At Inukshuk Capital Management, our focus is on building lasting relationships rooted in trust and collaboration. By focusing on active risk management and long-term value creation, we help families and institutions achieve financial sustainability.

Stay up-to-date on the latest developments by following us on LinkedIn here.

In this issue:

- Global Equity Market Performance

- Tariffs

- Time

- More Time and Data

- Wrapping Up

- Wealth Longevity – Pacing Your Financial Clock

Global Equity Market Performance

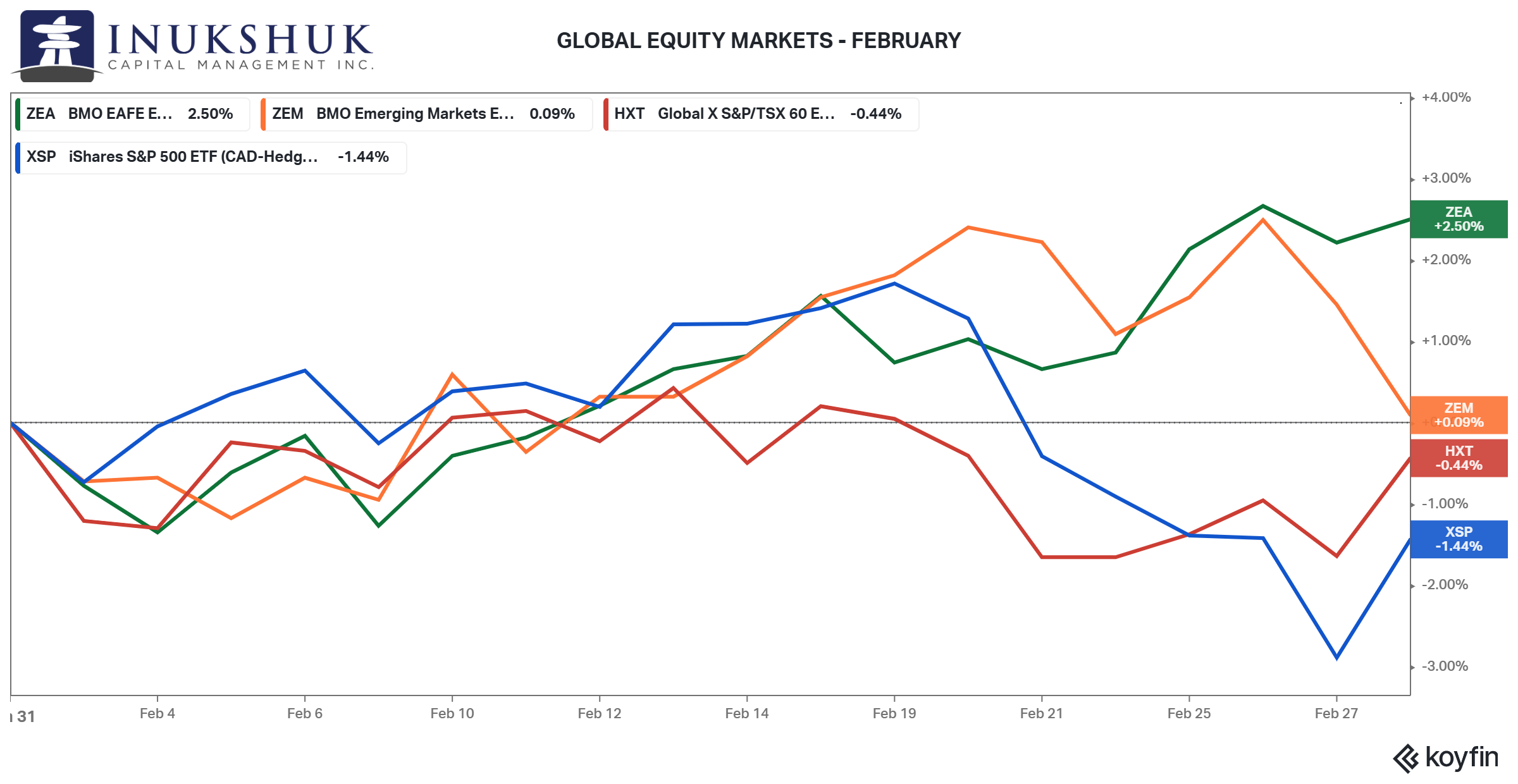

MSCI EAFE continued its trend of outperformance. It was the only equity index to put in a solid gain on the month. After gaining 6% in January, it was up 2.5% in February and has outperformed the S&P 500 by more than 7% this year. Emerging markets were close to flat, the S&P/TSX 60 was down 0.4% and the S&P 500 1.4%.

This is the second month in a row that the S&P/TSX 60 has outperformed the S&P 500. That might be a surprising result for those concerned with the impact of tariffs on the Canadian economy.

This is the second month in a row that the S&P/TSX 60 has outperformed the S&P 500. That might be a surprising result for those concerned with the impact of tariffs on the Canadian economy.

Our systems remain fully long both the S&P 500 and the S&P/TSX 60.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here

It’s almost impossible to avoid the discussion of tariffs. There seems to be a tariff-related headline hitting the screens every other hour. This letter will cover a bit of that as well as the Daylight Saving Time (DST) effect on stock market.

Tariffs

It’s difficult to keep up, but as this is being written there have been multiple announcements.

Here are a few on that timeline.

March 3 – 25% tariffs on all imports from Canada and Mexico starting March 4

March 5 – A one-month exemption on tariffs on imports from Mexico and Canada for U.S. automakers

March 6 – A one-month exemption for anything that falls under the existing free trade agreement, USMCA, for Mexico. A few hours later Canada is included in the exemption

March 10 – Ontario puts a 25% tax on electricity exports to the U.S.

March 11 – The U.S. announces a doubling of tariffs on aluminum and steel from Canada then announces they won’t double, and Ontario cancels the electricity tax

March 12 – Canada announces 25% reciprocal tariffs on $29.8 billion of American imports after U.S. levies on steel and aluminum went into effect

Stay tuned.

As we observed in last month’s letter, in the first Trump administration these on-off tariff announcements were common but spread over years.

Now it’s days. Time flies.

Time

Spring forward, fall back. Repeat. It’s kind of like watching the news.

A friend asked if there was any truth to the idea that March is generally a bad month for stocks. So, we took a look.

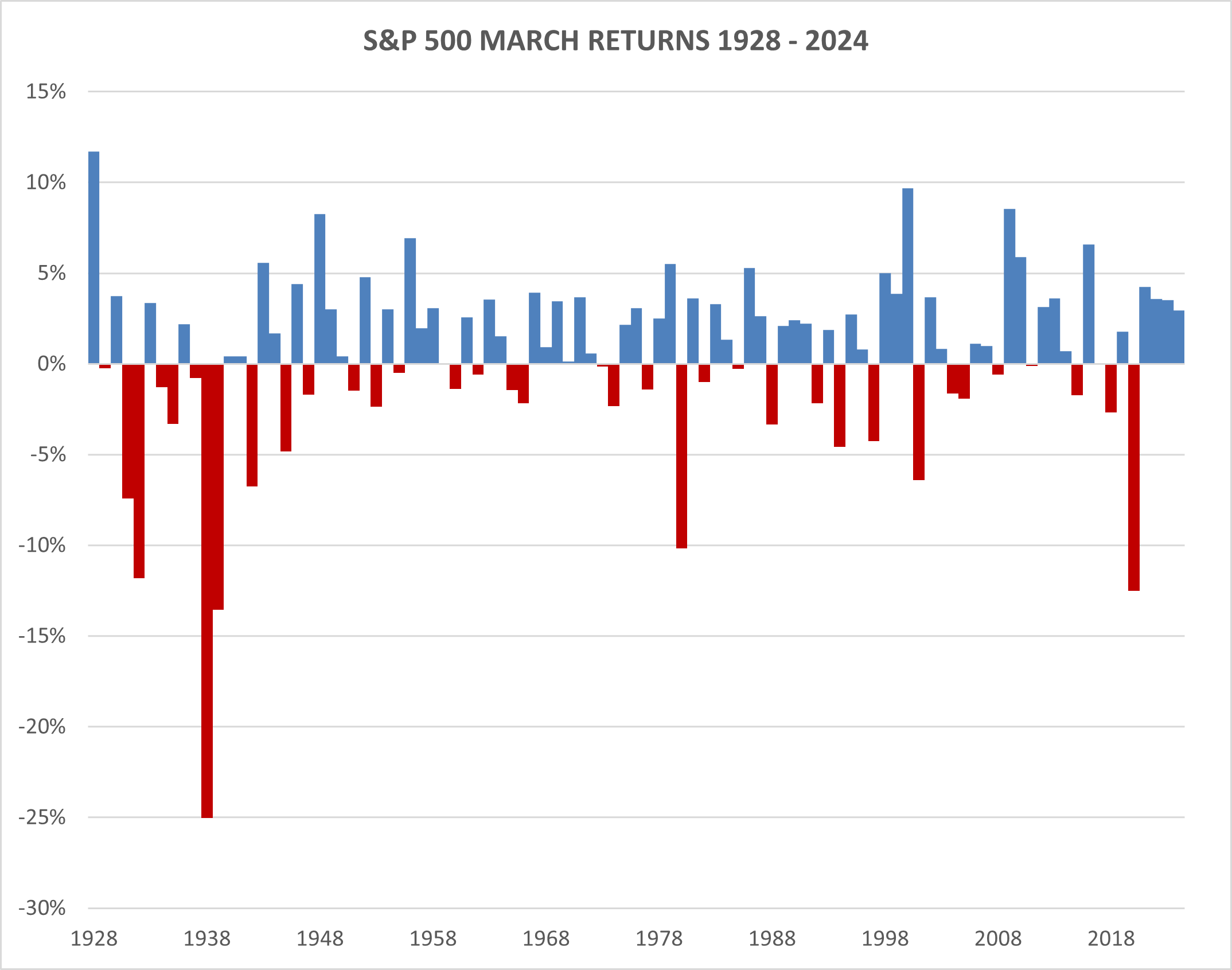

Using S&P 500 data going back to 1928 we can see that March has had a few bad results.

It’s been down 39% of the time which is close to the average month at 40% of the time. March’s average return ranks 9th of the 12 months, but its median ranks 6th.

That means it’s had a few bad outlier months over the past ninety-plus years. For example, it had the second worst month ever, in 1938. Only September 1931 was worse, down 30%.

More recently, after the 2020 debacle, down 13%, it’s been up more than 3% for the past four years.

Overall, it’s not much of an anomaly when studied at this level.

More Time and Data

We prefer to do our own analytical work, but sometimes it’s helpful to look into other research. In a 2000 paper published in the American Economic Review, titled Losing Sleep at the Market: The Daylight Saving Anomaly more markets were studied.

The authors found a statistically significant effect that was two to five times worse than the ‘weekend effect’. The weekend effect is described as: Significantly negative effects of weekends on stock returns have been observed for Belgium, Brazil, Canada, New Zealand, Switzerland, the United Kingdom, and the United States…

So, the gap between Friday and Monday is generally not good for markets but it is worse after we spring forward. Our analysis didn’t look at the weekend effect, just the entire month. But this is interesting and may have contributed to some of those outliers.

There are other studies that attempt to estimate the economic cost of changing the clocks. Automobile accidents, workplace injuries and overall bad decision-making are associated with the loss of sleep and coincide with DST.

In general, the evidence suggests we should stop doing this to ourselves.

It might be a good plank in a political campaign platform.

Wrapping Up

Humans get ideas in their head that are not necessarily correct. For example, sell in May, go away is a saying, and it does have some truth to it, but it’s not a sound basis for an investment strategy.

Another one – people associate October with bad performance. However, when you investigate, September is worse.

We are affected by the seasons. But based on our research and how we manage risk it is not something that is practical to implement.

First, it is costly to trade too much. Second, you need to have a plan to get invested after you’ve sold to try and avoid these cycles. These are patterns, but not necessarily tradeable events for an investor as opposed to a trader.

Time’s a funny thing—central bankers can’t control it, markets don’t respect it, and we all lose an hour of sleep over it.

As Yogi Berra might say: It’s déjà vu all over again—except the clock’s an hour off.

Now, let’s look at pacing your financial clock for retirement.

Wealth Longevity – Pacing Your Financial Clock

Retirees often juggle RRIFs, TFSAs, and non-registered accounts, but strategy matters. Withdraw from RRIFs early to avoid OAS clawbacks, use TFSAs for tax-free supplements, and spread capital gains from non-registered accounts over low-income years. It’s about aligning with market cycles, not just the calendar, ensuring your financial clock keeps ticking.

Have a question? Contact us here

Challenging the status quo of the Canadian investment industry.