Inukshuk Capital Management (ICM) is a multi-asset class, high-net-worth wealth management firm. We help individuals and families achieve financial longevity by tailoring solutions that integrate their unique financial planning considerations with modern wealth management approaches designed to deliver superior returns while minimizing tax and fees.

We are pleased to share our monthly newsletter which contains information on our ETF portfolios, as well as market commentary and other relevant news.

Stay up-to-date on the latest developments by following us on LinkedIn here.

MAY 2020 – SHOULD I STAY OR SHOULD I GO ?

We hope this note finds you healthy and safe as the pandemic continues to run its course. These are challenging times. As workplaces start opening up and some social activity restrictions are relaxed, we hope everyone continues to be mindful of the existing risks. The history of prior pandemics is a guide that suggests caution is warranted for some time. Stay safe and continue to be good to those who are most vulnerable.

SYSTEMATIC TRADING CAN MAKE YOU FEEL LIKE WILE E. COYOTE SOMETIMES

After adding a small Emerging Markets (EM) position near the end of April, and then getting fully long over the month of May the prior congestion and lack of follow-through finally resolved higher. EM was the first to warn us, even if we didn’t know it, of what was to come after February and then lead the re-entry into equity positions in other markets. By the end of the month, our systems took a long position in the TSX and in the first week of June we added a slightly larger sized position in the S&P 500.

The volatility in stocks is still elevated, and the rally from the March lows has been historic in its velocity. The strategy of investing our significant cash position in fixed income ETFs which would benefit from a retracement of the rapid credit spread blowout has worked. We have been taking some profits in credit as our systems begin to dip their cautious toes into the major equity indexes and still maintain a substantial cash position. As at the end of May the aggregate fixed income position was 52%. At the end of the first week of June our equity allocation had grown to 35%.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here.

TRY AND KEEP UP, OKAY

In last month’s note we took a look at what was driving equity markets higher and the evidence indicated large capitalization stocks were dominating performance. In early April, Rosenberg Research and Associates, noted four stocks – Amazon, Netflix, Google and Facebook – were a 35% share of the S&P 500. And they have been on fire. Many smaller stocks were lagging the overall index dramatically, but now they are moving. In this market, things change quickly. According to Bespoke Investment Group, in a note published Sunday, the 7th of June:

Here are two other stats that are pretty mind-blowing. First, there is only one stock (COTY) in the entire S&P 500 that’s down since March 23rd and it’s down less than 2%. ( Editor’s note: Mister Market rectified this tragedy with a COTY rally of 22% the next day). Second, there are only eight stocks that aren’t up more than 10% since March 23rd (emphasis added), and these include names like Walmart (WMT), Costco (COST), and Kroger (KR).

As of June 8th, the Nasdaq Composite closed at all-time highs and the S&P 500 is up on the year, and only 2.6% away from the all-time high of February 19.

NIGHT MOVES

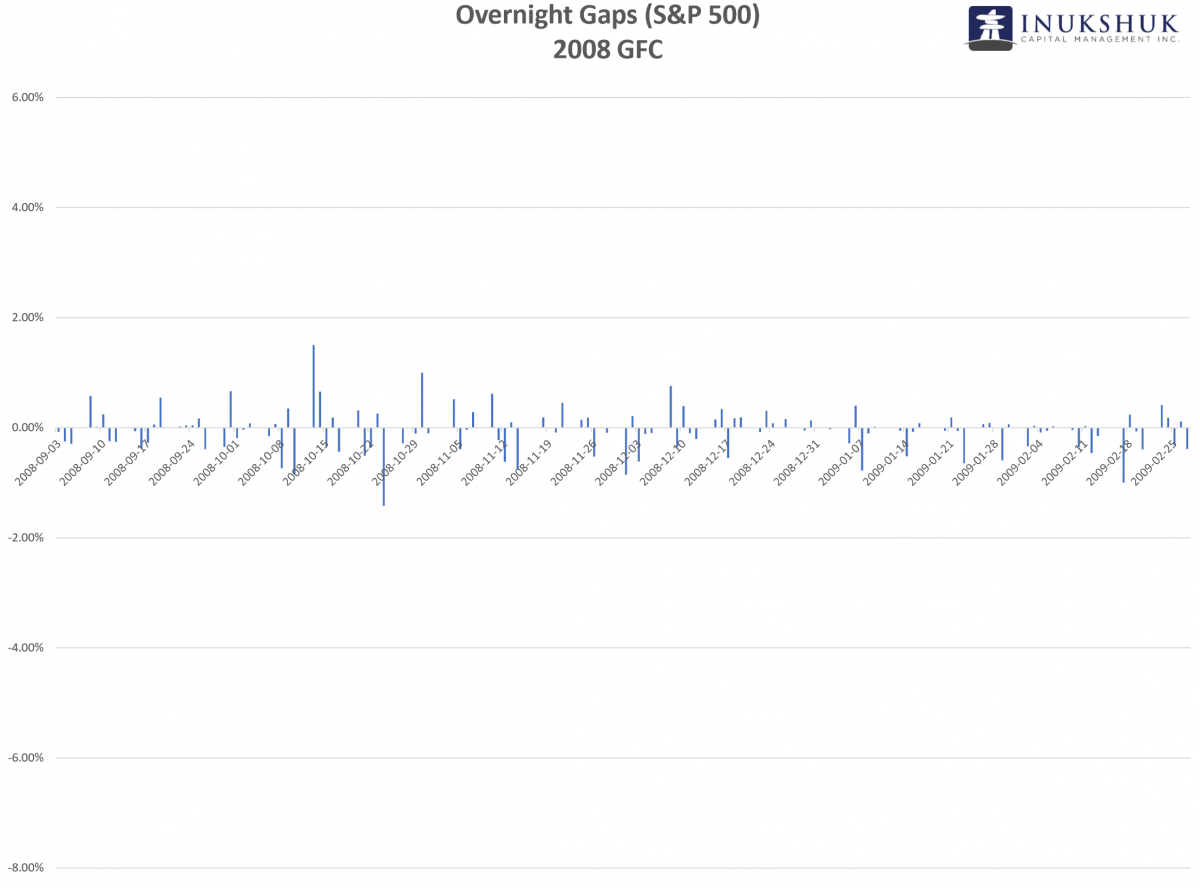

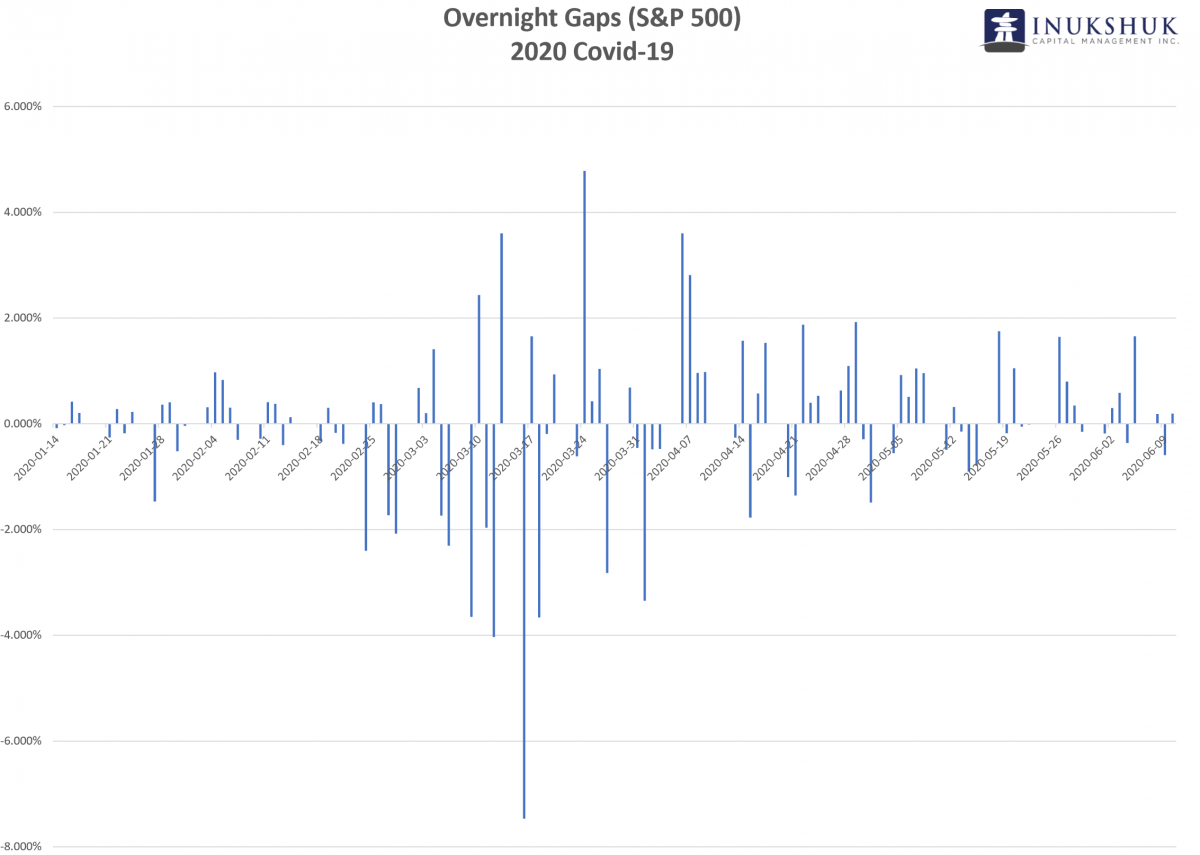

The level of volatility realized, whether up or down, has been breaking historic records of all kinds. The origins of the panic were global in nature and the futures’ market performance after regular trading hours represented this fact. The difference in the index level from its close to open the next day is referred to as a gap. Gaps occur for many reasons, and in this instance equity traders were responding to events after-hours in wildly pessimistic and optimistic ways.

Comparing the S&P 500 futures’ overnight performance these past few months to that of the 2008-2009 global financial crisis (GFC), it is clear any information that could potentially impact markets did so, in an extreme way – more so than during the GFC. In that prior panic the maximum after-hours range of the largest capitalization equity index on the planet was plus or minus 1.5%. In this year’s version of the phenomenon, the range expanded and there were cases of the market being down more than 6% or up more than 4% before anyone on the east coast of North America went to bed or woke up, if they could sleep at all.

THIS TIME IT’S DIFFERENT

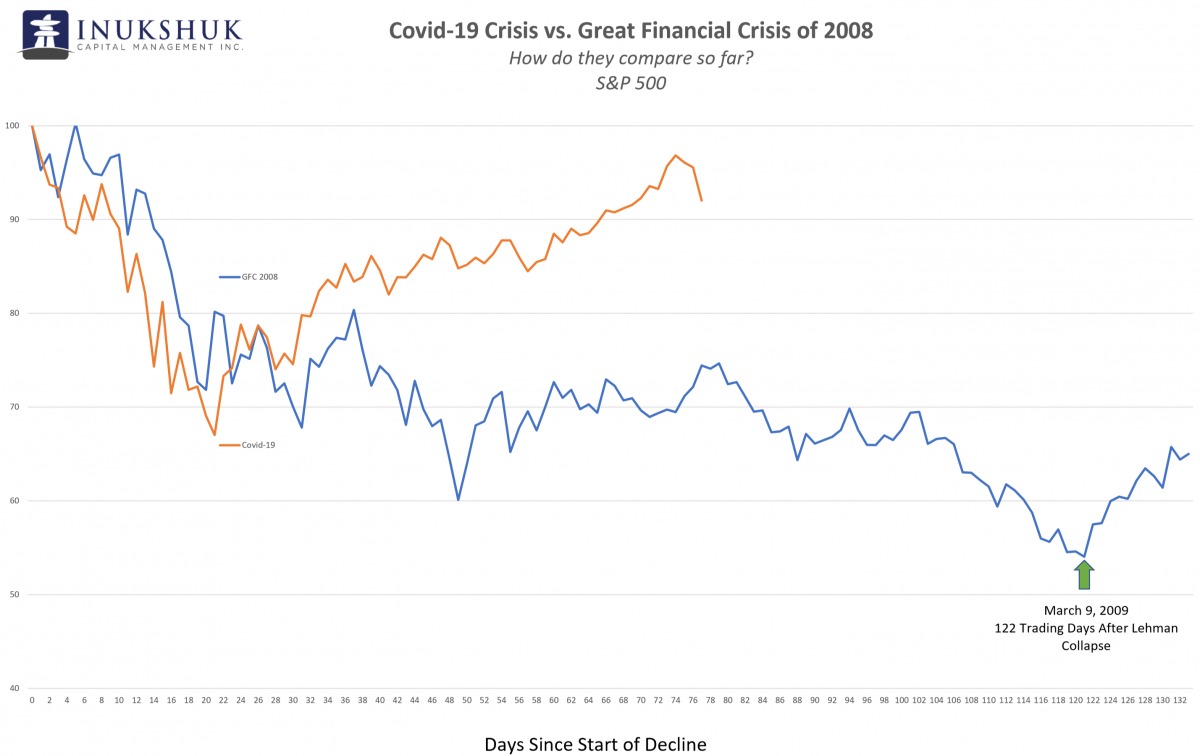

After what is now the low on March 23rd, we did an analytical exercise to see how things compared to past meltdowns. This is not the kind of data we use in our investment process, but it is interesting to see how things evolved in the past and what might be different or similar this time around. The funny thing about markets: ‘it’s different this time’ and ‘it’s the same’ are not mutually exclusive.

This path is clearly different from the 2008 GFC although some things occurred that were similar, but bigger. The unprecedented monetary and fiscal response to the pandemic’s potential effect on financial markets was coordinated globally, and at levels and speeds not seen, as far as we can determine… ever.

BACK TO REALITY

Both the Bank of Canada and the Federal Reserve have been enthusiastically buying anything they can. T-bills, Banker’s Acceptances, government bonds, provincial bonds, mortgage backed securities and even, in the US, corporate bond ETFs. At the same time, both Canada and the US have resorted to ‘helicopter money’ by creating various programs which deposit money directly into people’s bank accounts. It’s not clear whether Ben Bernanke, who took the term from a Milton Friedman paper published in 1969, thought this was ever a good idea. [Opinion: of course he did – it’s not in the nature of an economist who works for a central bank to ever consider the idea they are fallible and their policies may cause more harm than good.]

What could go wrong, we have no idea. But the reality of economic trends is concerning. Sampling some relevant indicators does not paint a pretty picture. Canadian household spending in Q1 fell 9%, “….the largest quarterly decline ever recorded.” The monthly numbers by industry are tragic: arts, entertainment and recreation were down 41.3% with the next worse being accommodation and food services, down 36.9%. Many of the workers in these industries are some of the least financially resilient in the country. A look at the results from the US, our largest trading partner does not inspire confidence. Even with a shocking (and questionable) upside surprise in the latest payrolls data the unemployment rate is 13%. An estimated 22 million people lost their jobs in May and April to increase the total to more than 40 million. Many jobs might not be coming back as industry looks to automate more roles, considering the necessity for physical distancing and what that implies for how work is done in the near future.

Whatever central bankers think or believe their actions should accomplish, the immediate result has been to ramp stocks to all-time highs while most people are experiencing extreme economic hardship, and everything that comes with it. The widespread protests and riots across the US and some parts of Canada are probably exacerbated by this knowledge. The performance of stocks is hard to ignore in daily media reports. And it’s ‘all good’. The most harmed by the virus are those who had the lowest incomes in the first place. The social fabric of civil society is under extreme stress. The memories of the Wall Street bailout eleven years ago are still fresh and many, from all sides of the political spectrum question how equitable those decisions were.

Compounding this stress is the reality and implications of asset holdings by income quintile. Rosenberg Research offers some sobering facts. To paraphrase: the top 20% of income earners in the US has a net worth 244 times that of the bottom 20%. If the stock market rallies 40% in a few weeks, the most financially fragile will not be participating in the ‘boom’. The median income of the highest quintile earners is 18 times that of the lowest, which is a record and may expand. So the prospect of earning your way out of the added debt incurred during the lockdown is not great, when you make $11,000 a year.

What this means for the future of how our society is organized is anyone’s guess. If you subscribe to the idea that the policies of central banks enable the ‘privatization of profits and the socialization of losses’ it should be a good guess that those unelected policy makers might be a political target in the coming years. Never mind leaders of other more important institutions. How that will play out and what it implies is difficult to comprehend.

“WHAT, ME WORRY?” Alfred E. Neuman, Chairman, MAD Magazine Inc.

Worrying is one way to describe a part of what we do. Our investment process is wholly quantitative and the majority of our strategies are 100% dependent on price trends. That’s what we believe works over the long term. Our job is to preserve the wealth of our clients while working to earn a reasonable risk-adjusted return on that capital. That does not mean we aren’t concerned with developing events and what that may mean for our clients’ prospects, financial or otherwise.

Things are continually changing and in the financial world it sometimes happens a little faster. So we are continuously preparing for what may happen, even though we also believe no one is very good at predicting anything consistently. When you have been investing and trading for as long as we have, you can’t help but laugh at some of the things that happen in markets, even when they are painful. Sometimes that means the iconic MAD Magazine is more reflective of reality than what is actually happening.

All of this drives us to do more research, be more creative and think even harder about what we can do as investors on behalf of our clients to navigate what we think is going to be a very unusual and difficult environment. Hunter S. Thompson famously said: “When the going gets weird, the weird turn pro.” To some, our investment process is ‘weird’ but we’ve always been pros. It might be time to think even more differently and that is what we always try and do.

Have a question? Contact us here.

Inukshuk Capital Management actively manages equity risk through our proprietary strategies which have shown to significantly reduce drawdowns, while outperforming their benchmarks over time.