IG: @bcormier_art

We built Inukshuk Capital Management to serve the needs of clients looking for a unique approach – void of conflicts of interest, commission sales and pushed products. We began by putting our own money where our mouth is. With low fees and active risk management, we help families achieve financial longevity, that’s the bottom line.

Stay up-to-date on the latest developments by following us on LinkedIn here.

September 2022: New Complaints

In this issue:

- Global Equity Market Performance – August

- History

- What is Going On

- What is Inflation?

- Time and Money

- Inflation and Humans

- Reality

- Summing Up

- Health is Wealth

GLOBAL EQUITY MARKET PERFORMANCE – AUGUST

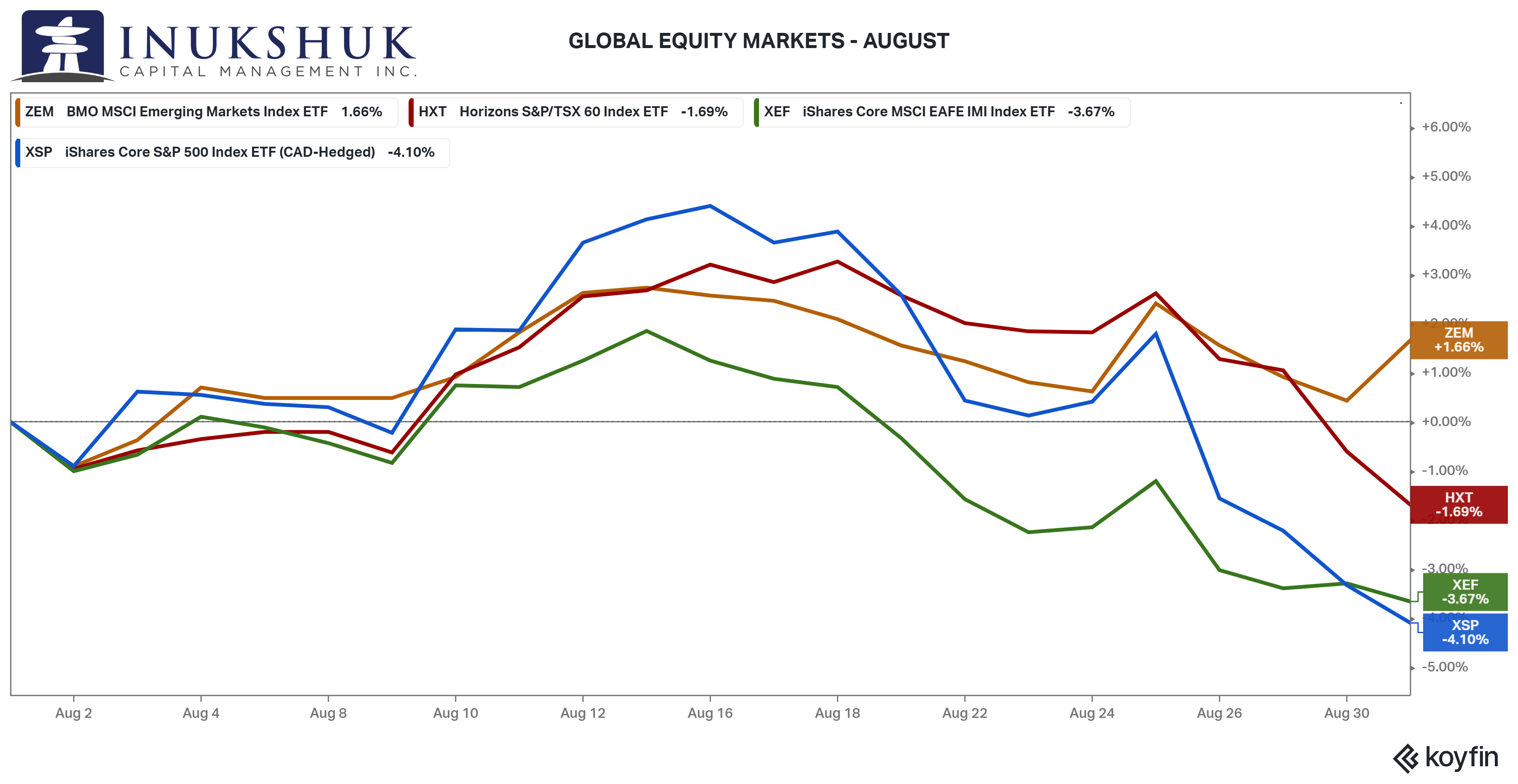

August was quite the rollercoaster ride. Continuing the July rally (+9.1%), the S&P500 was up another 4% by mid-month and then closed down roughly the same. EAFE (Europe, Australasia and Far East) performed a similar round trip, but with less upside, and finished the month down 3.6%. Emerging markets actually held onto gains of 1.6%, while the S&P/TSX60 was second with a loss of 1.7%.

On the day of this writing, Sept. 13, the S&P500 was down 4.3%, the worst day of a year of bad days. Our systems had a brief signal of optimism in Emerging Markets in mid-August, but that has since gone to caution. The S&P500 had a similarly, but weaker, brief positive signal, which has also faded. Canada and EAFE are still in high-caution mode.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here

HISTORY

We are always interested in history. Our models are based on historical price data. So, it is natural to ask: Is this similar to any other price-action in the past?

We wrote about just that in the Halftime Report in July. Click to read if you want some further background on the work we do.

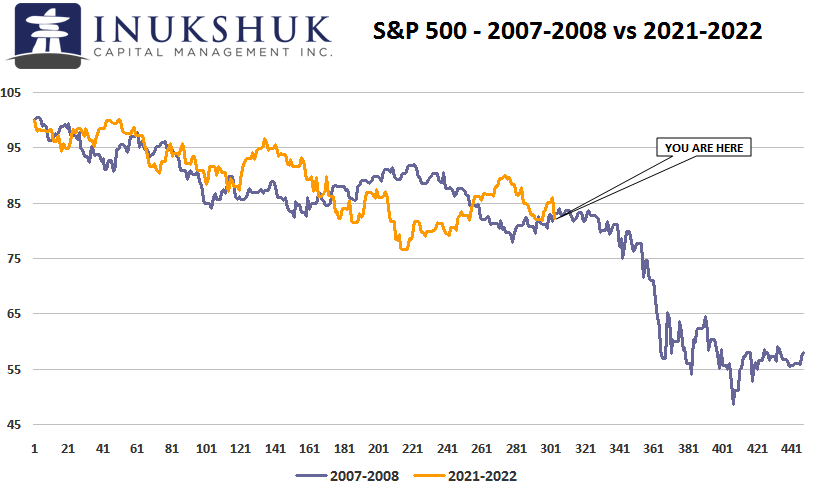

In this thought experiment, let’s look at what happened after the S&P500’s all-time high in 2007 and compare it to its most recent all-time high in January of this year.

It’s fairly obvious this is a different path, but the interesting thing is – at the same day-count from the all-time high, the two are at almost the exact same point.

WHAT IS GOING ON

Market participants (there has to be a better word) are attempting to figure out how the various central banks around the world will address inflation. It seems recent worries are related to expectations that the Federal Reserve, and the Bank of Canada, will keep cranking up interest rates to dampen inflation, while at the same time there are concerns about general economic conditions deteriorating.

We’re aware of all this, but it is not what we predicate investment ideas upon. It’s in the mix, but our active strategies focus on the price of large broad stock indexes. And the messages we get from those signals is primarily one of caution.

There are always worries in markets. The idea of uncertainty causing nasty market moves is almost redundant. That’s the only thing that is consistent – uncertainty.

This next bit will focus on inflation. Everybody is talking about it, so let’s have a go.

WHAT IS INFLATION?

The current definition is primarily based on the consumer price index (CPI). There has been a long and complicated evolution of the term’s definition in ‘economist world’. It has moved from being a discussion about how much money is available relative to the actual cost to produce something in labour and material terms. Then to how much money exists relative to a bank’s assets. And now to what we are talking about here today.

To further complicate things, over time, since Adam Smith, who published the Wealth of Nations in 1776 (interesting year), the definition of money has changed. Money is now paper that the central banks ‘print’ – either in physical or digital form. It’s now mostly digital – more on that later.

Money, for a very long time, was a metal of some kind, mostly gold and silver. It evolved into paper. In the metal era, inflation was when there seemed to be too much coinage out there that could buy less and less. Or, in the Roman-dominant era, they debased the actual coins by diluting the content of them with cheaper metals. More recently, it is a conversation about what paper money can buy at any point in time. These are similar ideas, but different.

Let’s look at what role time plays in this.

TIME AND MONEY

In the mid-nineties the Bank of Canada (the Bank) adopted an inflation target. The definition of inflation in this case is CPI. The idea being: keep inflation between 1% to 3%. It’s not clear as to how the magical mid-range 2% target came about, but this how things go. There are good arguments that the goal should be zero, but they seem to have been forgotten.

The thing about single-digit inflation is, over time, everyone loses. It’s a form of phoney prosperity. That’s a philosophical discussion that can’t be covered here. But the simple idea behind this approach is: if everyone in an economic system ‘feels’ they are better off, then it is OK.

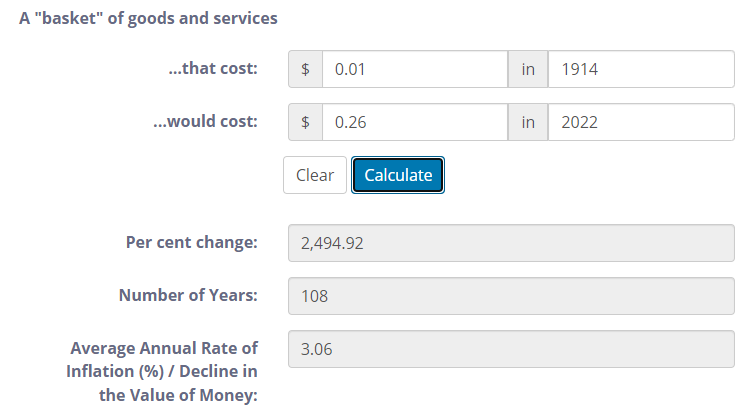

According to the Bank of Canada’s inflation calculator, the average annual rate has been 3.06% since 1914 (as far back as the data goes – also another interesting year).

What does the inflation calculator tell us?

A “basket” of consumer goods that cost a penny in 1914 would cost 26 cents today. Hmmm.

Inflation Psychology

One thing economists struggle with, regarding the origins and evolution of inflation, is how it gets out of hand. As in Weimar, Germany, where wheelbarrows of paper notes were once required to buy a loaf of bread. That is hyper-inflation – for a more recent example, look to Zimbabwe.

But inflation is not something that you can predict with much confidence. The reason being: it’s human behaviour. Simply put: If I have a dollar today, will it buy more or less tomorrow? And if I think it is less, I will spend it on things I need right now.

Who controls that?

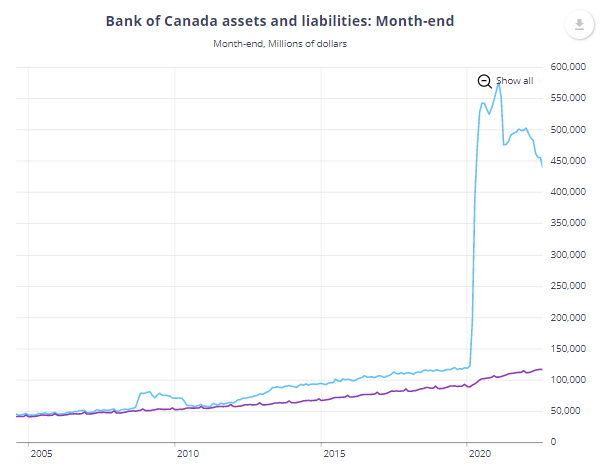

Further, there are few mechanisms the Bank of Canada, or any central bank, can utilize – the overnight interest rate for banks, who create credit, and the amount of assets the Bank has purchased to increase the amount of ‘money’ in the system. That’s it, other than moral suasion.

If the tinder is available, then anything is possible. So, what has the Bank been up to?

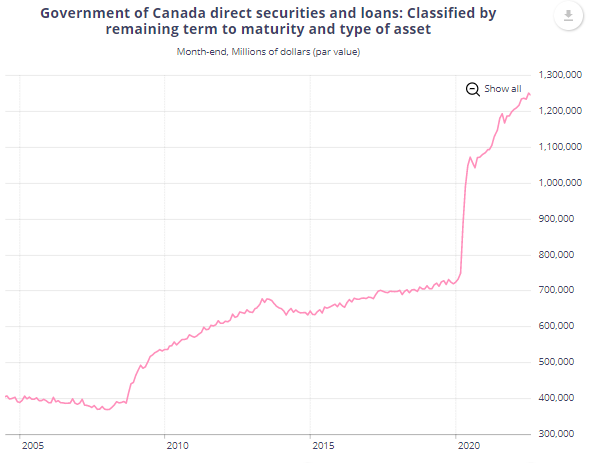

Source: Bank of Canada

Jeepers. That’s some policy at work. Note that the 2008 financial crisis barely registers a blip on this chart.

This is inflation of the Bank’s balance sheet, which reflects an historical definition. The thing is, for every asset the Bank buys, more ‘money’ goes into the system. Paper notes do not matter to the extent they used to anymore. Currency in circulation just chugs along relative to the increase in assets. And, it is an actual liability of the Bank. Money is created by the Bank buying assets and then the Big Six lending it. So, who do they buy these assets from?

Source: Bank of Canada

Oh, it’s the Government of Canada (GOC). Since March 1, 2020, just as the pandemic panic was unleashing its fury, the Bank has bought 78% of all new issuance of GOC debt. What could go wrong?

REALITY

In the actual day-to-day life of Canadians, this is a problem that has been escalating for many months. Stuff costs more. Much more.

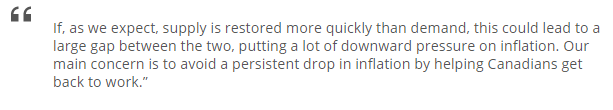

This is a quote from Tiff Macklem’s first speech in his new role as the Governor of the Bank, June 22, 2020.

Whoops.

It’s not that clear why the Macklem’s of the world believe that they can control the prices of things by changing the overnight interest rate and the amount of government debt they buy. It doesn’t make much sense. You cannot fix supply chains with either of those ‘tools’. We could go on.

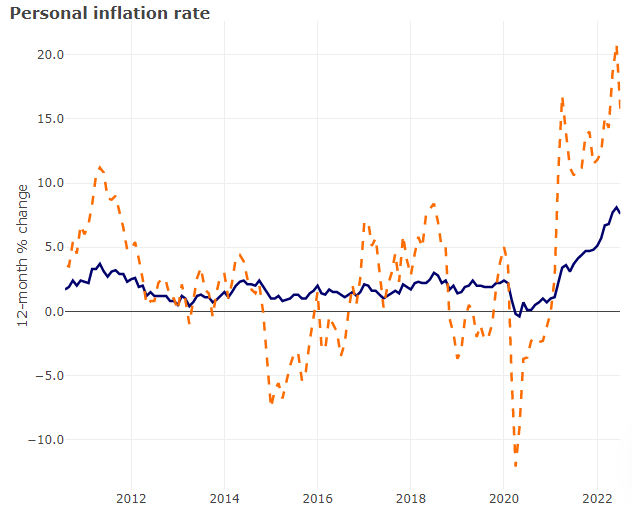

So, what does this mean for Canadians?

According to Statistics Canada, Table: 11-10-0223-01 (formerly CANSIM 203-0022), in 2019 (the most recent data available), the lowest 20% of income earners spend 78% of their budget on basic necessities categorized as: food, shelter, water, fuel and electricity for principal accommodation, household operations, transportation, health care and personal care. The top 20% of earners spend 49% of their budget on all those things. The dollar values are $29,292 and $90,479.

Headline CPI for July, published in August, rose 7.6% year-over-year. Without getting into the adjustments, exclusions and other calculations that go into the CPI rate of change, that is concerning. Because when you apply that inflation rate to the lowest income earners, their bill goes up by $2,226 a year. This is much less than the top income earners’ increase in costs of $6,876, but in terms of the proportion spent just simply to live, it has a far greater impact.

If the same ratio of necessities to overall spending were applied to the top 20%, that increase would be $10,998. This is a problem for everyone.

Furthermore, if all we had to pay for was food, it would be much worse. Using the Statistics Canada handy Personal Inflation Calculator it would more than twice as worse, at 15.8%.

SUMMING UP

These are all government-sourced statistics. There is much more going on beyond these aggregate numbers. But even the probably underestimated figures of inflationary impacts are a cause for concern.

All of this is a government-sourced problem. Humans simply respond to the conditions imposed upon them and what they perceive to be a potential future risk to their survival. The tinder is all there, but what this means for actual inflation in the future is not known. It’s what humans do with the information they perceive as important and its impact upon their ability to live. That can change quickly.

Underlying commodities prices have been strong for several years, across all sectors. Supply chains are still under stress. And we haven’t even touched the housing issue as it relates to current incomes or the dispersion between the wealth of the haves and have-nots. Stay tuned for next month’s note when those will be covered.

The late great Kurt Cobain of Nirvana sums this up nicely in Heart Shaped Box, even though he wasn’t referring to monetary and fiscal policy:

Hey! Wait! I got a new complaint

Forever in debt to your priceless advice

Hey! Wait! I got a new complaint

Forever in debt to your priceless advice

The thinking “priceless” is exactly that – worthless.

If you’ve had enough of inflation, try some inflammation. That’s Victoria’s topic coming up next.

HEALTH IS WEALTH

Inflammation

I’m often asked about inflammation and what to do about it. As much as we hear about inflammation, it’s important to understand that it’s both good and bad. Acute inflammation occurs when we are injured or fighting infection. This is a normal response from our body’s immune system to heal itself.

Acute inflammation can lead to chronic inflammation, but so can certain things we control, like diet and lifestyle. Chronic inflammation will eventually damage healthy cells, tissues and organs and it is linked to the development of many diseases, including – cancer, heart disease, rheumatoid arthritis, type 2 diabetes, obesity, asthma, cognitive decline and dementia.

Each day, we make choices about what we eat and how we spend our time. These choices play a significant role in our health and longevity. When it comes to nutrition, there are some well researched foods that should be included and avoided to reduce or avoid chronic inflammation.

Foods that are known to have anti-inflammatory properties include:

• Olive oil

• Leafy greens

• Tomatoes

• Fatty fish (salmon, sardines, mackerel)

• Nuts

• Fruit, especially cherries, blueberries, bananas, grapes and oranges

• Ginger

• Garlic

• Avocados

• Peppers

• Dark chocolate

• Mushrooms

Foods that should be avoided include:

• Fried foods

• Sweetened drinks

• Vegetable cooking oils

• Dairy products

• Red meat and processed meats

• Alcohol

• Junk food

These lists are not exhaustive, but hopefully directional enough to help you make informed decisions about what you consume. Be wise, be healthy. You’re worth it!

‘To sustain it, you must maintain it’

Victoria Bannister

ICM Health Ambassador

Have a question? Contact us here.

Challenging the status quo of the Canadian investment industry.