Frank Danielson

IG: @frankdanielson66

We built Inukshuk Capital Management to serve the needs of clients looking for a unique approach – void of conflicts of interest, commission sales and pushed products. We began by putting our own money where our mouth is. With low fees and active risk management, we help families achieve financial longevity, that’s the bottom line.

Stay up-to-date on the latest developments by following us on LinkedIn here.

June 2022: Tough Times

In this issue:

- Global Equity Markets

- Stonks

- Summing Up

- Health Is Wealth

Please note: This newsletter was written on June 13 – major equity markets are wildly volatile at this time. Not all of these charts may reflect their current status once this is distributed.

GLOBAL EQUITY MARKETS

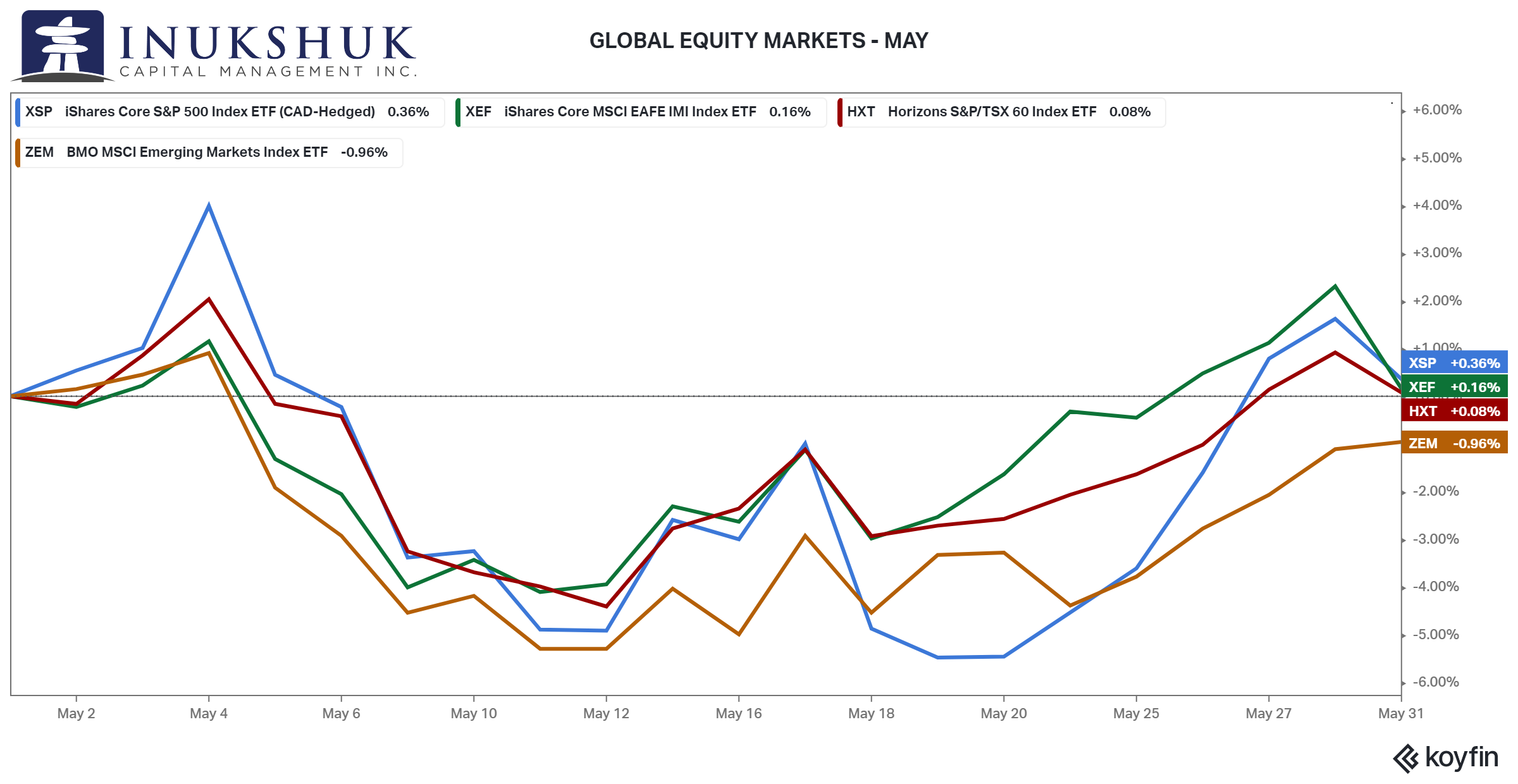

Equity markets were on pause in May. After an initial rally in the first few days of the month and then a selloff that bottomed at around down 5% on the month, stocks rallied and managed to get back to the starting line. Well, all but Emerging Markets (EM), but considering recent performance a loss of 1.0% might count as a win.

By the end of May our active strategies had pared back the remaining S&P 500 allocation to flat. We have had no exposure to EAFE (Europe, Australasia and Far East) for more than a year and EM since last July. By the end of May our active risk management program signalled to exit the small remaining positions we had in the S&P 500 and the S&P/TSX 60.

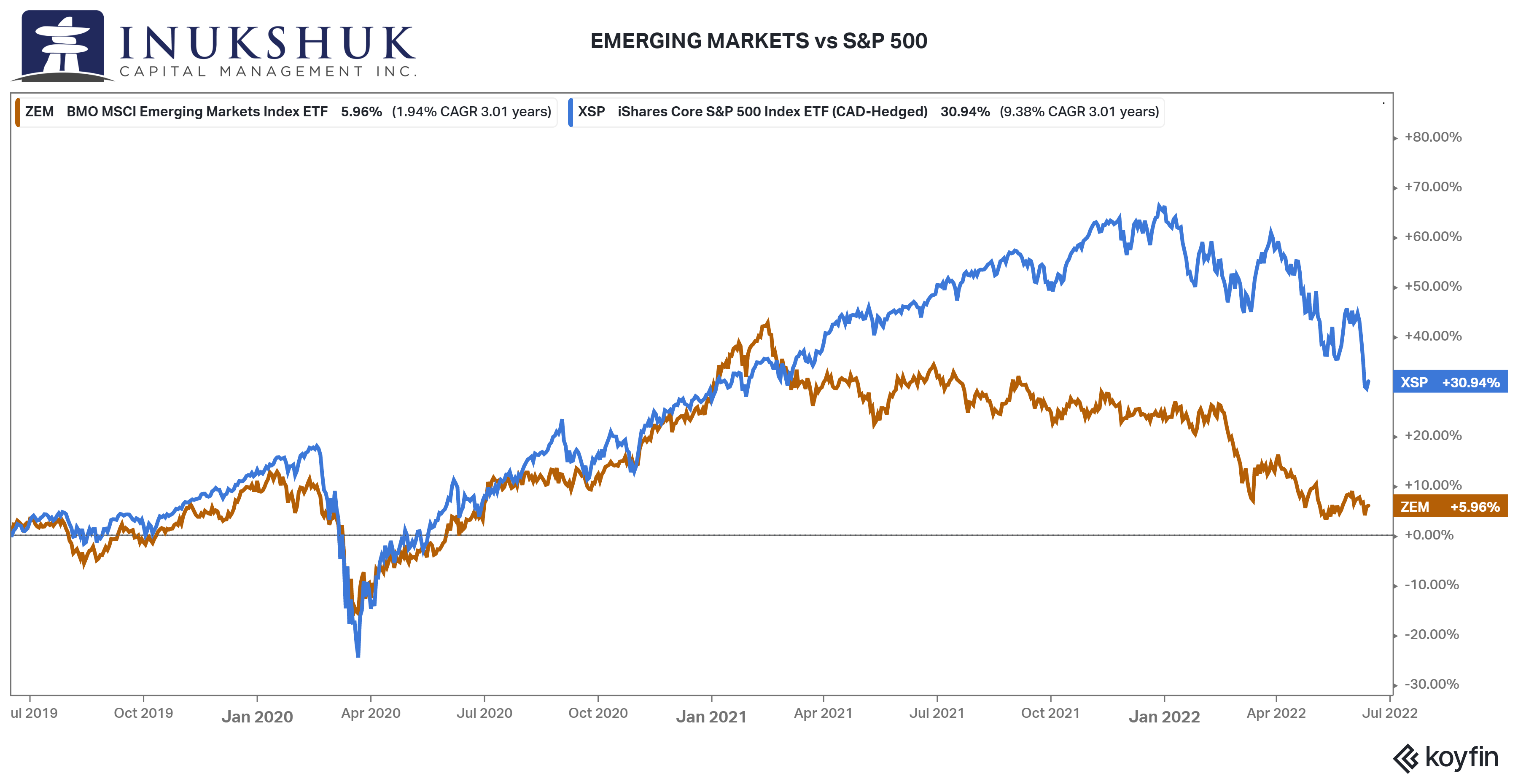

Our systems are designed to detect the signal in the noise. They operate without emotion, judgement or complaint. These strategies measure the trends in global markets every single trading day and when the trends bend, they notice. It’s for this reason that we exited our investments in EAFE (Europe, Australasia and Far East) over a year ago, and EM last July. A quick glance at a chart of EM (below) provides a good example of the market action we seek to avoid. Note that while North American stocks were making new all-time highs regularly last fall, EM was not.

Since our systems went ‘live’ at the end of February 2017 this will be the third time they have managed to avoid some of the worst parts of drawdowns in equity markets.

These strategies are a core component of most of our client portfolios. Diversification across all asset classes and across time is necessary to protect capital when traditional correlations break down – or even when they don’t. Bonds have been one of the weakest performers for some time – they have not been your friend and have become highly correlated with stocks. Presently, we have a higher than ‘normal’ level of cash in our portfolios. This is intentional. Sometimes that is an uncomfortable feeling. At the time of writing, it is not – funny how that works.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here

STOCKS (STONKS?)

These letters talk about broad indexes and asset classes. This is because the sytems we build to manage risk require a large amount of data. Also, being able to trade a broad index of stocks or bonds in one low fee ETF is very efficient.

Last month, a section of our letter highlighted the performance of the various sectors of the equity market. If you would like to have a read, it’s here. In this note, let’s take a look at some of the stocks that comprise those sectors and the broad indexes.

Staples

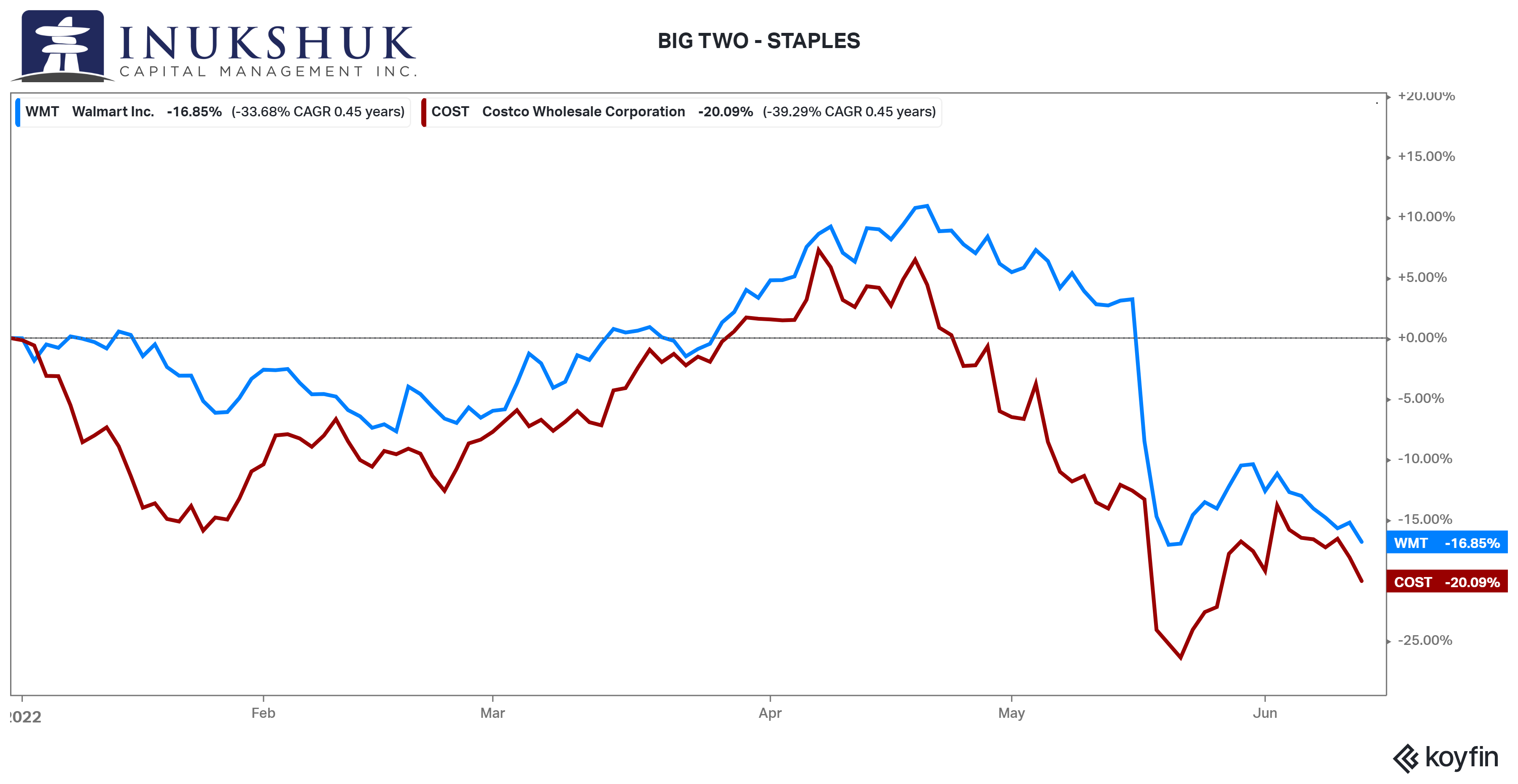

Some of the biggest companies in the world are in the business of selling ‘staples’ – things like food, clothing, the stuff humans require to stay alive. Almost everyone in North America has shopped at Walmart or Costco. In times of economic stress, staples outperform many of the other sectors of the stock market – makes some sense. So, how is it going this year?

Outperforming doesn’t mean holding value or going up. These two companies, worth more than $500 billion combined, own supply chains – globally. And the reason for using them as examples is that they represent more than 15% of the market capitalization of all U.S. companies considered to be in the Consumer Staples sector. Also, out of the top 10 companies in this sector, they are the only ones you can visit, in person, to shop.

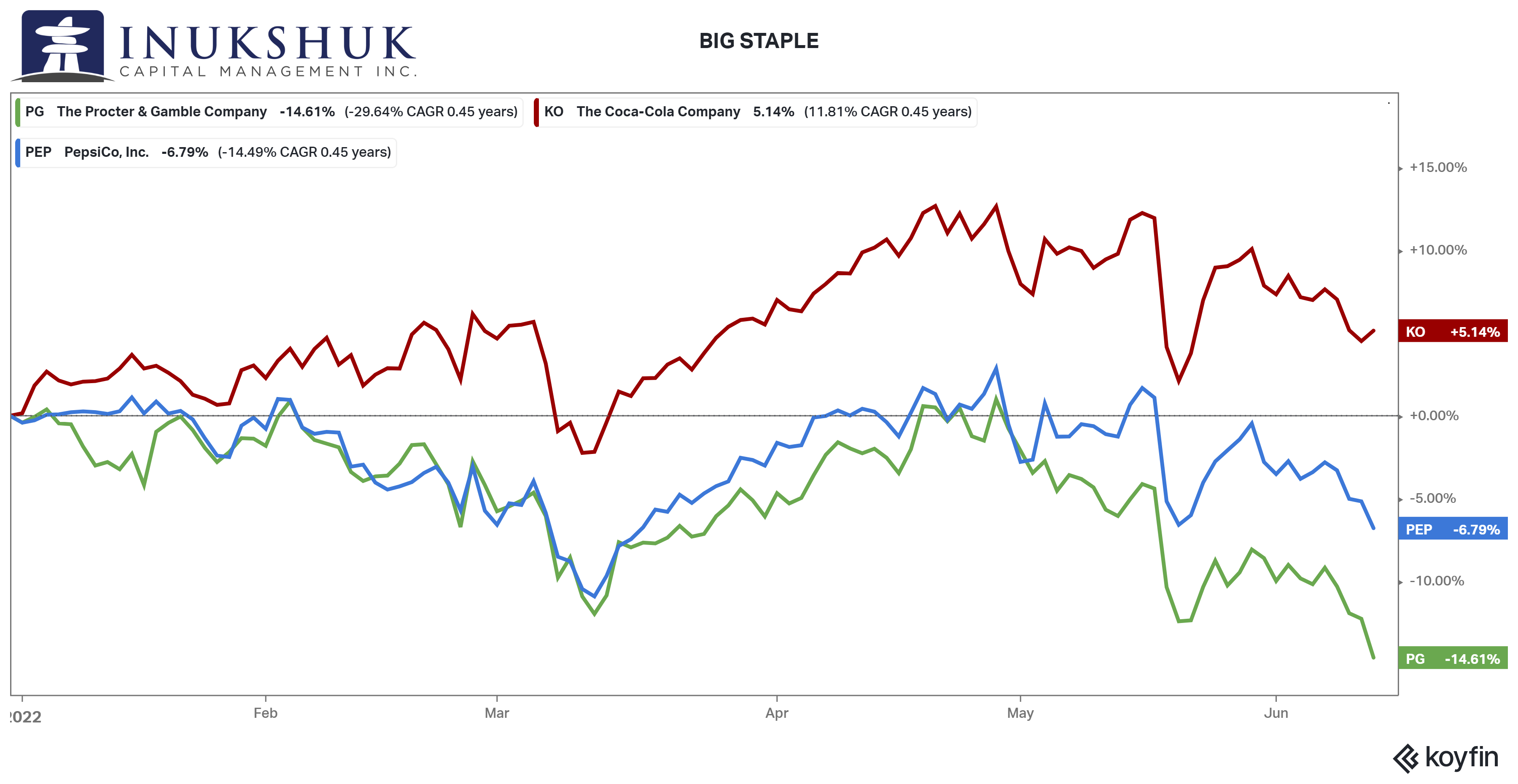

The top three, by market capitalization, in this sector are: Procter & Gamble, Coca-Cola and PepsiCo. But you don’t visit their stores because they don’t have any. They provide the products to sell. So, how is that going?

Not too bad, so far. Perhaps this is a lagging indicator. Who knows? But stay tuned.

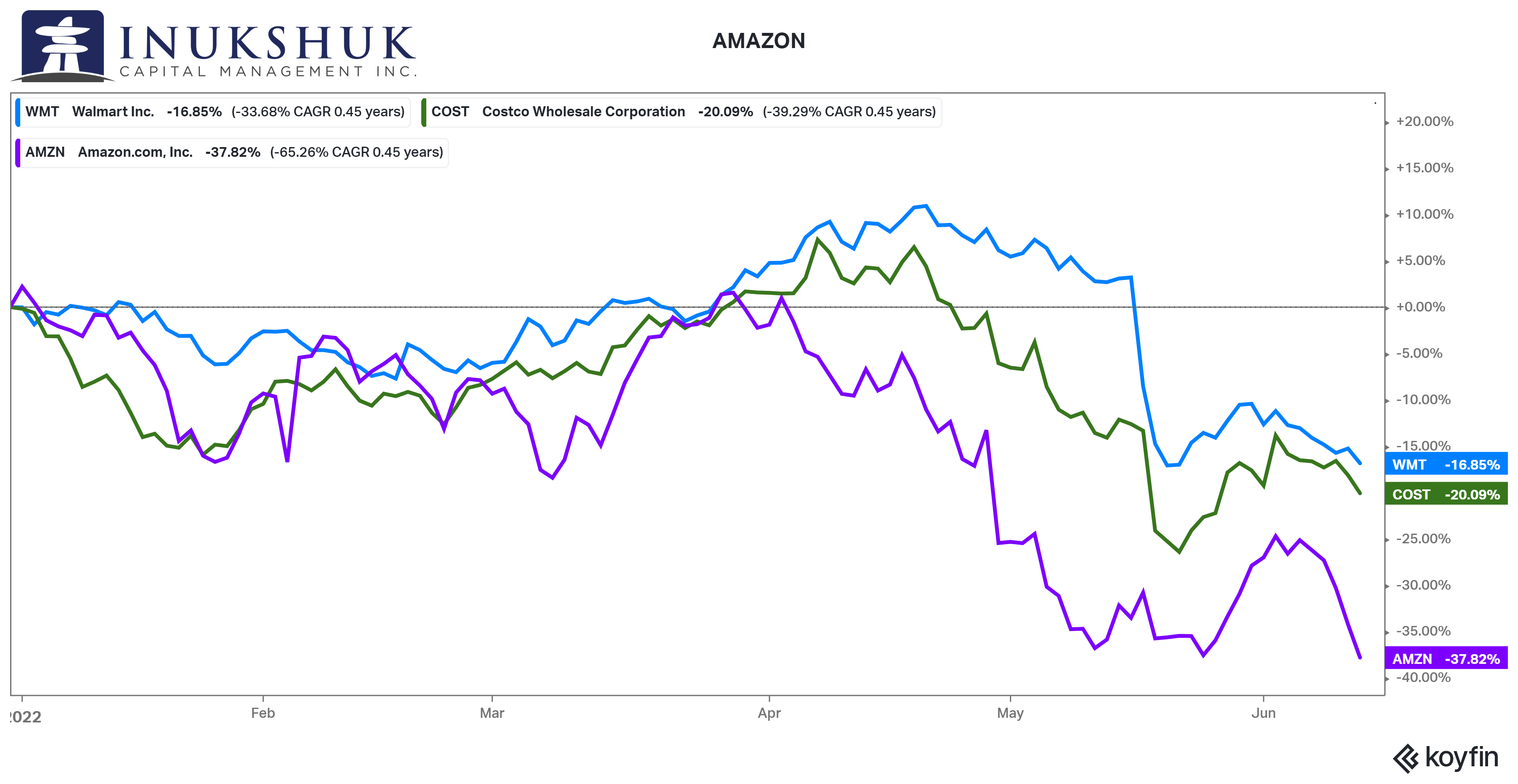

To avoid being called a goal-seeker in terms of finding examples to tell a story, let’s look at the online world. An argument often heard is the big-box retail stores are done with. Amazon will deliver anything overnight. Why bother with anything else, surely Amazon is ok. Let’s add AMZN to the prior picture.

Not good.

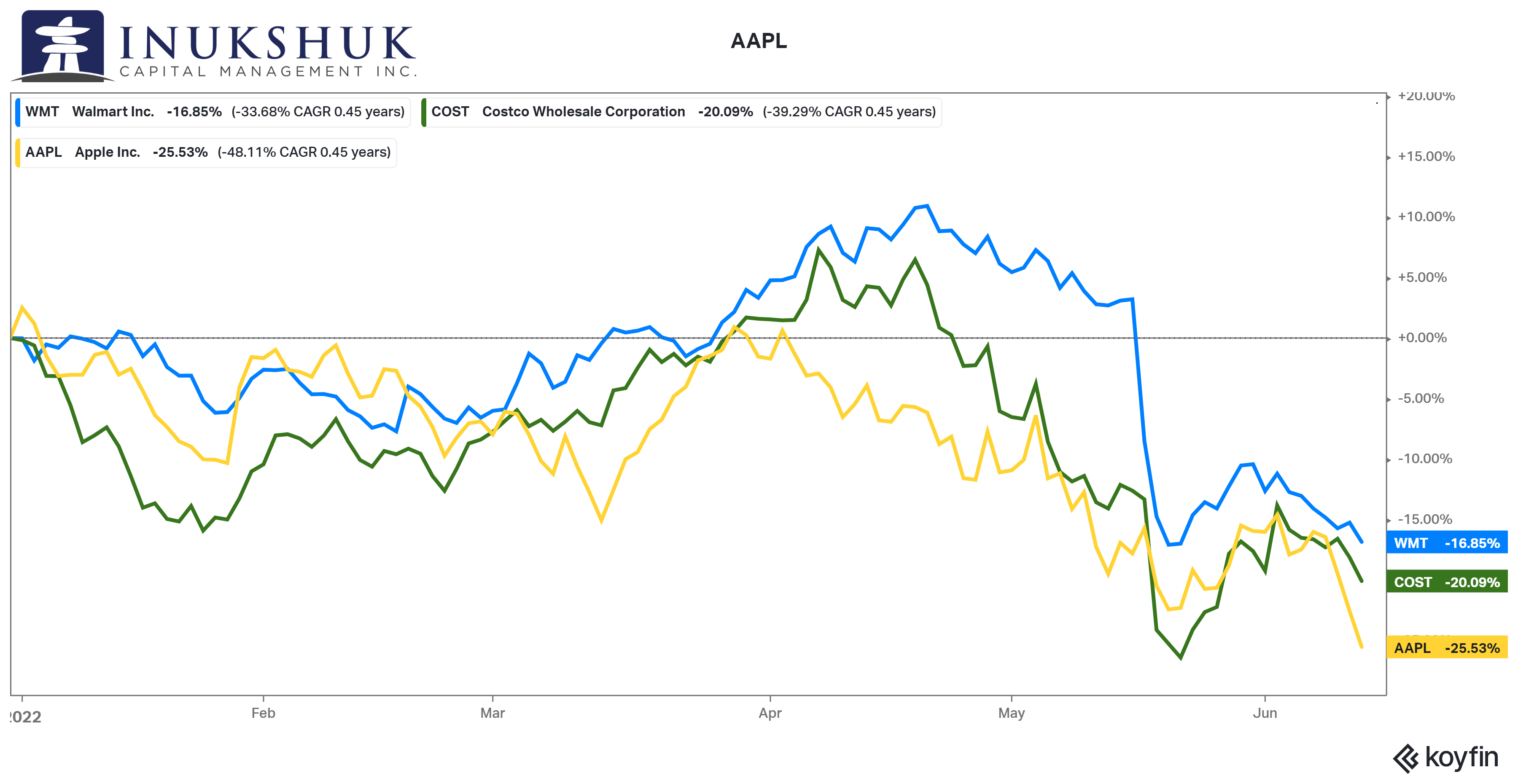

Ok, you think (or maybe not), but something must be working. For goodness sake, Apple has a lock on so many different business lines and has a ton of cash, so they must be fine.

Jeepers – worse than the S&P 500.

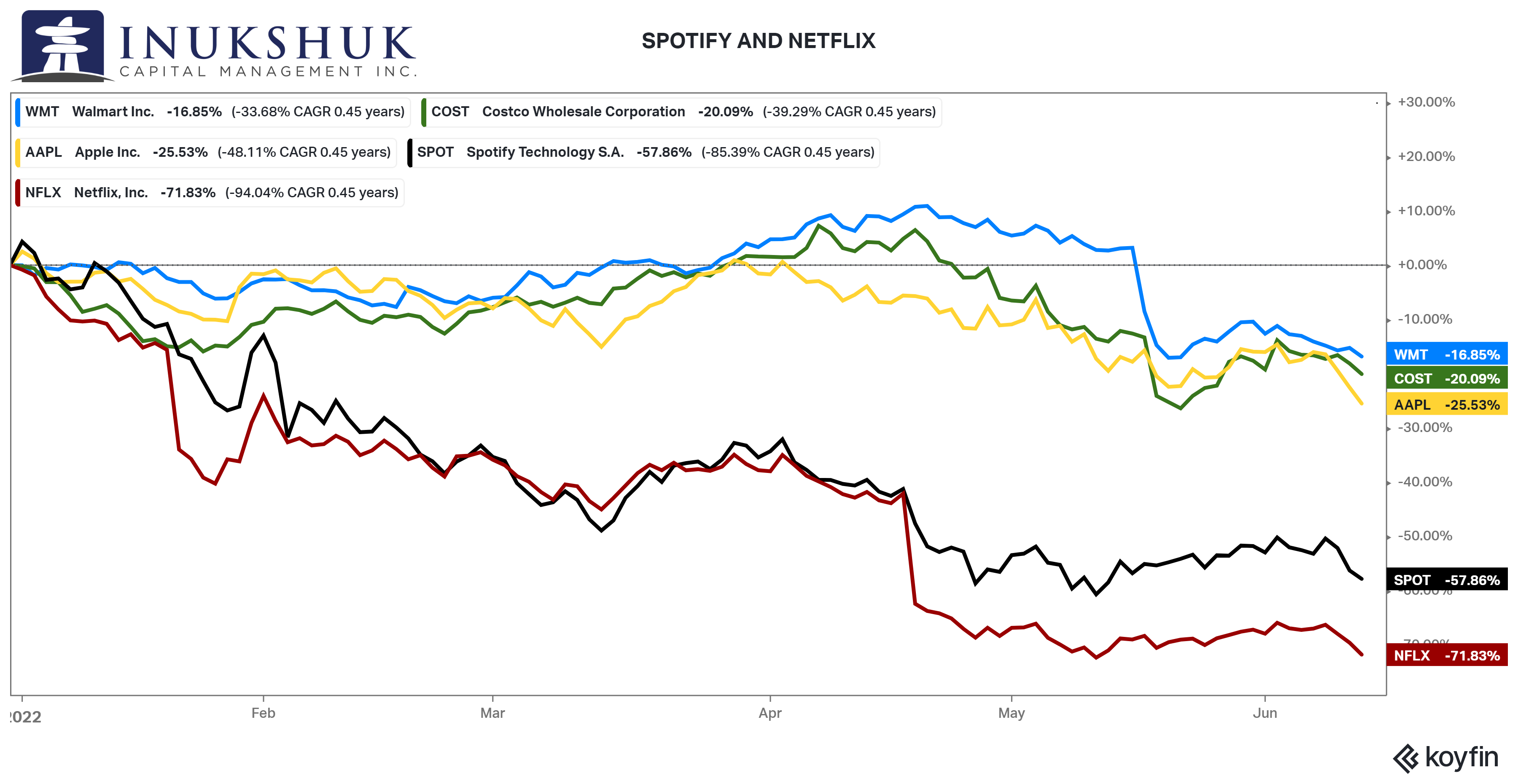

Let’s look at what people consume in terms of music and movies, online, streaming – that kind of thing. Surely that must be in better shape. Sure, AAPL may have some supply chain issues, but Spotify and Netflix aren’t constrained by those problems, right?

AAPL is a stone-cold blue chip, compared to that.

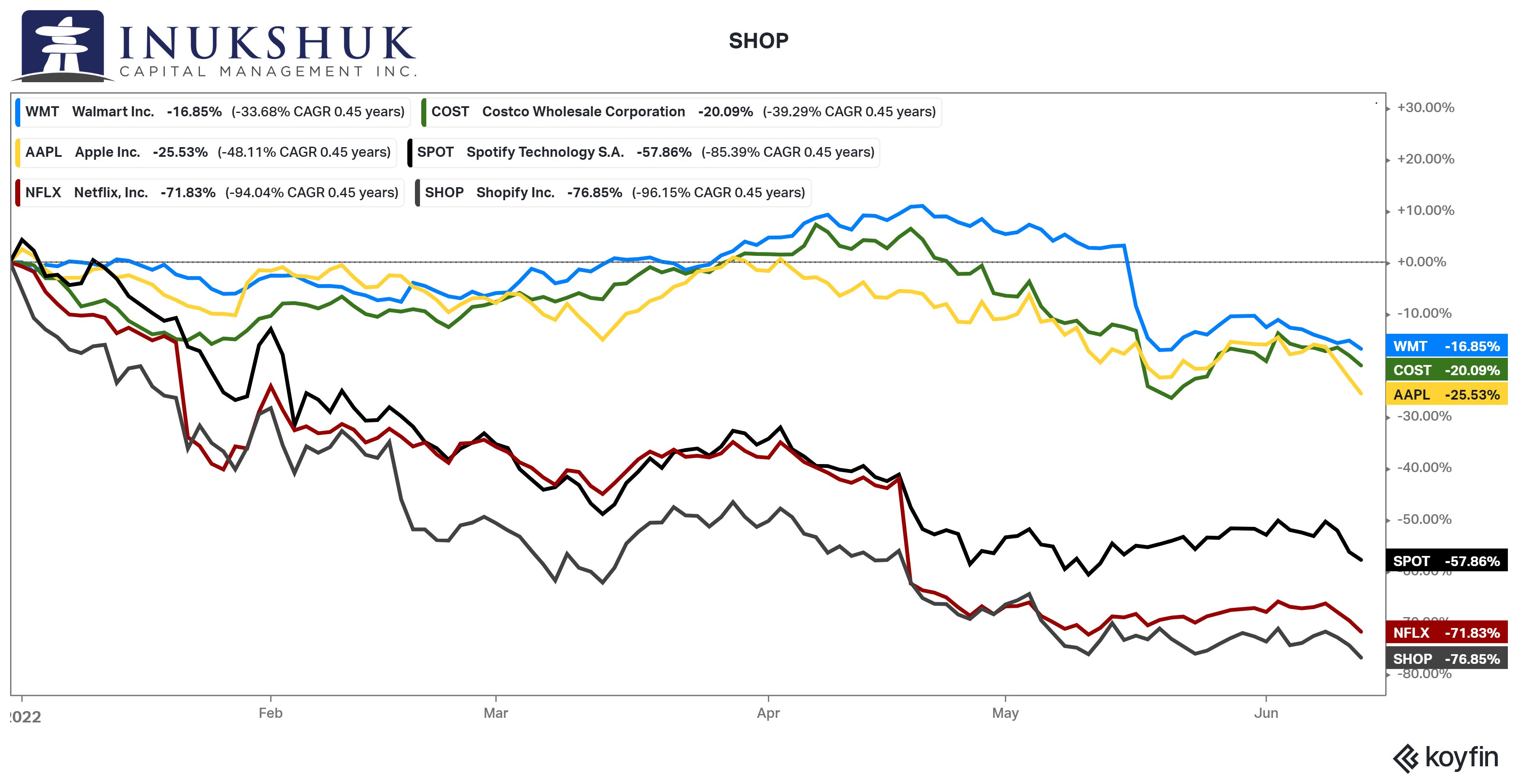

Anticipating the next thought that might be running through a reader’s head – ok, that’s a bunch of U.S. tech and retail stocks, surely it is not the same in Canada. Shopify has been killing it for years.

Let’s have a look.

The point being made is: there is a lot of damage under the hood of the equity markets. Things that everyone wanted to have at the highs in November are being thrown into a dumpster fire. No predictions. These are observations.

Note: if you bought SHOP at the tippity-top high in November, you need it to rally 450% for you to get back to even.

IN SUMMARY

These observations are not to be taken as schadenfreude, gloating, or anything else negative. There is too much pain out there in the real world, and now the financial world. These are simply facts we want to bring to the attention of our partners and clients and anyone else who cares to read.

This ain’t no party, this ain’t no disco,

This ain’t no fooling around

This ain’t no Mudd Club, or C. B. G. B.

I ain’t got time for that now

Talking Heads, Life During Wartime

HEALTH IS WEALTH

Low back pain

“You are as old as your spine.” Chinese proverb

The lumbar spine is strong and resilient. It is interconnected with bones, joints, tendons, ligaments and muscles, all working together to provide support, stability and mobility. It is also subject to a high degree of stress and load, which may cause various issues potentially leading to pain.

There are five lumbar vertebrae (L1-L5) that are the largest of the spine and progressively increase in size going down the lower back.

The low back supports the weight of the upper body and mobility for everyday motions. Muscles of the low back are responsible for flexing and rotating the hips while walking, as well as supporting the spinal column. The nerves of the low back supply “feeling” and power the muscles in the pelvis, legs and feet.

Approximately 80% of people will experience “low-back pain” at some point in their lives. For many it will last a few days and some rest will do its job. Others find the pain persists.

Most commonly, mechanical tissue and soft tissue injuries are the cause of low back pain. Mechanical back pain occurs when structure in the back is stressed or deformed. It can be localized to an area on the spine or spread right out. If a nerve has been affected, it may shoot pain away from the back and down the leg.

Soft tissue injury is also referred to “back strain,” which covers muscles, tendons and ligaments, and is a more common cause of low back pain. Torn /pulled muscles and/or ligaments can happen suddenly or progress over time from repetitive movements.

Common causes may include, lifting a heavy object, or twisting the spine while moving, sudden movements that place too much pressure on the spine (fall). Poor posture and sports injuries.

If back pain persists more than three months and/or exceeds the body’s natural healing process it is considered chronic and most often involves a disc or joint problem, and/or an irritated nerve root.

These include:

- Lumbar herniated disc

- Degenerative disc disease

- Facet joint dysfunction

- Sacroiliac joint dysfunction

- Spinal stenosis

- Spondyolistishesis

- Osteoarthritis

- Scoliosis/kyphosis

- Trauma

- Compression factor

This list is just the more common causes of low back pain. Less common causes would be an infection, tumour or auto-immune disease.

This video will provide some exercises for back pain relief.

*Please Note – Finding optimal treatment for low back pain should come from a clinical diagnosis. These are simply some daily stretches that I do to help prevent low back pain and keep my spine flexible.

‘To sustain it, you must maintain it’

Victoria Bannister

ICM Health Ambassador

Have a question? Contact us here.

Challenging the status quo of the Canadian investment industry.