Inukshuk Capital Management (ICM) is a multi-asset class, high-net-worth wealth management firm. We believe that Exchange Traded Funds (ETFs), managed with proper knowledge and experience, are the best financial instruments to help our clients with financial longevity. We also believe in the importance of providing our clients with insights into the thought processes and market trends that guide our investment decisions.

We are pleased to share our monthly newsletter which contains information on our ETF portfolios, as well as market commentary and other relevant news.

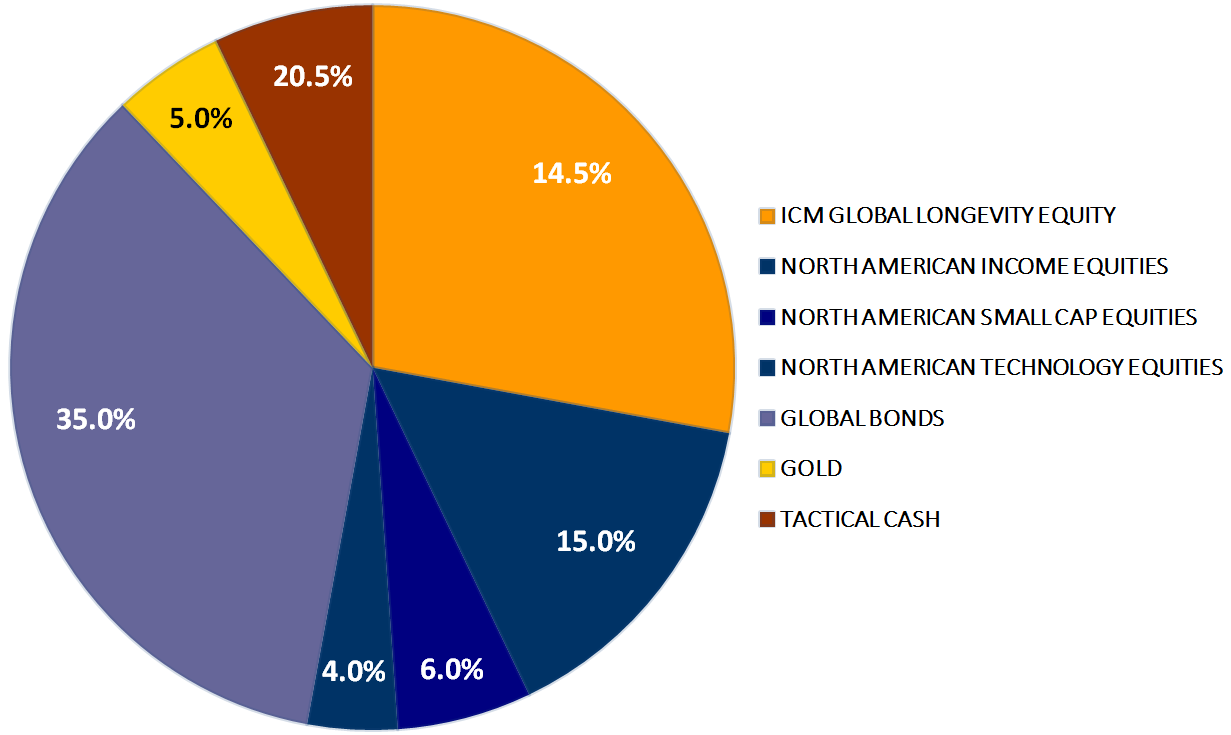

PORTFOLIO COMPOSITION

The past two quarters of 2019 have seen equity markets locked in a choppy, sideways trend. The S&P 500 ended the quarter close to where it began – it was up 1.4% in July, down 1.6% in August and then up 1.5% in September. As of October 8th, after only seven trading days in Q4 it is down 2.8%. The TSX had a less bumpy ride over the same timeframe but is now down 2.2% as of October 8th.

At the end of August our strategies had a full allocation in the S&P 500, a small position in the TSX and no exposure to Emerging Markets (EM) or the MSCI Europe, Australasia and the Far East Index (EAFE). Over the month of September, we added to the TSX position, maintained our maximum allocation in the S&P 500 and added small positions in MSCI EAFE and EM. In early October we scaled back our position in the S&P 500 and are no longer fully allocated to this market.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here.

ICM ASSET ALLOCATION – SEPTEMBER 2019

INVESTMENT TRENDS

The ‘Active vs. Passive’ debate is a recurring theme in investment literature and the financial media. This debate is centered around the question of whether one is better served by investing in a fund managed by an active ‘stock picker’, or by taking a passive approach, such as investing in ETFs or index funds which track a particular benchmark.

ICM does not advocate ‘stock picking’ due to the overwhelming evidence of underperformance by actively managed equity funds. ICM also understands that a purely passive, buy-and-hold strategy exposes clients to the risks of a bear market. Our approach, therefore, is to invest in low-cost, high-quality ETFs that provide exposure to the broader equity markets and to supplement this passive approach by actively managing risk in a systematic way.

Our proprietary systematic risk management tools allow us to decrease our exposure to equities as market conditions deteriorate. To understand why we view this approach as superior to active stock picking we have put together a report that shows how Canadian actively managed equity funds have performed relative to their benchmark over the past decade. The results are eye-opening and you can read our report here.

ETFs WE FOLLOW

We work diligently to identify the best-in-class ETFs which will effectively complement the strategies we manage on behalf of our clients. Recently we added the Wisdom Tree Yield Enhanced Canada Aggregate Bond Index ETF, symbol CAGG, to our fixed income portfolios. CAGG, which trades on the TSX, has a very well-thought-out index structure and offers a disciplined exposure to the Canadian bond market. CAGG is benchmarked to a unique bond index that captures the returns of the aggregate bond market based on a systematic approach to investing – this fits very well with our investment philosophy.

OTHER MARKETS, CENTRAL BANKS AND THE DOLLAR

Once again the rates market was correct in betting the Federal Reserve would cut the Fed Funds target 25 basis points to a range of 1.75-2.00% at the September meeting. The odds of two further cuts of 25 basis points by the end of the year are now 87.5%. That expectation was less than 50% at the beginning of July. The 10-year Treasury yield was 1.43% a few weeks ago, spiked to 1.90% in the middle of September and now stands at 1.54%, less than half of what it was a year ago.

The Bank of Canada overnight target rate has been sitting at 1.75% for almost a year. The expectation of a rate cut of 25 basis points by the end of the first quarter 2020 has gone from 99% in early September down to 22% later on in the month and is now 66%. The lowest available 5-year fixed major bank mortgage rate remains at 2.87% but Meridian Credit Union is now advertising a rate of 2.39%. That may be an indication the major banks will be heading back down to the 2.50-2.60% level in the coming months.

The Canadian dollar is still trading in the 1.3000 – 1.3600 USD/CAD range. For almost a year, a Canadian dollar will have purchased you approximately 75 US cents. The 3-month BA rate (BA = Banker’s Acceptance, a key rate for Canadian financial products) is 1.85% while 3-month LIBOR (London Interbank Offered Rate, one of the most important USD reference rates, globally) is 2.09%. It still pays to own US dollars despite aggressive moves in rate cut expectations.

ICM uses Exchange-Traded Funds to build bespoke portfolios for our clients. We actively manage equity risk through our proprietary trading models which have shown to significantly reduce drawdowns, while outperforming their benchmarks over time.