At Inukshuk Capital Management, our focus is on building lasting relationships rooted in trust and collaboration. By focusing on active risk management and long-term value creation, we help families and institutions achieve financial sustainability.

Stay up-to-date on the latest developments by following us on LinkedIn here.

In this issue:

- Global Equity Market Performance

- Mexico, Canada and China

- Sell in May

- July So Far

- Wrapping Up

Global Equity Market Performance

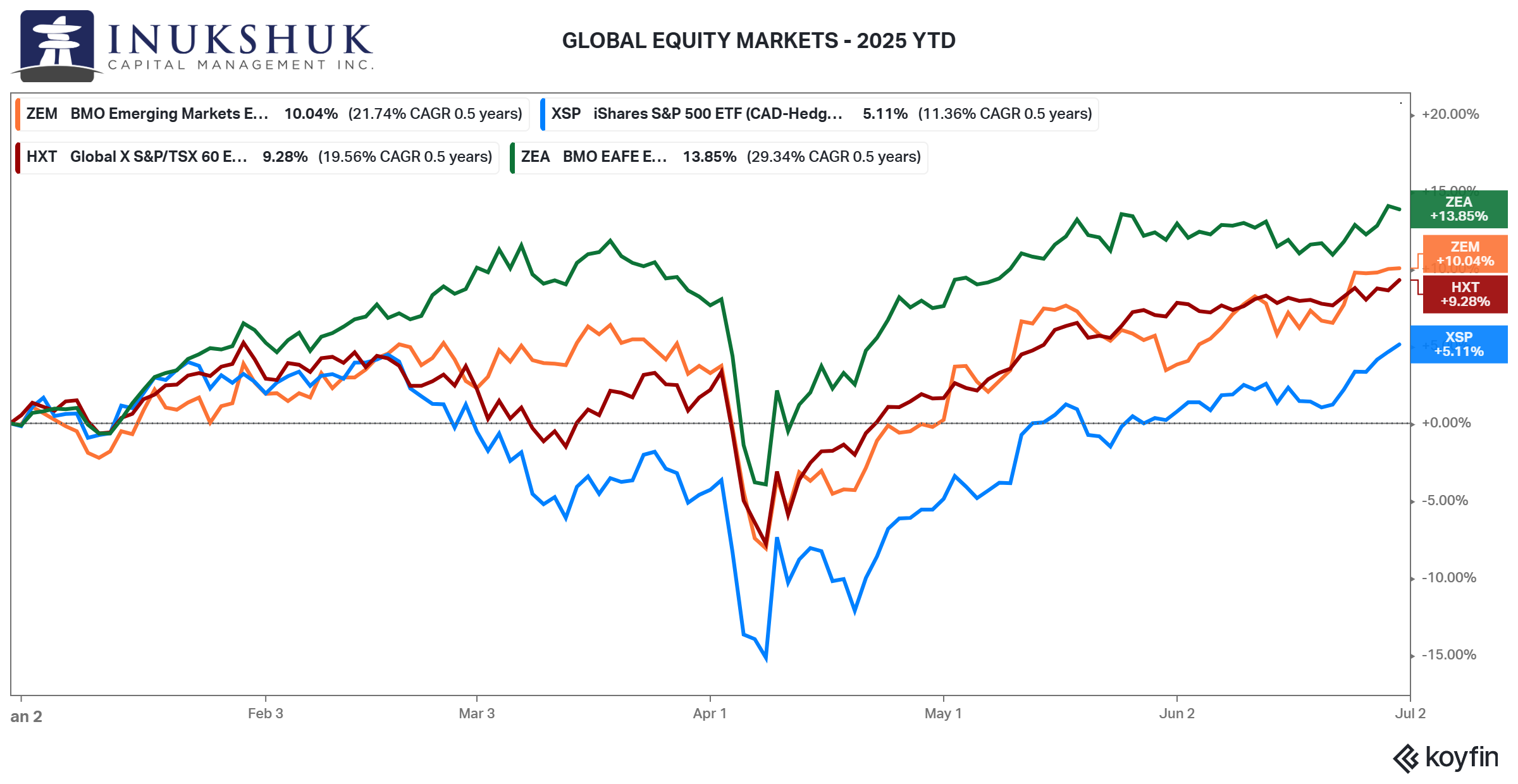

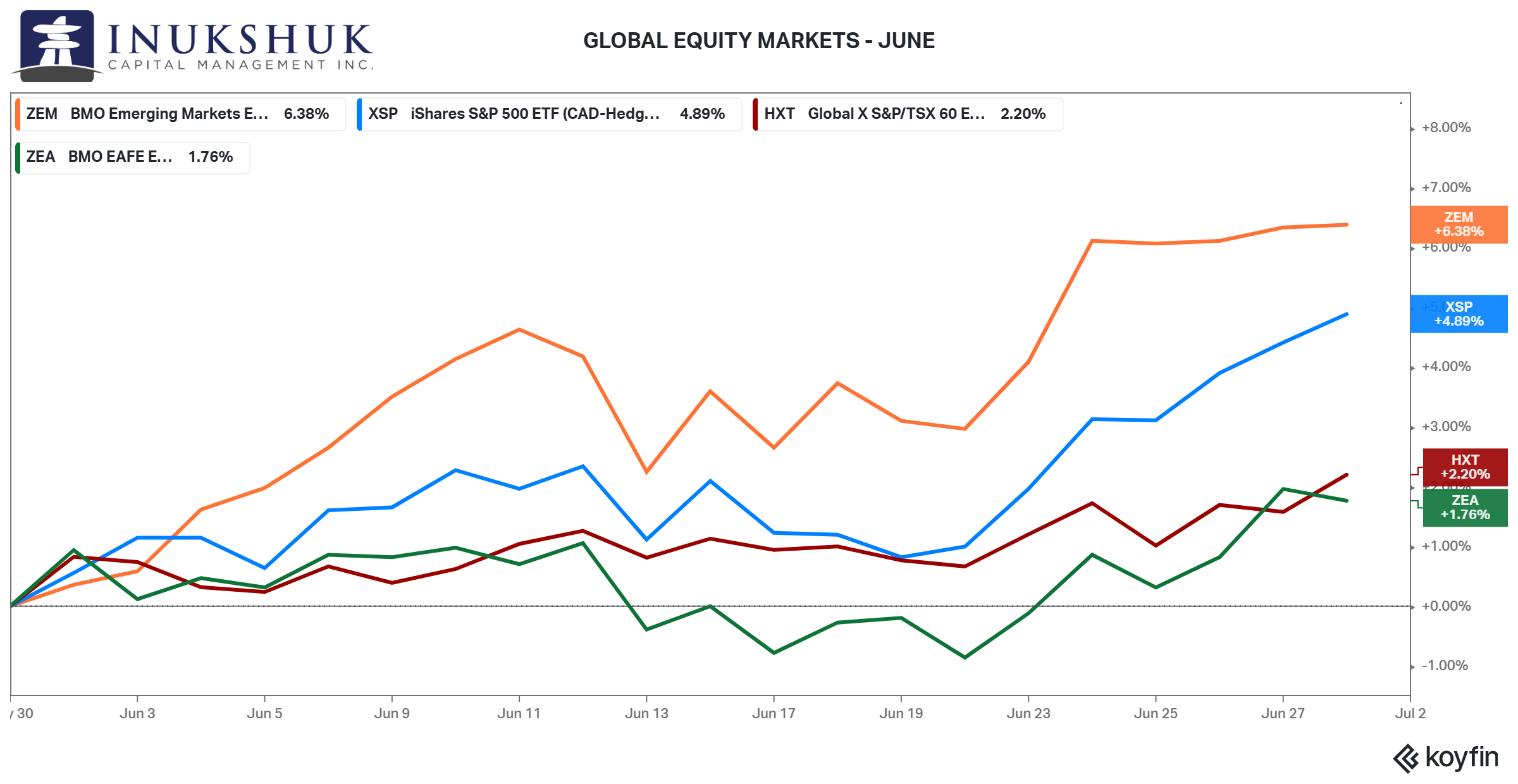

June was another good month for stocks. MSCI Emerging Markets took the lead after lagging for two months, gaining 6.3%. The S&P 500 and S&P/TSX 60 rallied 4.8% and 2.2% respectively. MSCI EAFE was fourth, up 1.7%.

MSCI EAFE was the weakest performer in June but is still leading the pack, up 13.8% year-to-date. Emerging markets are second at 10% with Canada close behind at 9.2% and the U.S. at 5.1%.

MSCI EAFE was the weakest performer in June but is still leading the pack, up 13.8% year-to-date. Emerging markets are second at 10% with Canada close behind at 9.2% and the U.S. at 5.1%.

This is the same rank as before the tariff-inspired panic of late March and early April.

As of this writing, the second week of July, our systems are indicating positive momentum in all four of these equity indexes.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here.

As noted throughout the year, Canada has outperformed the U.S. In this note we look at how America’s top three trading partners’ markets are performing.

Mexico, Canada and China

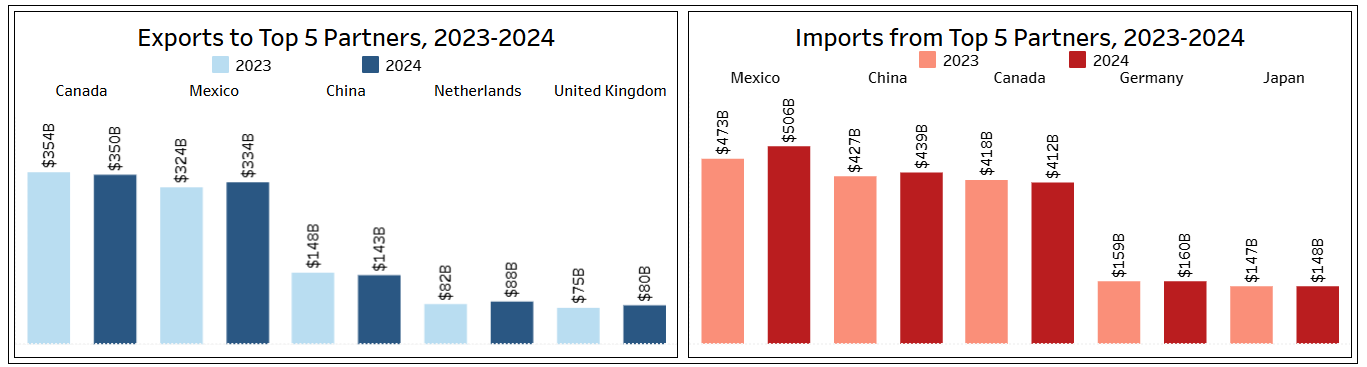

Data for 2024 from the U.S. International Trade Association shows that Mexico, Canada and China dominate global trade with the U.S. at 15.8%, 14.3% and 10.9% total trade respectively. That’s USD 2.18 trillion.

In all three cases, the U.S. runs a trade deficit. While China is the third largest trading partner it has the biggest surplus at USD 295 billion. Mexico and Canada are at USD 172 and USD 63 billion respectively.

The most recent data from the World Bank shows that Canada’s exports account for 34% of its GDP and roughly 75% of that is to the U.S. The Mexican economy is more trade dependent with exports accounting for 43% of GDP and 78% of that to the U.S.

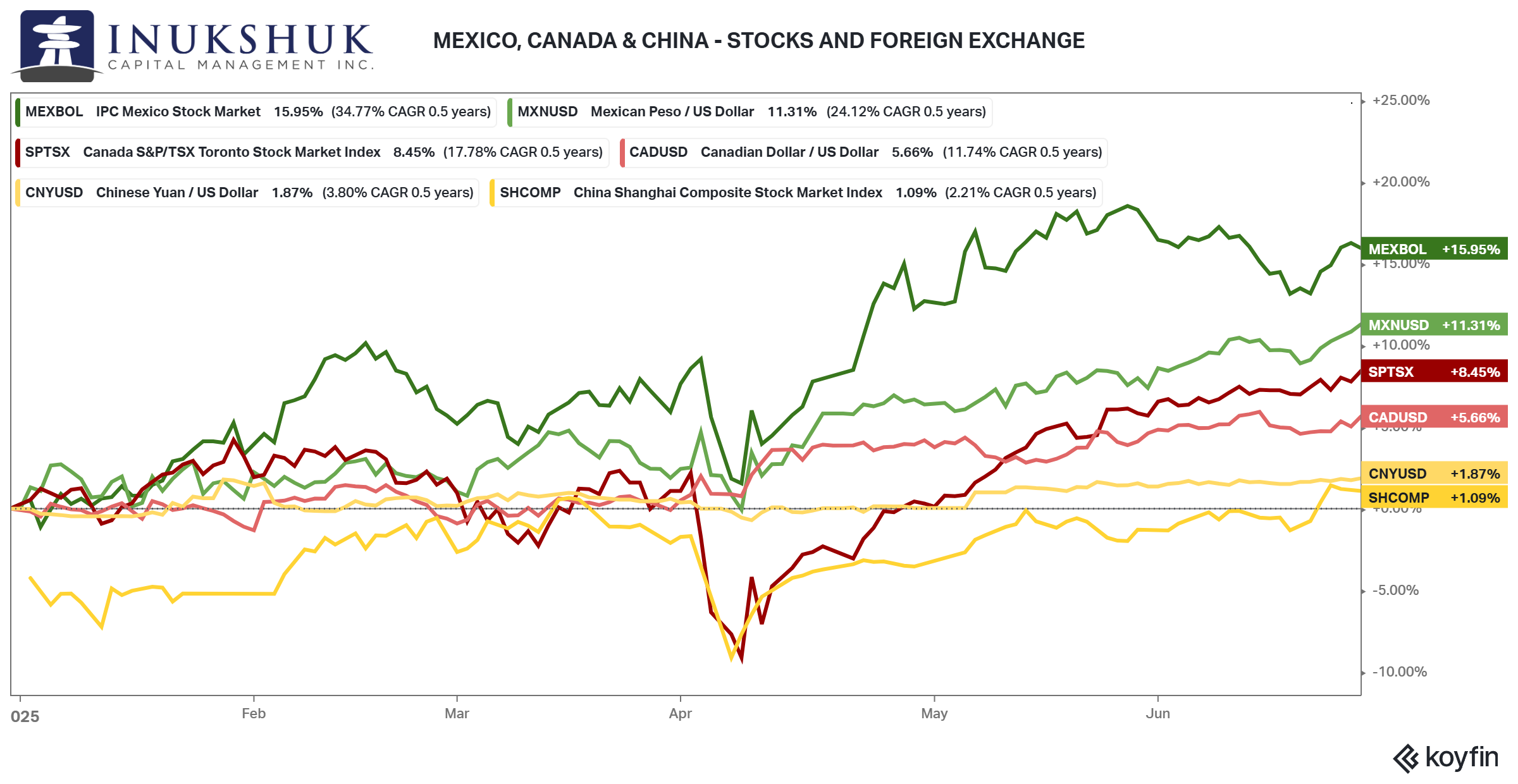

If trade is hurt by tariffs, it would make sense that exporter economies would suffer. A pundit might have thought that the local markets and currencies of these trade partners would be negatively impacted. The Canadian dollar experienced a moment of panic in February and the S&P/TSX 60 was down roughly 8% on the year in April. But neither the Mexican peso nor stock market have been significantly negative at any time this year.

China has had a more muted response in both the Shanghai Composite and the yuan, although its stock market was down about the same as the TSX in April. Note that the Chinese yuan is a controlled currency, so it is less volatile than freely traded currencies like the Canadian dollar and Mexican peso.

Canada and Mexico’s stock market and currency strength are surprising. If you had sold on expectations of weakness due to tariffs you would have been doubly wrong. This is another example of how you can lose money in markets even if you knew what was going to happen in the real economy.

If you’re a Canadian exporter, your goods or services are becoming more expensive not just due to tariffs but a rising Canadian dollar. Often, a floating exchange rate will adjust to the competitive landscape. In this case a weaker Canadian dollar would benefit exporters. That’s not happening. The economic consequences may or may not impact markets. So far, they haven’t.

How’s that ‘sell in May’ trade going?

Sell in May

So far, the ‘sell in May’ strategy discussed in last month’s letter is not working. We also noted in the same letter that the term TACO (Trump Always Chickens Out) had turned into a trading strategy – buy every dip triggered by a headline or social media post from the president.

Bank of America, via Grant’s Interest Rate Observer, has studied an indicator that attempts to quantify the success of this strategy. They found that buying the Nasdaq 100 after a down day would have generated a 31% return so far this year. The index itself is only up 8%.

The only other years that this strategy was more rewarding were 2020 and 1985. As stated, things in markets work until they don’t. It’s two and a half months until the end of September when the ‘sell in May’ trade ends. Maybe the TACO-inspired tactic keeps ticking and ‘sell in May’ is proven to be wrong (again) this year.

July So Far

On the last weekend of June Trump announced that he will be “…terminating ALL discussions on Trade with Canada.” This was in response to the digital services tax Canada was going to start collecting on June 30. Shortly thereafter, the digital services tax was rescinded.

Talks have been resumed, but on July 9, Trump announced a 50% tariff on copper. The next day he announced a 35% tariff on all goods and services from Canada. These are to begin August 1, the new deadline for trade negotiations to be completed.

It’s not clear what position PM Carney’s elbows are in at the moment.

Also, on July 9, Nvidia became the most valuable company in the world and the first to top a $4 trillion market capitalization. The dip-buyers have been rewarded. At one point in April, it was down 30% on the year.

The same day, bitcoin broke its previous high of $112,000 and as of July 14 has set a record at $123,000. What’s up with July 9?

Wrapping Up

Whether real wars or trade wars, not much seems to stick to this market.

It’s important to be aware of current events, but it’s not always helpful from an investment management perspective. We will stick to what has worked for us.

Lesson learned: don’t cheer for any team—in writing. The past two years we’ve ended the June letter with ‘Go Oilers.’ Apologies to Oilers fans.

It should be noted, however, that the Blue Jays are in first place in the American League East at the All-Star break.

That hasn’t happened since 1993…

Enjoy the Midsummer Classic.

Have a question? Contact us here

Challenging the status quo of the Canadian investment industry.