We built Inukshuk Capital Management to serve the needs of clients looking for a unique approach – void of conflicts of interest, commission sales and pushed products. We began by putting our own money where our mouth is. With low fees and active risk management, we help families achieve financial longevity, that’s the bottom line.

Stay up-to-date on the latest developments by following us on LinkedIn here.

March 2021- A Recent History of Futures Past

In this issue:

- Markets

- 2020

- Health is Wealth

MARKETS

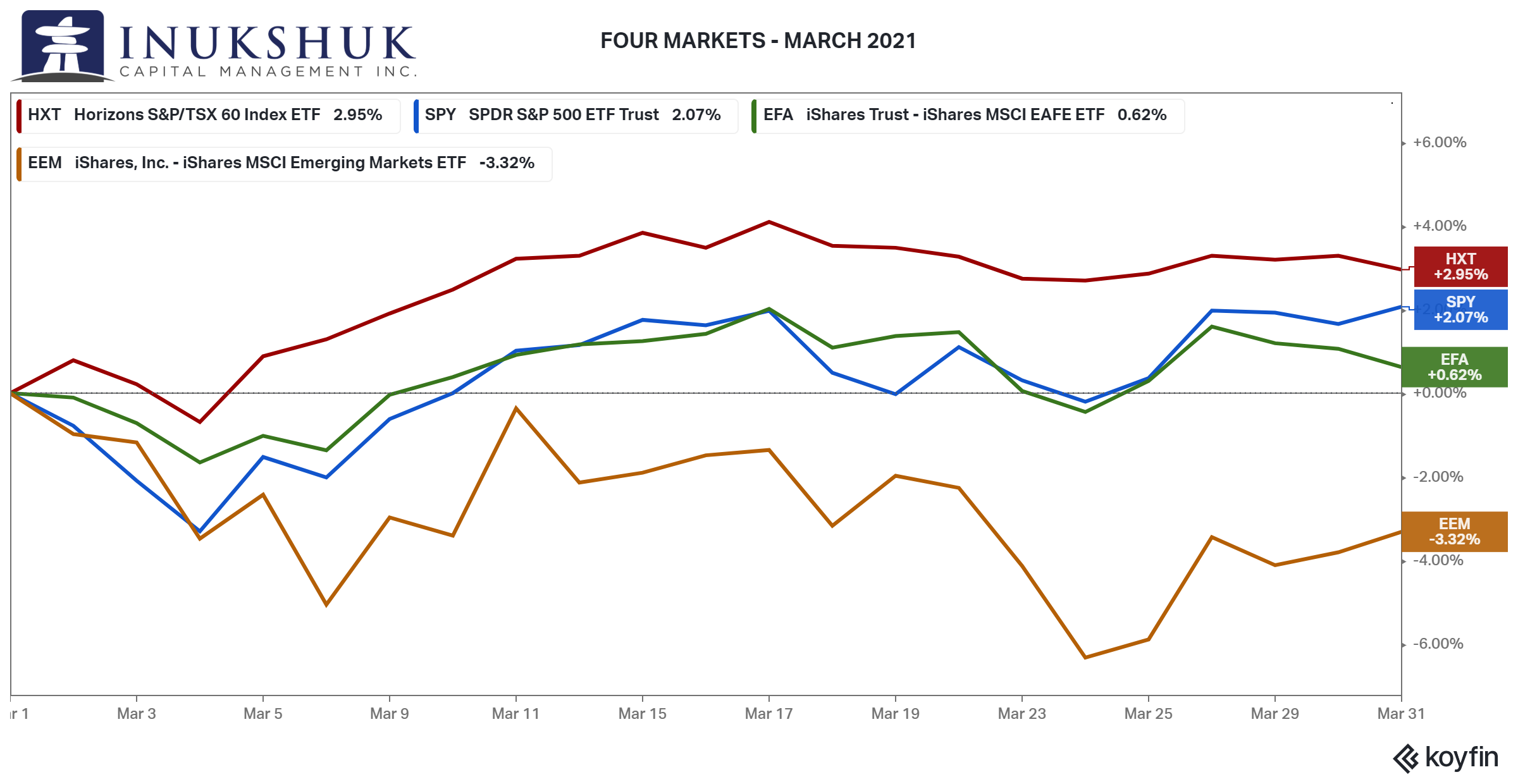

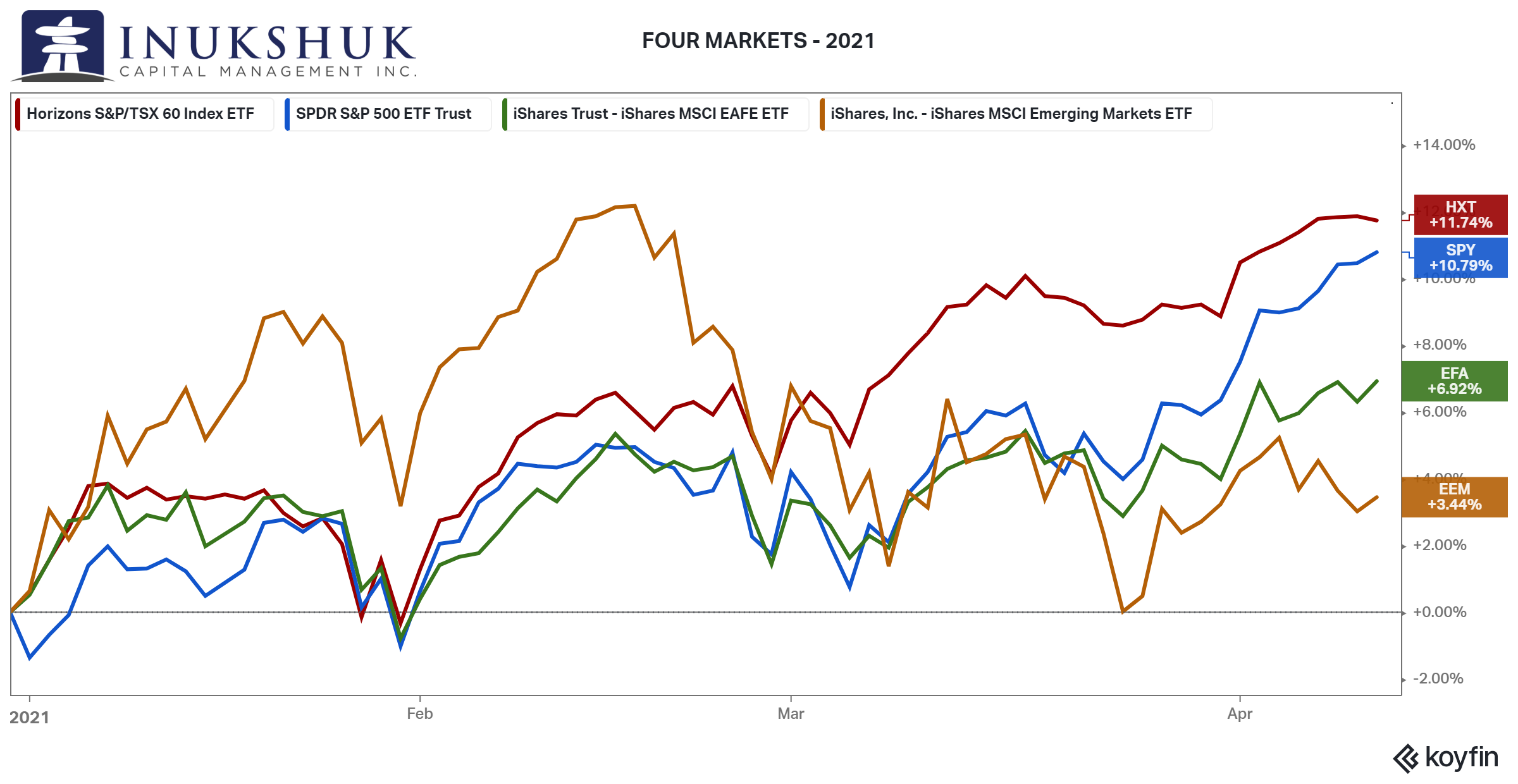

Spring has sprung except in Emerging Markets (EM). EM was shunned in February eking out a tiny gain versus good returns in the S&P/TSX 60, S&P 500 and MSCI EAFE (Europe, Australasia and the Far East) and the trend continues. In March, EM was down 3% while the TSX was up by the same amount.

Our systems have been flat EAFE since February and exited EM by the third week of March. We are still long full allocations to the TSX and S&P 500. In this case the ranking of performance of the four indexes in March was precisely the same as 2021’s year-to-date performance. This is a good example of how trends evolve.

Our systems have been flat EAFE since February and exited EM by the third week of March. We are still long full allocations to the TSX and S&P 500. In this case the ranking of performance of the four indexes in March was precisely the same as 2021’s year-to-date performance. This is a good example of how trends evolve.

Many things change over time but humans will be humans, particularly when it comes to risk and reward. There are many reasons why systematic trend-following works, human behaviour is one of them. Even as technology and information become exponentially powerful and massive, it is humans who teach the machines what to do in order to learn.

Many things change over time but humans will be humans, particularly when it comes to risk and reward. There are many reasons why systematic trend-following works, human behaviour is one of them. Even as technology and information become exponentially powerful and massive, it is humans who teach the machines what to do in order to learn.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here.

2020

Running with the theme of spring, a couple things come to mind. The first season of the year also coincides with the start of baseball. Ya sure, there is a song about the boys of summer but up here in The Great White North opening day is a hint summer is coming, not that it is actually here.

Baseball is fascinating or deadly boring depending on your tastes. The interesting thing about baseball is its longevity. A game doesn’t end until one team wins. The season is the longest in professional sports at 162 games. And big Canadian connections: the first game to be officially recorded was at Beachville, Ontario in 1838 and Babe Ruth hit his first homerun at Hanlon’s Point on the Toronto Islands in 1914 against the Toronto Maple Leafs of the International League.

Another interesting thing about baseball is the records and performance statistics have been documented in great detail for some time. In our research and development of systems we benefit from a similar circumstance – the price history of many things has been recorded in detail for many years.

We thought it would be interesting to take a look of some of the observations we made in our 2020 newsletters, from the onset of the pandemic panic to mid-July, just before the delayed 2020 baseball season started. These were made in the midst of an environment no one alive had ever experienced. The good, the bad and the ugly.

February 2020

“The late January collapse in Emerging Markets (EM) led to our first major sell signal, taking our EM allocation to zero by mid-February. After falling 6.2% to start the year, EM declined another 3.8% in February and is down another 16% after the first 9 trading days of March”

The first observation on this statement is: it was simply a fact. We had no idea at the time what was to come. A takeaway is: we are getting similar signals now.

March 2020

“We identified another excellent opportunity in government bonds – medium-duration Canadas, Canadian agencies and provincials.”

This was a pretty good call. Call it a solid single. We had a lot of cash to deploy and were still sitting on it, waiting for a signal. A takeaway for us is perhaps we were too cautious, but our systems at this time were telling us to stay away from stocks. They are built with a primary emphasis on preserving capital. The upside is our systems incorporate new price history so these experiences are now embedded in the process.

April 2020

“April was the best month for the Dow since 1987. In 1987 the Dow made an all time high in August and didn’t surpass that high until January 1992. Or take a recent CNBC headline: ‘Dow rallies more than 1,300 points, capping its biggest 3-day surge since 1931’ – we know what happened after that – the Great Depression, and a further fall in the Dow of 60%. And also from CNBC on April 28: ‘Stocks jump 2%, putting the S&P 500 on track for its best month since 1974’. After 1974, the Dow fell more than 50% and didn’t get back to 1974 levels until… 1987.”

This one is complicated. Volatility in securities prices tend to cluster. This is like disastrous innings in baseball, where one mistake seems to beget another. Or on the offensive side, one solid hit can lead to a game-winning rally. The excerpt above is an observation and reflection of the time we were experiencing, in the moment, when our models were not exactly enthusiastic about buying. We do have what you could call a ‘hit-and-run’ sign which will kick in if similar high-speed crashes and rallies occur in the future. Late 2018 and early 2019 was similar in the velocity of change so as the humans and machines learn, they adapt.

May 2020

“Worrying is one way to describe a part of what we do. Our investment process is wholly quantitative and the majority of our strategies are 100% dependent on price trends. That’s what we believe works over the long term… That does not mean we aren’t concerned with developing events and what that may mean for our clients’ prospects, financial or otherwise”.

This still stands as a description of our views on our investment process, our care for our clients themselves and their savings. See above regarding how our systems learn. Sort of like a ball manager pacing a dugout, chewing on a pencil and wondering if the strategy in place will work as more information is gathered.

June 2020

“As some of the strangest things in financial markets that have ever happened are happening, we have been able to keep risk in check as much as possible. And due to that fact, we are able to continually explore new opportunities. These opportunities are guided by our belief that price is the most important thing to use as an input to our investment process. We have been able to adjust our asset allocation systematically to avoid some wrecks. We are now using that same process to chart more paths we think will protect our investors’ capital and provide attractive risk-adjusted returns. As the great Yogi Berra said: You have got to be very careful if you don’t know where you’re going, because you might not get there.”

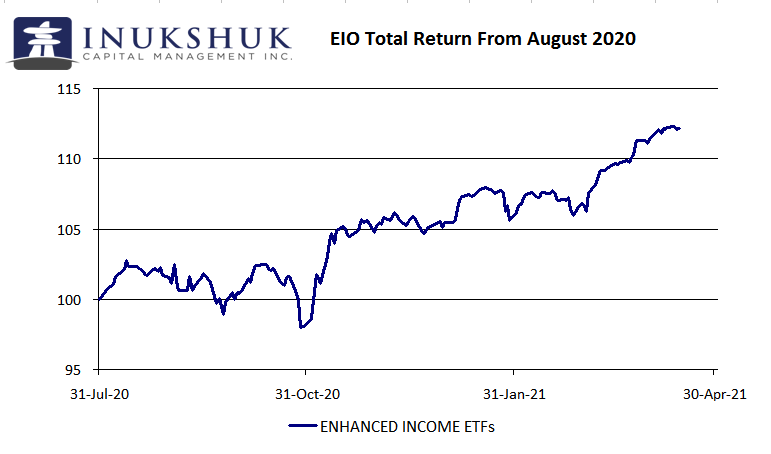

What we were referring to here is the research we were doing on covered call ETFs in order to earn yield via selling options and have a chance at some equity upside. This became our Enhanced Income Opportunities portfolio or EIO, an equally weighted group of four covered call ETFs. The underlying stocks that comprise these ETFs are filtered for quality, dividend paying consistency and deep, liquid options markets.

We started buying this basket of ETFs in August 2020. It was a bit of rough going in the first few months but has since generated decent equity returns and good dividend income with less volatility than the TSX. It looks like a double with a run batted in.

By the time this quote was published on July 13th, the TSX had rallied 40% from the March low and was still 10% below the high prior to the sell-off. Note that the market had fallen 35% at its worst point on March 23rd. This is a great example of why protecting capital is central to our investment process. If you lose 35% you need to make more than 55% on that investment to get back to even. That didn’t happen until the first week of December. And after all that the TSX was only up 2.2% on the year. What a ride.

One thing we do know is life offers opportunities – whether they feel like failures, struggles or success. There is always an opportunity in avoiding risk or taking a chance. There is a great song about the world and maybe the responsibilities we have as part of it. The following is in memory of musician Paul Humphrey:

Thinking ‘bout the future

Thinking ‘bout the past

Searching for the reason

Things are changing fast

You say it’s not your fault anymore

Still you can’t forget, it’s up to you, up to you, up to you*

*Blue Peter, ‘Up to You’

Like the painting above of a beautiful calm lake leading to a sunset, no one ever knows what is around the corner. Let’s hope what that may be is good, while keeping in mind that hope is not a strategy. It’s up to us to worry about the future, on our clients’ behalf.

HEALTH IS WEALTH

Habits, routines

I’m sure everyone is feeling fatigued by the ongoing pandemic. We all have so much on our mind and staying mentally and physically fit without social interaction and places to exercise is harder than ever before. There is no shortage of material going around about diet and exercise, so I have decided to stay off this bandwagon and approach things a little differently with my clients of late.

The words diet and exercise cause most of us anxiety. On top of work obligations, family needs, to-do lists, email overload and a constant flow of negative news streaming across our devices, how can we expect ourselves to really commit to a new way of living at a time like this?

While many of us have health goals, I propose we try to achieve them in smaller bites. In any given week, we all do healthy things. We eat some good meals, we find time for exercise, we watch a show, read a book, listen to a podcast, talk to a positive friend. I have made a point of taking stock of these things and tried to add more of them to my life one day at a time. The first step is to identify them, the second step is to incorporate more of them in my life. This doesn’t require us to re-invent our lives, it simply means doing more of the things we already do that serve our mental physical and spiritual health.

Be kind to yourself. Your goals are best achieved by doing the next right thing and doing things that suit your lifestyle.

In the coming months, I will be sharing some videos of simple things you can do at home to keep your body healthy and happy.

In order to sustain it, you have to maintain it.

Victoria Bannister, ICM Health Ambassador

At Inukshuk Capital Management, we are firm believers in the connection between Health (physical, mental and spiritual) and Wealth.

Our ICM Health Ambassador is available to our clients for complimentary consultations. Contact us for more information.

Have a question? Contact us here.

Challenging the status quo of the Canadian investment industry.