We built Inukshuk Capital Management to serve the needs of clients looking for a unique approach – void of conflicts of interest, commission sales and pushed products. We began by putting our own money where our mouth is. With low fees and active risk management, we help families achieve financial longevity, that’s the bottom line.

Stay up-to-date on the latest developments by following us on LinkedIn here.

May 2023: When the Waves Turn the Minutes to Hours

In this issue:

- Global Equity Market Performance – April

- Shipwrecks and Banks

- Navigating

- Summing Up

- Health is Wealth

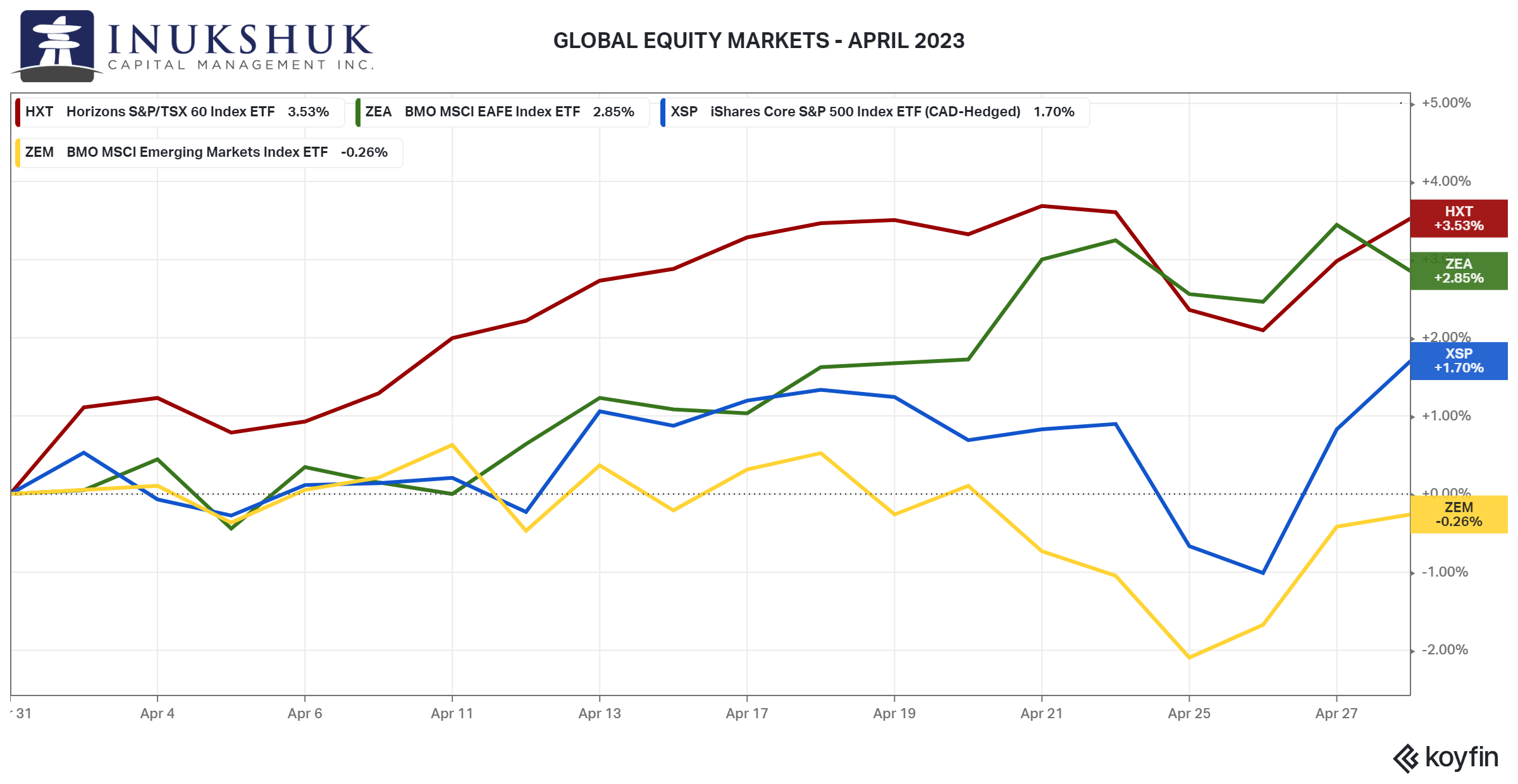

GLOBAL EQUITY MARKET PERFORMANCE – APRIL

The S&P/TSX60 had a very good April, up 3.5%, followed by MSCI EAFE (Europe, Asia the Far East and Australasia) up 2.8%, maintaining its momentum from a solid performance in March. The S&P 500 couldn’t hang on to the leader role after ripping 3.8% higher the previous month but still put in a quality performance at plus 1.7%. Not so much for EM (Emerging Markets), down 0.3%.

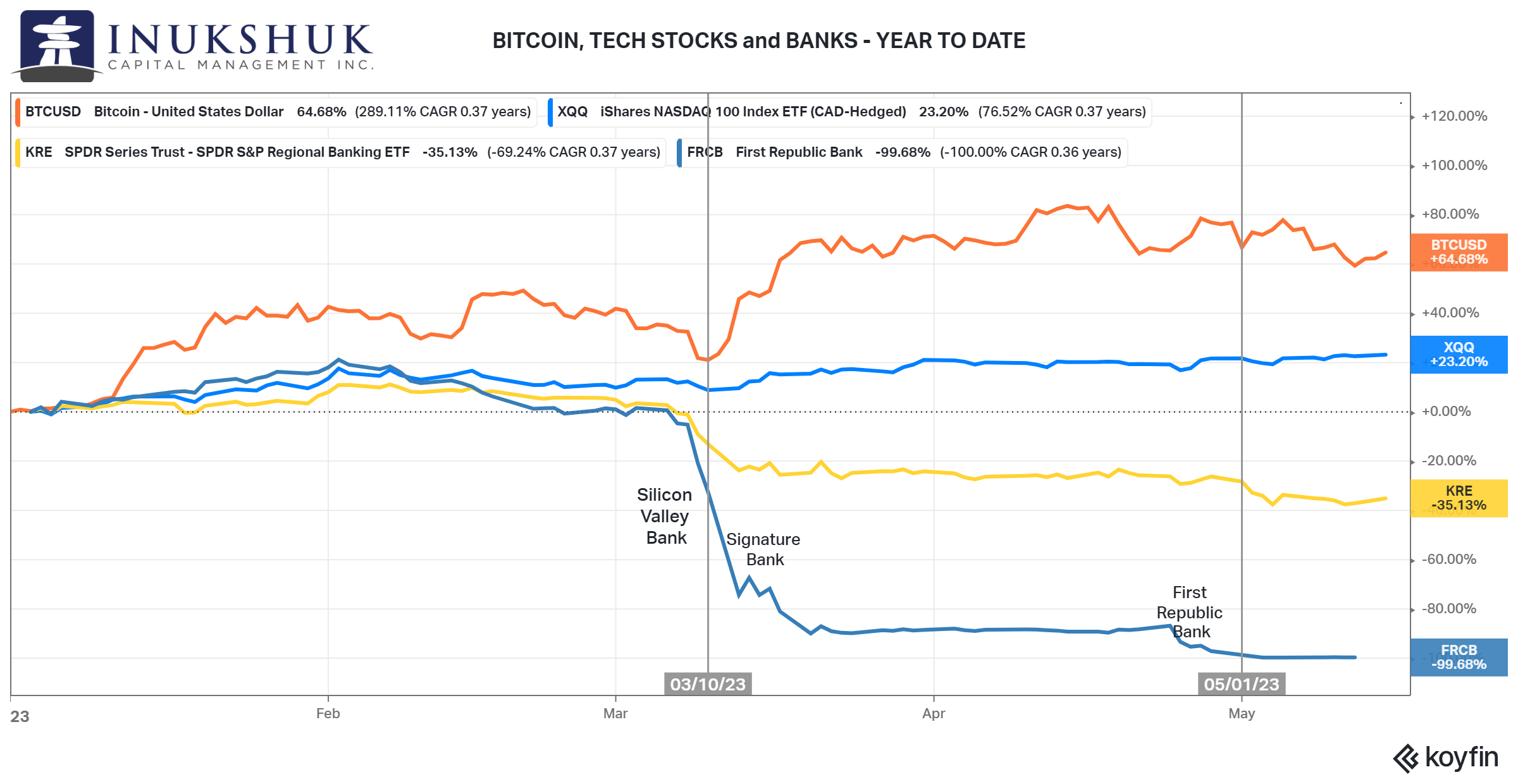

Another U.S. regional bank, mentioned in our last note, finally gave up the ghost. First Republic, which evaporated on May 1, was the fourteenth largest bank in the U.S. and is now the third-largest bank in U.S. history to collapse. J.P. Morgan received all of their assets and no liabilities.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here .

SHIPWRECKS AND BANKS

You may have noticed the picture prefacing this note. That is Gordon Lightfoot as imagined by artist Hadyn Butler, in stained glass. If you can get out to Manitoulin Island, some of his art is on display at the Perivale Gallery.

If you are a fully paid-up subscriber to our letters (that’s humour) you would know our resident music nerd likes to use lyrics to sum up ideas and themes in these notes. Sometimes those are from artists we have recently lost.

On May 1 Gordon Lightfoot died at Sunnybrook Hospital in Toronto. His first record was released in 1966 and his most recent in 2020. That is longevity. He was one of the first globally successful musicians to sing about Canada at a time when that wasn’t seen as a particularly cool thing to do. He wrote some of the greatest songs that exist and has inspired artists of all kinds.

“Does anyone know where the love of God goes, when the waves turn the minutes to hours?” is a question Gord poses in the epic song ‘The Wreck of the Edmund Fitzgerald’. A shipwreck is somewhat like a bank run in that it usually happens gradually and then suddenly. That description of bankruptcy is lifted from Ernest Hemingway’s book ‘The Sun Also Rises’.

In March, two regional U.S. banks, Silicon Valley (March 10) and Signature (March 12) failed. According to Forbes, at that time, these were the second and third largest bank failures in U.S. history. First Republic was the fourteenth largest bank in the U.S. and is now the third-largest bank in the U.S., by assets, to collapse. We now have a new failure podium. Signature is bumped out of medal contention by Republic, which is now the current holder of bronze. Silicon maintains silver and Washington Mutual stays at the top, since 2008. Stay tuned for updates. It may get sporty out there.

NAVIGATING

Things that occur in financial markets are seemingly explainable after the fact but are usually not obvious in the present. While a few may notice some leaks, they could turn out to be benign or prove to be disastrous.

Prices are a result of human behaviour. Nobody knows nothing, is something Jack Bogle, the founder of The Vanguard Group and inventor of index investing, said with regard to predicting. Investing is further complicated by the fact that even if you could predict the future, trying to determine how markets will respond to events is even trickier.

For example, if someone told you there would be a pandemic in 2020 and that the consequences of this would include lockdowns and a global collapse in trade would you think stocks end that year up or down? After falling 28% in the first four months the S&P/TSX60 finished the year up 5%.

If investing is this complex how is it possible to proceed?

One way we do this is by using price to guide our asset allocation. In that same year, our systems started flashing caution signals. Our models first turned negative in EM at the end of January. The S&P/TSX60, MSCI EAFE and the S&P 500 soon followed, in that order. In retrospect that made sense. When it was happening it was not clear as to why. Price contains information, but it is not always possible to figure out what that information is.

Diversification across asset classes, think stocks and bonds, is a well-worn subject. We have covered this topic for years. But bitcoin and other things weren’t accessible to most investors until recently.

Here is another example. If you had full foresight and knew Silicon Valley Bank was going to have a run on its deposit base, keeping in mind that its depositors were largely venture capital firms and others who are involved in technology investing, would bitcoin and tech stocks be higher or lower after the fact?

As it turns out bitcoin was more than 40% higher a month later, the Nasdaq 100 up 12%, the regional banking index, as represented above by KRE, the SPDR S&P Regional Banking ETF, is now down 35% on the year and First Republic disappeared.

SUMMING UP

There will likely be further consequences to these events – stresses on various parts of the financial system, policy responses and others that do not seem obvious at the moment. All we know now is what has happened and that our EM signals have turned negative.

Victoria’s piece below on her recent investigation into the importance of DNA’s role in matters of health is interesting in that she discovered something about her Achilles’ heel. Does the Fed have any insight into what that may be in the banking sector?

HEALTH IS WEALTH

“Genetics Don’t Lie: What Your DNA Reveals About Your Achilles’ Heel (And More!)”

Recently, I attended a wellness event with a group of CEO’s, where I had the opportunity to undergo DNA testing to determine my personalized sport nutrition and performance report. The report was based on the most current evidence-based scientific research that has been published in peer-reviewed journals and reviewed by a team of world-renowned experts in the field of nutrigenomics.

The laboratory used state-of-the-art genetic testing procedures to analyze my DNA sample. They examined my genetic code to determine how my genes can influence recommendations related to weight management, body composition, cardiometabolic health, food intolerances, eating habits, various performance-related elements, and injury risk. Based on these results, the laboratory developed a series of nutrition and performance-related recommendations that are aligned with my genetic profile and gathered additional genetic insights for me and my doctor to consider.

As new discoveries in the field of nutrigenomics are made, I will have the opportunity to access this information to further fine-tune my personalized nutrition and training plan. I can now use the personalized recommendations contained in this report to help me optimize dietary and other performance-related strategies. I can create a plan to maximize my genetic potential by starting to eat according to my genes.

What blew my mind was that the report suggested that my DNA makes me prone to Achilles injuries, something I’ve struggled with in the past. Knowing this information will allow me to take proactive steps to prevent future injuries and improve my overall health and well-being.

The advancements in genetic testing and screening are not limited to athletic performance. Genetic testing can also provide valuable information about an individual’s risk for certain diseases and conditions, such as cancer, Alzheimer’s disease, and heart disease. Armed with this information, individuals can make lifestyle changes to reduce their risk of developing these conditions.

The advancements in genetic testing and screening have provided us with an unprecedented opportunity to gain insights into how our genes can influence our health and wellness. Armed with this information, we can make meaningful changes to our lives to support the results. The question we must ask ourselves is, if we knew what was good and not good for us, would we be willing to make the necessary changes to improve our health and wellbeing?

The answer, of course, is not a simple one. Change is never easy, and changing longstanding habits and behaviors can be particularly challenging. However, armed with the knowledge provided by genetic testing, we can take control of our health and make informed decisions about our lifestyle choices.

In the end, it all comes down to sustainability. Making changes to our diet and lifestyle is one thing, but we must be willing to sustain those changes to maintain the benefits. It is not enough to simply make changes for a short period and then revert to our old habits. We must be committed to making lasting changes that will support our health and wellbeing in the long term.

So, would you be willing to make meaningful changes to your life if you knew what was good and not good for you? The answer lies within each of us. We must decide for ourselves whether we are willing to take control of our health and make the necessary changes to support our wellbeing. But one thing is certain: if we choose to make changes, we must be willing to sustain them to maintain the benefits.

P.S. If you’re interested in learning more about my experience with personalized DNA testing, feel free to get in touch with me.

‘You have to sustain it, to maintain it’

Victoria Bannister

ICM Health Ambassador

Have a question? Contact us here

Challenging the status quo of the Canadian investment industry.