Inukshuk Capital Management (ICM) is a multi-asset class, high-net-worth wealth management firm. We help individuals and families achieve financial longevity by tailoring solutions that integrate their unique financial planning considerations with modern wealth management approaches designed to deliver superior returns while minimizing tax and fees.

We are pleased to share our monthly newsletter which contains information on our ETF portfolios, as well as market commentary and other relevant news.

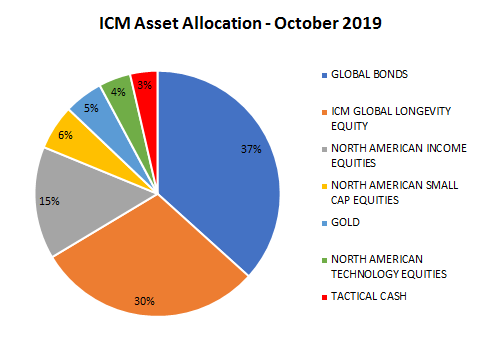

Portfolio Composition

October market action was a compressed version of what equities have been doing since March. In the first three days of October trading, the S&P 500 fell 4.1% and the TSX60 was down 3.1%. Then over the remainder of the month, they rallied 6.1% and 2.1%, respectively. At the end of the first full week of trading in November, both indexes closed at all-time highs.

In October our Longevity portfolio maintained an 80% exposure to global equities which allowed us to participate in the upward market trends. As equities rallied off the early October lows, we moved from a partial to a full allocation in Emerging Markets and doubled our investment in the MSCI Europe, Australasia and the Far East Index (EAFE). We saw a slight decrease in our TSX position over the month as the TSX rally was tepid in comparison to the other equity markets – closing October with a small loss. As of the close on November 8, we have full positions in all equity markets.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here.

Investment Trends

One of the most significant trends of the past decade has been the rise of artificial intelligence (AI). AI seems to be infiltrating all areas of the economy and the investment industry is no different in this regard. From the major banks to robo-advisors, from hedge funds to mutual funds, the entire financial industry seems to be transforming at the hands of AI-powered technologies. But what exactly is AI? How is it being used in the investment industry? And to what degree does ICM make use of such technologies? In the following article, we explore these questions: AI and Investing: How it Can Help You

Other Markets, Central Banks and the Dollar

The Federal Reserve is improving its ability to manage expectations for interest rate changes. The market priced the odds of two further cuts of 25 basis points by the end of the year at 87.5% prior to the October 30 meeting. They cut the target rate 25 basis points to a range of 1.50 – 1.75%, and it now looks as though they will be on hold for the rest of the year. The odds for a further 25 basis point cut by the end of March 2020 have declined from 33% before the October meeting to 25% now. The 10-year Treasury yield moved up from 1.54% in early October to 1.84% the day before the Federal Reserve meeting and has extended that yield rally to 1.94%, which is a few points above the September highs.

The Bank of Canada overnight policy target rate has been sitting at 1.75% since October 2018. At the most recent meeting, rates remained unchanged with Governor Poloz citing weakening global growth and trade considerations as concerns. As well, he stated: “…energy-producing regions continue to struggle, as the full adjustment to the decline in oil prices back in 2015 is not yet complete, and transportation constraints are making the situation worse.” This was post-election, which is very interesting considering the majority of those elected are opposed to improving the delivery of Canada’s energy resources across the country and to foreign markets. The rates market puts the odds of an interest rate cut by the end of March 2020 at 32%, down from 66% in early October. The lowest available 5-year fixed major bank mortgage rate remains at 2.87%, although the lowest current offering by non-banks has moved up from 2.39% to 2.59%.

The Canadian dollar rallied slightly to around 1.3050 just prior to the two central bank meetings and is now at 1.3230 but is still trading in the 1.3000 – 1.3600 USD/CAD range it has been in for more than a year, which is roughly 75 US cents. The 3-month BA rate (BA = Banker’s Acceptance, a key rate for Canadian financial products) is still 1.85% while 3-month LIBOR (London Interbank Offered Rate, one of the most important USD reference rates, globally) is 1.91%. So even though the Fed has cut rates three meetings in a row, it still pays to own US dollars versus Canadian dollars.