Gillian Schultze

Instagram:@gillian_schultze

We built Inukshuk Capital Management to serve the needs of clients looking for a unique approach – void of conflicts of interest, commission sales and pushed products. We began by putting our own money where our mouth is. With low fees and active risk management, we help families achieve financial longevity, that’s the bottom line.

Stay up-to-date on the latest developments by following us on LinkedIn here.

October 2021- Complex Connections

In this issue:

- Global Equity Markets

- Supply Chains

- Health is Wealth

GLOBAL EQUITY MARKETS

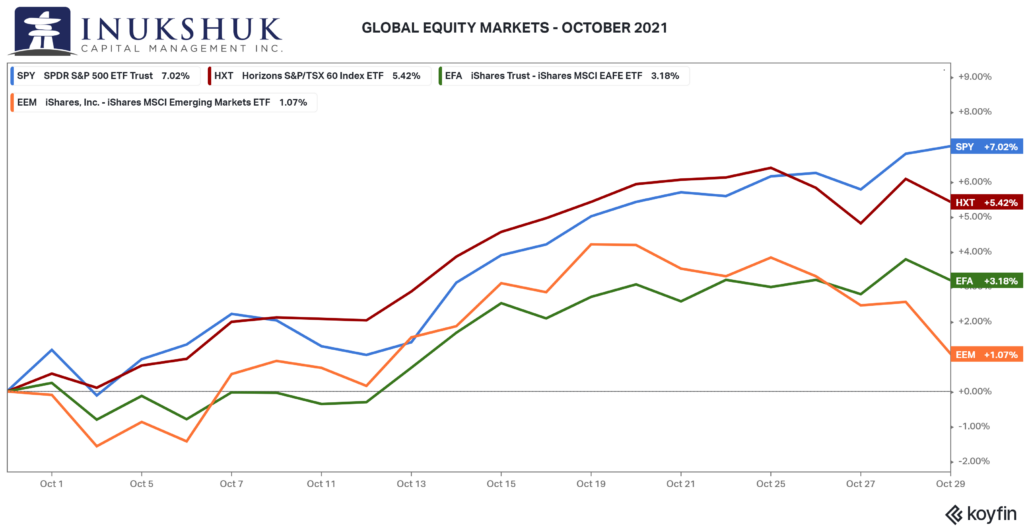

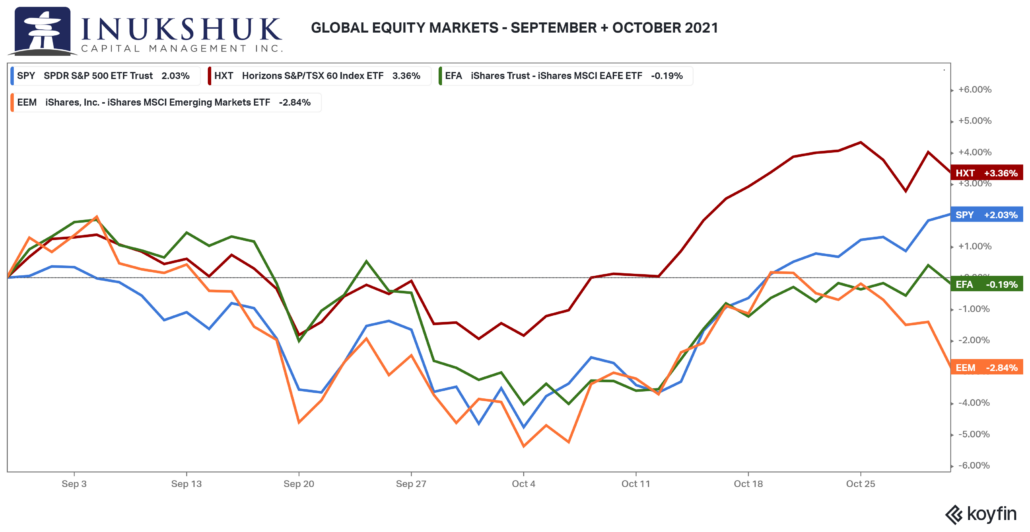

October is supposed to be the spooky month but this year, nothing to fear. The S&P 500 made an impressive gain of 7.0%, after leading the way down in September with a loss of 4.7%.

All four of the global market indexes we actively trade were up however, only the S&P 500 and the S&P/TSX 60 recovered from the September’s selloff. MSCI EAFE (Europe, Australasia & the Far East) almost recovered its losses, but EM (Emerging Markets) did not.

EM is roughly flat on the year and our systems are still signalling caution in both EM and MSCI EAFE, so our positioning remains the same.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here

SUPPLY CHAINS

This subject is not a reader request, but it is being widely discussed, as worries increase about inflation, and the retail-buying frenzy that is U.S. Thanksgiving’s Black Friday (and Cyber Monday), along with the holidays in December, fast approach.

It’s also motivated by the fact that, this Halloween, most of the Smarties (hidden in the cupboard for ‘backup’) that weren’t handed out but devoured, were stale. What has the world come to? Note: it turns out this tragedy is not related to container ships floating idle outside of ports, since Smarties are made in Toronto.

Fun fact: Smarties in Canada are different than Smarties in the U.S., which we call Rockets. If you want Canadian Smarties in the U.S., you’ll have to smuggle them in along with your Shreddies.

There have been many reports of container ships lined up outside of ports on the U.S. west coast, along with closures of ports in China that normally deliver the inputs and finished goods North American industry requires to get products to customers. These two things seem incompatible. If there are fewer ships, why are so many sitting in the water, unable to deliver the goods?

Here is a picture taken from a satellite by NASA’s Operational Land Imager, on October 10, of ships waiting to unload offshore one of the busiest container ports in the U.S.

Source: https://earthobservatory.nasa.gov/images/148956/waiting-to-unload

This is but one example of how complex this topic is: fewer ships, but longer line-ups. There are no clear answers, but a little background can shed light upon what is going on.

Cars

The current system of importing goods from China to North America to get products to consumers is historical in its importance to trade. And it seems it is related to not just volume, but timing as well. The ‘Just in Time’ practices for production were first employed by Toyota in the 1930s. Ninety years later most North American business runs on this principal at a very high speed using metrics and analytics Toyota could only imagine back then.

One irony of this occurred following the 2011 earthquake off Japan’s east coat and the resulting tsunami and Fukushima disaster. Japanese automakers suffered from all sorts of disruptions that travelled up and down the value chain. Essentially, they couldn’t produce new car models because of the interconnectedness of all involved industries, which provide the parts and materials needed to build a car that were suddenly inaccessible. The same thing is happening now at North American car manufacturers primarily due to a semiconductor chip shortage. A new car has hundreds of chips. The Japanese experience was due to a natural catastrophe. Maybe the pandemic could be considered the same thing.

Another example of how supply and value chains can be disrupted occurred during the Global Financial Crisis in 2008. The CEO of Ford testified to U.S. congress that Chrysler and GM should be bailed out because of the impact to the suppliers that would be passed on to Ford. If neither of these competitors could pay invoices from their suppliers, the suppliers would have no working capital and be unable to supply Ford with the parts they required. The reason being: all car manufacturers share many of the same suppliers.

Hubs

Anyone who has flown to, from or within the U.S. has likely experienced the confusing frustration of flight delays or cancellations. From personal experience: sitting in the Denver airport waiting for a flight back to Toronto that hasn’t appeared for hours because Atlanta has some weather issues and planes cannot depart. Or maybe it was of flights to Atlanta being delayed because of some other issue in Los Angeles. It doesn’t seem to make sense. But this is a network. When nodes are blocked, it can result in a chain-reaction where the entire system stops working.

Spokes

In March, a container ship named The Ever Given blocked the Suez Canal for six days. This may have contributed to today’s issues, since everything is connected and one break in the supply chain has consequences that ripple through the system. In a study by German insurer Allianz, reported by Reuters, $6 to $10 billion of global trade was disrupted by this one incident. According to the authors: “The problem is that the Suez Canal blockage is the straw that breaks global trade’s back…” When humans create tightly coupled systems that are dependant on prior experiences to work, surprises can be devastating. Hubris is a thing. See Lehman Brothers.

The Lindy Effect

We are susceptible to the fallacy that because something has worked, it will continue to work. In this case: improving efficiency and margins via practices that do not properly diversify risk. China became a reliable supplier, so the whole system relies heavily on that node and a few links to other massive nodes. This is relatively new in terms of connectedness and speed. It’s tightly coupled. Throw in a massive externality, a few random events, and boom. Networks are complicated.

The Lindy Effect has been around for decades but was popularized most recently in Nassim Nicholas Taleb’s book Antifragile: Things That Gain from Disorder. From Taleb’s blog, Incerto:

Lindy is a deli in New York, now a tourist trap that proudly claims to be famous for its cheesecake, but in fact has been known for the fifty or so years of interpretation by physicists and mathematicians of the heuristic that developed there. Actors who hung out there gossiping about other actors discovered that Broadway shows that lasted, say one hundred days, had a future life expectancy of a hundred more. For those that lasted two hundred days, two hundred more. The heuristic became known as the Lindy Effect.

Because of the way humans think, poor decisions can be made by confusing the fragile for the robust because the fragile, on the surface, appears to have worked for a good enough amount of time.

For example, restaurants start and fail rapidly. The ones that stick around for decades become popular and sometimes iconic because they’ve lasted so long. They have a good reputation. If a restaurant had to close for a few days because of a family circumstance, you are not at risk. You can go to another steak joint or grill your own.

Supply chains and value chains are not like that. They are fragile and whoever relies on them is taking a risk, which has rewards through the ability to extract value from that chain. As well, some of the largest players in this network take risks they do not fully comprehend or do, and ignore them, because it is profitable to do so. But some of the smaller nodes in the network are not aware of those risks because they don’t have enough information.

Snowboarding

Inukshuk Capital is a proud supporter of competitive snowboarding in Canada. Here’s a personal anecdote on how tiny nodes in a network can be blindsided by supply chain issues due to a lack of information. In February 2020, Ontario Snowboard hosted a World Cup alpine snowboard race. It’s a complicated endeavour that requires roughly a year in advance to prepare for. There are multiple components, and each is assessed for risk to the event. Being outdoors complicates things further as weather plays an important role. Safety, training, compliance with international standards, the standards of the host resort, media, corporate and individual sponsors, patrons, roughly 100 volunteers and sensitive equipment are all priorities. The last thing on the risk assessment list was the winter clothing the officials and volunteers would be given. It happens that the supplier was shipping from China.

The clothing was delayed in arriving by weeks. The items needed to land in Toronto in January, so they could be branded with Ontario, Canada, and the event logos. No one could explain exactly what the problem was. There were rumours of a virus outbreak in a large city in China in the first weeks of February, but that didn’t immediately appear to be of concern. Until it was, and rumours in the snowboard community of participants unable to travel to Canada started circulating.

The short version is: the clothing arrived a few days before the event, but there wasn’t enough time to have various branding applied. This was unfortunate, but not tragic. And the event was a massive success. But if that supply chain was delivering essential equipment, the event would have been cancelled. The cost would have been upwards of hundreds of thousands of dollars. The remaining competitive season schedule would change. Athletes from all over the world would be impacted over time. A World Cup snowboard circuit is similar to a network. It’s a hub that sits at the top with chains across the planet and effects down to the grass roots of snowboarding. It was simple luck that the component that failed to arrive was not critical to the race.

Conclusion

Luck plays an influential role in many aspects of our lives to a greater degree than most of us realize. This note was going to include a section on the possible inflationary impacts of supply chain disruption, but that story will have to wait. Complex is one word to describe that topic.

Stories

In case you missed the live event, enjoy the recording from our webinar on October 27. We chatted with Doug Keeley, CEO and Chief Storyteller at Stories Rule ! Doug explained why and how stories are important and shared tips on how to craft and tell your story. Storytelling for Leaders

HEALTH IS WEALTH

Sleep, why it is my No. 1 priority for my overall health

“Sleep affects every organ system, every disease state. Everything that you can do, you can do better with a good night’s rest.” – Dr. Michael Breus, The Sleep Doctor

When you don’t get enough sleep—or sleep a lot, but poorly—there’s a cascade of consequences to your health. There are cognitive problems like worsened memory, and physical problems like slowed reaction times. Your emotions become more volatile, and you’re more easily irritated or angered. Things literally start to hurt, as sleep deprivation leads to increased pain perception.

The Sleep Stages

There are five stages of sleep—stage one, stage two, stage three, stage four, and REM (rapid eye movement) sleep—and it takes approximately 90 minutes to complete one sleep cycle. Each night, the average adult goes through five different 90-minute cycles. Do the math and that works out to 450 minutes, or 7.5 hours, of sleep.

This is not a one-size-fits-all approach. We are all built a little differently.

To determine your ideal amount of necessary sleep:

- Establish what time of day you wake up every morning (which should be the same on weekends, sorry!) within 20 min, then subtract back 7.5 hours, and use this as your new bedtime.

- Go to bed at this new time for 10 consecutive days. If you wake up before or after the 7.5 hours, then that is your wake-up time. Some of us will need more sleep, and some less.

From the Outside In

Consider how external factors affect your natural sleep rhythm, as well. Eating or exercising, consuming too much caffeine, or exposing your eyes to blue light near bedtime can all send confusing messages to your body, that also hinder sleep.

When it comes to food and sleep, the most important thing to consider is when you eat, not what you eat. Dr. Breus recommends having your last meal two to three hours before bed, and having a small snack (250 calories) closer to bed, if you eat dinner early. The latter is because, if you don’t go to bed with adequate fuel, you may wake up in the middle of the night when your blood sugar dips.

The ideal food to eat before bed is high in carbohydrates, which increase serotonin, the calming hormone. Foods to avoid include sugar and spicy foods.

Sleep is a very complex topic. I recommend reading “The Power of When” by Dr Michael Breus.

Credit:“The Well Podcast”

‘To sustain it, you must maintain it.’

Victoria Bannister, ICM Health Ambassador

At Inukshuk Capital Management, we are firm believers in the connection between Health (physical, mental and spiritual) and Wealth.

Our ICM Health Ambassador is available to our clients for complimentary consultations. Contact us for more information.

Today is Remembrance Day. Here at Inukshuk, we have many personal connections to those who served in both the Great War and the Second War. Fighting a war is so complex, it seems incomprehensible that with the number of people, supplies, equipment, conditions, and distances involved that they result in such massive and prolonged periods of destruction and chaos. These two men managed to survive. Lucky or good, they probably didn’t care.

Lest we forget.

Peter Atherton, 1915 Gerry Keeley

Sketch from photo: Tyson Hiseler

Have a question? Contact us here.

Challenging the status quo of the Canadian investment industry.