Playing With Fire

We built Inukshuk Capital Management to serve the needs of clients looking for a unique approach – void of conflicts of interest, commission sales and pushed products. We began by putting our own money where our mouth is. With low fees and active risk management, we help families achieve financial longevity, that’s the bottom line.

Stay up-to-date on the latest developments by following us on LinkedIn here.

September 2023: Playing with Fire

In this issue:

- Global Equity Market Performance

- Fixed or Floating

- Fed Funds

- Fire Starter

- Fire Embers

- Wrapping Up

- Health is Wealth

GLOBAL EQUITY MARKET PERFORMANCE

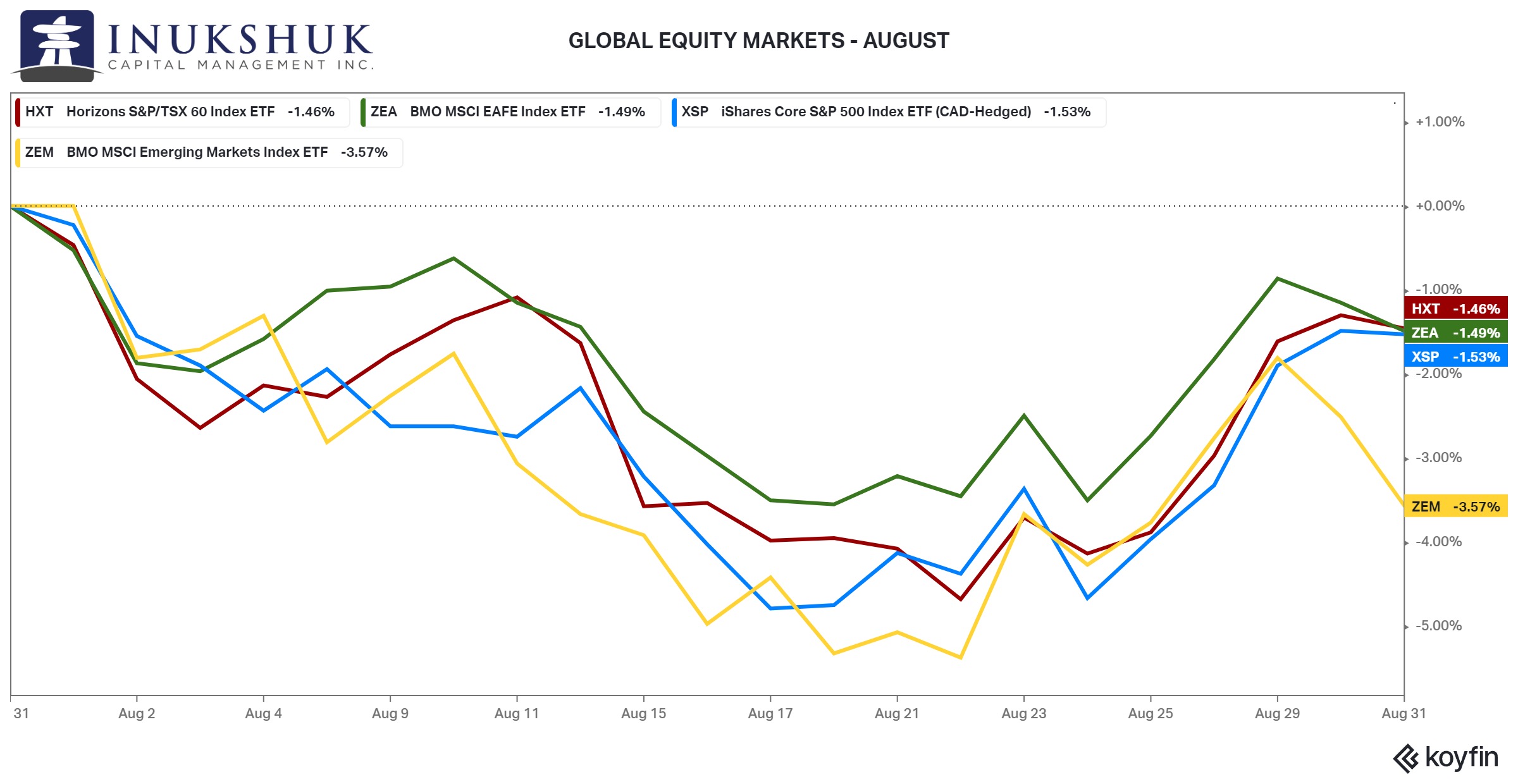

August was precisely the opposite of July in terms of the ranking of global equity market performance. Emerging Markets were the worst, down 3.5% after an impressive 4.9% rally the month before. MSCI EAFE (Europe, Asia the Far East and Australasia), the S&P 500 and the S&P/TSX60 all fell around 1.5% in order after closing 2-3% higher in July.

Our systems continue to remain fully long the S&P 500 and S&P/TSX60 although some warning signs are developing for Canada.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here .

FIXED OR FLOATING

In July we covered the impact on Canadians’ finances due to federal government policy and the Bank of Canada’s interest rate hikes.

Lately, the discussion of what to do with mortgage renewals is a concern for many friends and family – fixed or floating is the question.

The following is not advice. It is simply a description of the state of market expectations of what central banks may do, how this has evolved over time and what has happened in the past.

Reminder: the Bank of Canada is the primary determinant of mortgage rates.

FED FUNDS

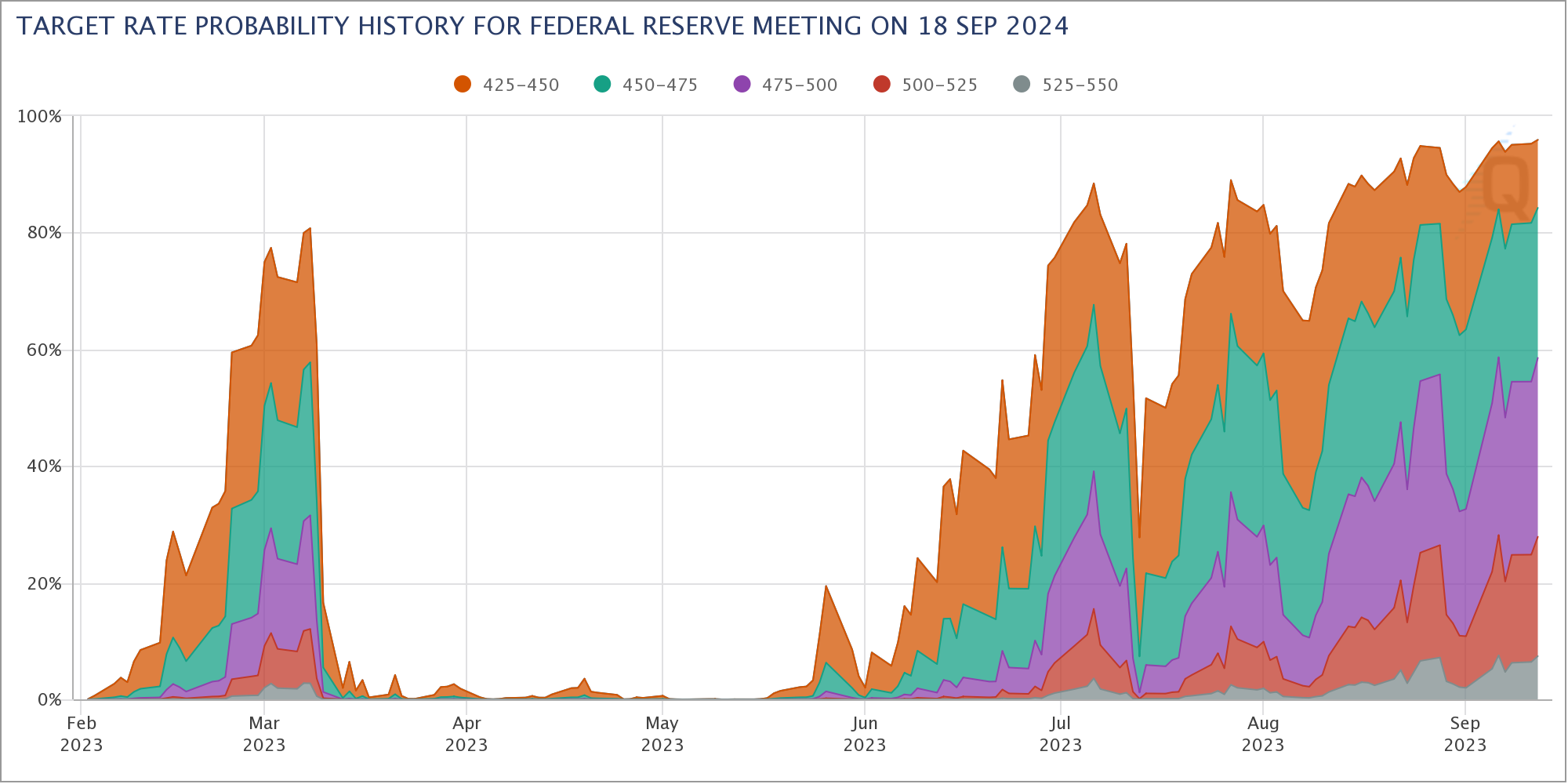

As recently as June the Fed Funds market ‘thought’ there was an almost zero chance the Federal Reserve would cut the current 5.25-5.50% target rate by September 2024. Since then the probability of holding at this level or dropping rates lower has climbed to over 90%. The odds of a rate hike by next year at this time are 0.1%.

Source: CME FedWatch Tool

FIRE STARTER

Tiff Macklem, governor of the Bank of Canada, along with his vast team of economists and deputy governors has engaged in the most rapid series of hikes in the Bank’s history. After keeping rates at very low levels for an extended period of time the Bank went from 0.25% to 5.00%.

At the most recent meeting they paused.

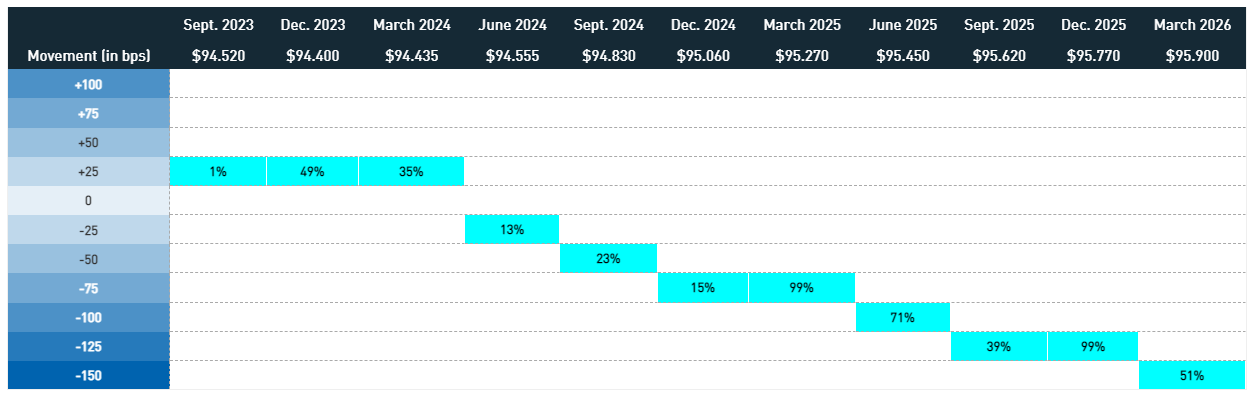

Interest rate expectations have shifted accordingly. It looks as though it is fifty-fifty for another 25 basis points by the end of this year but then that is it.

Source: TMX Montreal Exchange implied short-term interest rate movements and probabilities based on BAX prices.

More importantly the odds of them not moving or cutting rates by this time next year are increasing. Futures are priced to guess they will cut at least 75 basis points by March 2025.

Mister Market looks like it thinks Tiff is playing with fire and is going to get burned. Not him, the economy. No consequences ensue for the policy types. They get to make errors for free. We all know this, why we tolerate it is a whole other discussion.

FIRE EMBERS

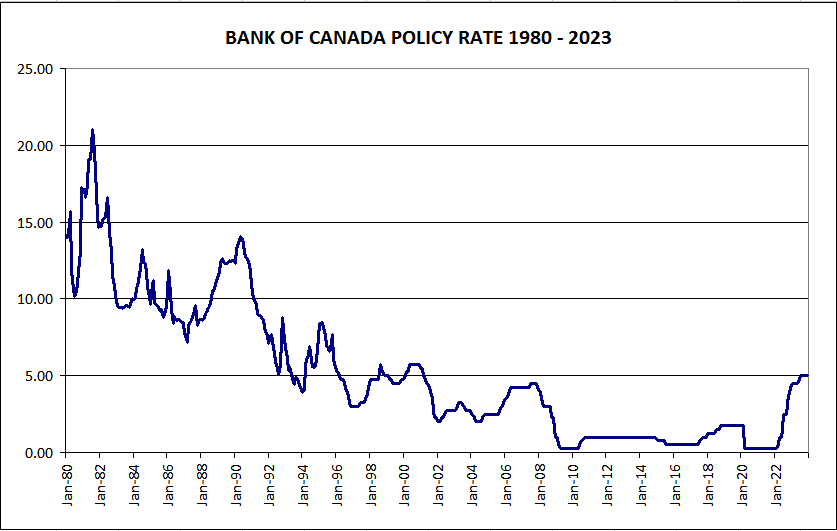

There is something more than current market expectations to offer some optimism to those who are getting hurt by this increase in interest rates. Looking back to 1980, when the Bank starts cutting rates they keep on cutting.

Source: Bank of Canada

From 1981 to 1983 the target rate went from over 20% to under 10%. The next big policy easing move over 1990 to 1992 took rates from around 14% to 5%. More recently (getting old) starting in 2007 to 2009 the Bank cut 425 basis points from 4.50% to 0.25%.

Will this time be different?

WRAPPING UP

Last month we ended our letter with the recommendation that due to perceived market risks, we stay frosty. Our systems are saying the same thing – makes sense, we designed them.

Funny the reason for that concern may have its origins in policy makers playing with fire.

This reminds our resident music nerd of a song by Pixies (according to him one of the top-ten bands of all time) titled ‘Dig for Fire’ – but in the opposite way of Canada’s policy makers.

Its message seems to be: it’s not important what people perceive what you are up to but what you are trying to do in reality that is important. In this case – find what makes you happy, a purpose and then pursue it regardless of what all others think.

We do that.

There is this old man who has spent so much of his life sleeping that he is able to keep awake for the rest of his years

He resides

On a beach

In a town

Where I am going to live

And I often ask him: are you looking for the mother lode?

No, no, my child, this is not my desire and then he said…

I’m digging for fire

It’s not for everyone, but there is a message here. Keep going.

HEALTH IS WEALTH

Longevity: A Diversified Portfolio of Health and Wealth

Some of you may have one of our limited-edition t-shirts that proudly proclaim “Longevity” on the front. It’s a word that embodies our aspiration for a long and prosperous life, both in terms of health and finances. At ICM, we firmly believe in the adage that “Health is Wealth.” Today, I am going to cover the topic of Longevity, drawing inspiration from Dr. Peter Attia’s best-selling book, “Outlive.”

Dr. Attia shifts our focus from mere lifespan to “health span.” Just as in the realm of personal finance, it’s the choices we make along the way that ultimately determine our well-being and wealth over time. One obvious parallel between financial planning and longevity is that it’s never too late to start.

Many of us may have picked up “Outlive” with hopes of discovering a wonder drug, miracle vitamin, or a revolutionary diet that promises to extend our health span. However, in the pursuit of longevity, exercise takes center stage. Dr. Attia refers to it as the most potent “pro-longevity drug” available. But here’s the catch—it must be complemented by good emotional health to achieve optimal results.

Exercise isn’t about becoming a professional athlete. Start small, with a daily walk or a few minutes of stretching. Gradually increase your activity level, and remember, consistency is key. Just as you invest money regularly to build wealth, invest time in your physical well-being to extend your health span.

Sleep and nutrition are two other critical variables in the equation of a long health span. Just as we carefully manage our financial assets, our bodies require proper care to thrive. Quality sleep and a balanced diet play pivotal roles in maintaining and enhancing our overall well-being.

Sleep isn’t a luxury; it’s a necessity. Prioritize good sleep hygiene—create a bedtime routine, limit screen time before bed, and ensure your sleeping environment is conducive to rest. Sleep is when your body repairs and regenerates, a crucial factor in the quest for longevity.

A well-balanced diet doesn’t mean deprivation. It means nourishing your body with a variety of nutrient-rich foods. Think of it as diversifying your health portfolio. Include plenty of fruits, vegetables, lean proteins, and whole grains. Minimize processed foods and excessive sugar intake. Just as you make thoughtful financial choices, make mindful choices when it comes to your plate.

Dr. Attia’s insights remind us that the pursuit of a longer and healthier life is both a science and an art—one where exercise, emotional well-being, sleep, and nutrition intersect to create well-being.

Invest in Your Potential for Longevity

Our journey to a longer, healthier life begins with a single step. It’s easy to be overwhelmed by the prospect of making significant changes, but the key is to start small and build gradually. Just as financial prosperity is built over time, your health span can be improved day by day.

Don’t fall into the trap of assuming it’s too late to make a difference. There are actions we can take today to positively impact our tomorrow; the most important thing is willingness. We all have the potential to improve our life span. I find practicing healthy living enjoyable and a worthwhile effort for years of vibrant health, fulfilling experiences, and precious moments with loved ones.

Start now, build gradually, and unlock the secrets to a longer, healthier, and wealthier life. Your journey toward longevity and well-being begins today.

‘You have to sustain it, to maintain it’

Victoria Bannister

ICM Health Ambassador

Have a question? Contact us here

Challenging the status quo of the Canadian investment industry.