just happened.

Going back to 2022, when inflation was dominating headlines and both stocks and bonds had a brutal year, the result is similar.

The standard 60/40 portfolio had a 20% drawdown, 60/35/5 lost 19% and 55/40/5 lost the same.

Every time there is a theme or an idea, someone wants to sell you something. Often, it’s not something you should buy.

Is there something Canada could do?

Wrapping Up

Sometimes a situation presents a wake-up call.

Canada should wake-up to the discussion of interprovincial trade barriers.

The Financial Post recently reported:

A 2022 study by the Macdonald-Laurier Institute, based on research done by University of Calgary professor and economist Trevor Tombe, found that the country’s GDP is between 3.2 per cent and 7.3 per cent smaller because of internal trade costs.

We can’t trade freely amongst ourselves.

It’s understandable to be angry at threats from the most powerful nation on the planet. We should also reserve a bit for the mismanagement of our economy.

Fixing this could offset some of the negative effects of tariffs, if they are imposed.

We will stick to our plan and let our systems manage risk. Maybe the government should actually develop a plan and implement it to improve Canada’s internal trade system.

It’s good to have a plan.

Read further if you want some reminders of why it’s important to have a plan and adhere to it.

Wealth Longevity – Sticking to a Plan

Investing, like policymaking, benefits from discipline and long-term thinking. When uncertainty rises – whether from tariffs, elections, or economic slowdowns – investors often feel pressure to react. But as history shows, knee-jerk decisions based on short-term headlines rarely pay off.

The key to long-term success is having a well-thought-out strategy and sticking to it. That doesn’t mean being passive in the face of change, but rather making informed, measured adjustments when the data – not emotions – suggest it’s necessary.

Take market downturns, for example. Investors who abandoned equities in 2022 after a brutal year for both stocks and bonds would have missed the strong recovery that followed. Those who stuck to their plan, maintaining diversified portfolios with risk management in place, were better positioned for the rebound.

The same principle applies to economic policies. A country without a coherent plan reacts rather than leads. Whether it’s managing trade relationships or eliminating barriers within its own borders, the ability to follow through on a strategy separates success from stagnation.

For investors, the best approach is to have a clear, rules-based framework that accounts for risk while keeping an eye on long-term objectives. The world will always present challenges, but those who stay the course, adjusting when necessary rather than panicking, tend to come out ahead.

Have a question? Contact us here

Challenging the status quo of the Canadian investment industry.