Photo by Grace Keeley in Lake of Bays, ON

Photo by Grace Keeley in Lake of Bays, ON

We built Inukshuk Capital Management to serve the needs of clients looking for a unique approach – void of conflicts of interest, commission sales and pushed products. We began by putting our own money where our mouth is. With low fees and active risk management, we help families achieve financial longevity, that’s the bottom line.

Stay up-to-date on the latest developments by following us on LinkedIn here.

February 2021- Same As It Ever Was

In this issue:

- Markets

- Talking Heads

- Nasdaq Analog

- Enhanced Income

- Bitcoin- How Thick Is This Ice

- Health is Wealth

MARKETS

Believe it or not, there exists a debate surrounding the meaning of the expression ‘Groundhog Day’. This is a thing because some people seem to have a lot of time on their hands. The argument is not about whether a rodent can predict the length of winter. It’s about whether the expression is a good metaphor for things repeating, in a loop. We are on Bill Murray’s team on this one.

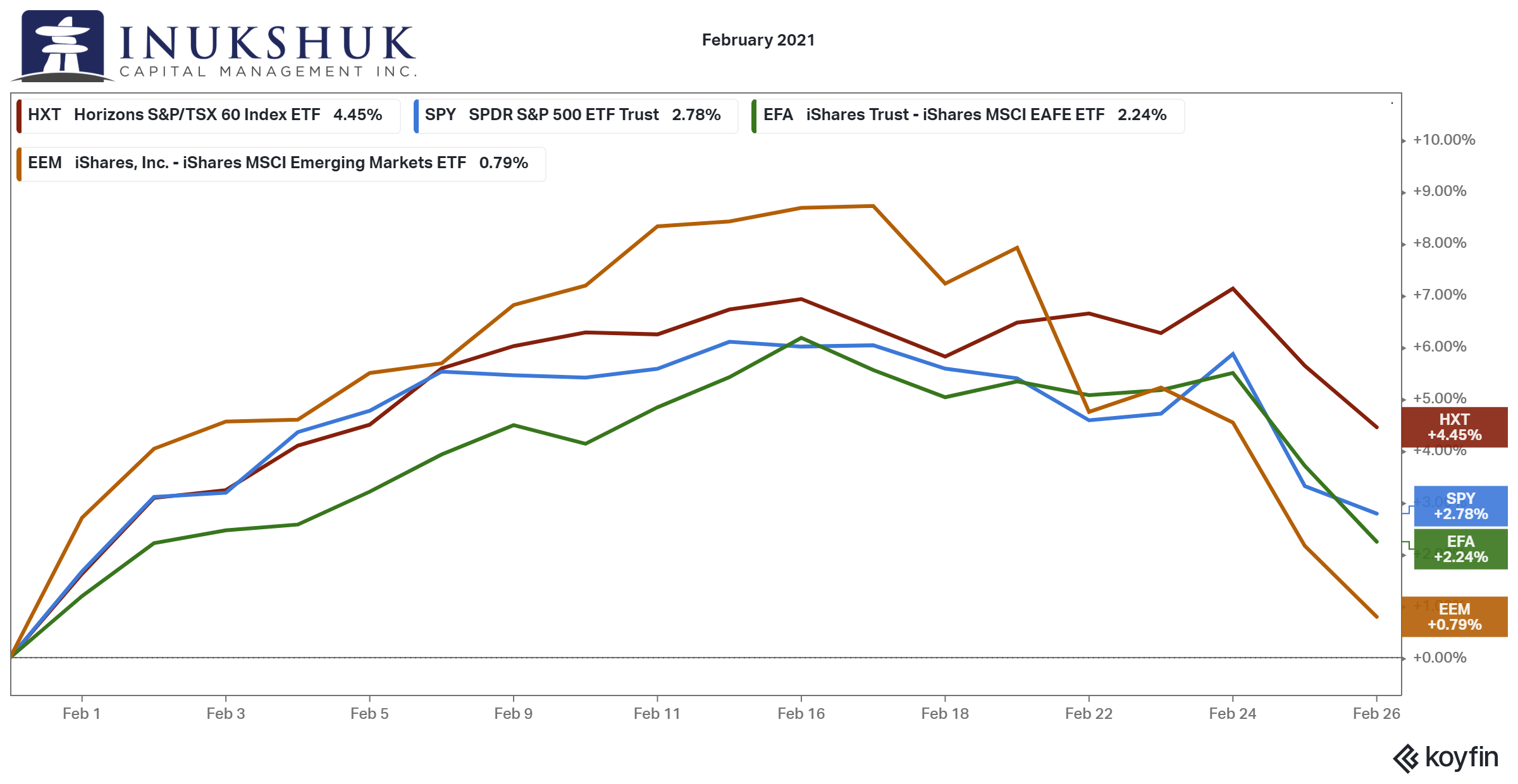

Groundhog Month’s global equity market performance was a repeat of January. Four of the past six months have started out well and then faded in the last week of trading. It is not a big sample but it’s an interesting development nonetheless. In January, the only major equity index to show a gain was MSCI Emerging Markets (EM).

In February, market indexes fell dramatically from their highs into the end of the month. EM, the January cool kid, was shunned and was the worst performer – these things happen. The TSX was the best performing index of the four, up 4.45%

At the end of January our active systems’ signals on MSCI EAFE warned us that the potential risk-reward in that market was unfavourable. Prior to the last week of February we had exited the entire position.

The upside to Groundhog Month is spring is around the corner. After a bit of a wobbly start to March, all four markets are up 1% to 4% as of Friday the 12th.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here.

TALKING HEADS

An interesting development over the past few weeks is the focus on inflation amongst the talking heads on TV and chirping ‘fintwits’ – those being the commentators on financial Twitter, who are quickly replacing traditional financial media as a source of opinion and information.

If there is a fear of inflation it makes sense that long-term bonds go down. On the other hand, gold had a worse month and inflation-protected bonds did nothing. That doesn’t sync with what is considered ‘normal’ if inflation fears are serious. Stocks have a decent history of performing well in an inflationary environment, but not this time. It looks like we need a three-armed economist, or some guy with his shirtsleeves rolled up ranting on CNBC.

From the highs around mid-February to the end of the month, here’s the score:

- EM down 7.30%

- EAFE down 3.14%

- S&P 500 down 3.07%

- S&P/TSX 60 down 1.81%

- Gold down 2.52%

- Long Government bonds down 1.39%

If you’re someone who needs to try to explain things to make a living, that is a lot of material to work with. And work with it they have. Same as it ever was.*

*Talking Heads, “Once in a Lifetime”

NASDAQ ANALOG

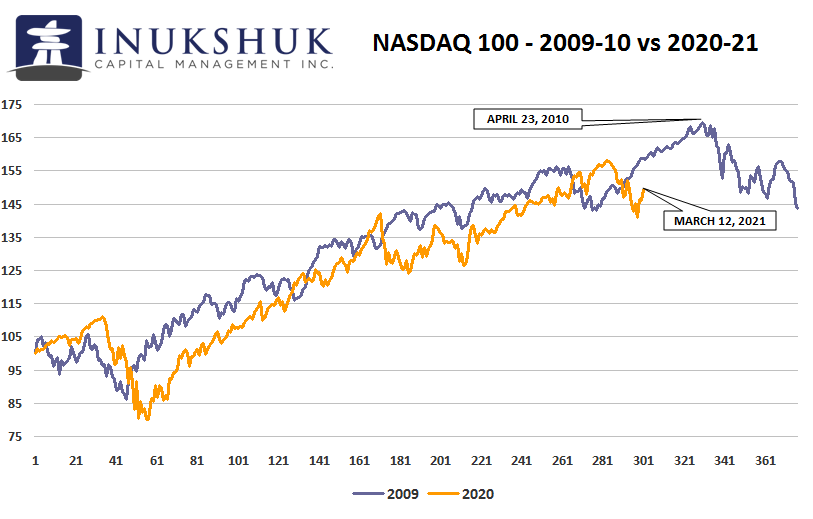

We study analogs to see what may be possible. It is not something our systems use directly as a signal to buy or sell but these things are all related.

The last analog we were following taught us the differences between the market’s reaction to the 2020’s pandemic crisis and the global financial crisis. In both cases the S&P 500 set new highs and then collapsed. The difference, we guess, is in the response of the fiscal and monetary authorities, globally. You can read that here.

If you accept the premise that the financial world changed around 2008 to 2009 and then again in 2020, it might be reasonable to look at what happened in the aftermath. Not on the way down, but on the way up.

As we compare the performance of the Nasdaq 100 this past year with its performance after the lows of 2009, bring some salt. These are thought experiments we might learn something from, not predictions – we’ll leave prognostication to the talking heads

ENHANCED INCOME

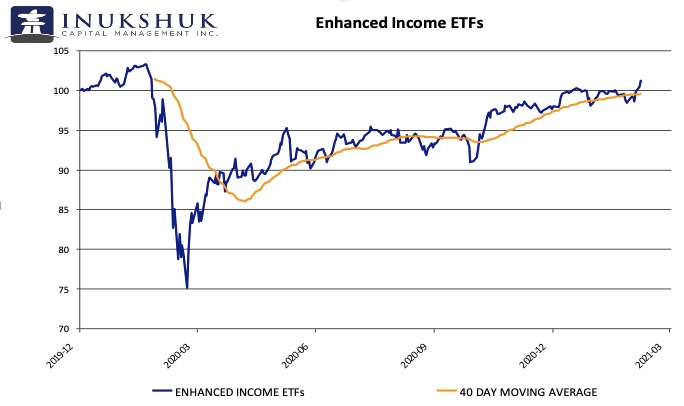

ICM does not focus on any one specific strategy to build portfolios. We diversify across strategies. The core of our tactical asset allocation process is based on trends in four main global equity markets – the S&P 500, TSX, EAFE, and EM.

Our systematic approach identifies trends in price but also recognizes opportunities that seem to be out of sync with the math. As an example, in the summer of 2020 we were buying high-yielding equity ETFs that realize much of their yield by selling volatility. We highlighted this in our September note.

The underlying stocks that comprise these ETFs are filtered for quality, dividend paying consistency and deep, liquid options markets. Below is an equally-weighted basket of those ETFs going back to early 2020. Maybe we are seeing the beginnings of a trend, driven by the thirst for yield.

BITCOIN- HOW THICK IS THIS ICE

In the past month, two ETF providers in Canada launched Bitcoin ETFs. There is another one in the works. Is this ‘Peak Bitcoin’? We have no idea. But the trend looks solid so we are involved.

In the spirit of much of what we try to do in these notes, a bit of history should put some perspective on the recent popularity of this virtual store of value and medium of exchange.

The primary two things that humans have ever cared about in terms of money over all of recorded history are:

- Is it accepted as a means of exchange for some good or service

- It is expected to be worth something in the future

The short form is: exchange and value are necessary conditions for money to exist.

The history of money is both fascinating and perplexing – a bit like the humans who have always found a need to create or define something money-like. Traditional academic economic reasoning is constructed from the perspective of barter. There is nothing wrong with that when you are attempting to simplify things and write papers. The math is easier.

In the real world, it is not very practical to carry the six chairs you built and exchange them for the wheat you need to make bread and then trade the excess wheat to the goat herder for your next month’s source of protein and then take half of the goat to the woodcutter to acquire some raw material to make more chairs.

Markets evolved to allow humans to do all of those things in one place. The ancient Greeks called it the Agora. But it still wasn’t ideal. If the woodcutter doesn’t need any more goat meat, you can’t make any more chairs. This problem’s solution was the evolution of banking and money. In our November 2020 note we highlighted advances in banking made by the Medici family in Italy starting in the 1400s.

That’s a bit of the background behind why a currency would evolve. The academic debate on what money is has always surrounded the ideas of a means of exchange and store of value.

If you really want to dig into the history you can find all kinds of stores of value and means of exchange used by humans for thousands of years. These include, in no particular order: boulders, gems, metals, rocks, paper and… chickens (that’s not a typo, scissors were never any of these things, as far as we know).

‘Why not Bitcoin?’ might be the question as opposed to: ‘Why is Bitcoin worth anything?’ Money is worth what it is worth – it is a confidence game. How about: ‘Why do humans think government-issued paper money is worth anything?’ It is the accepted and adopted policy of central banks to target an inflation rate of 2%. That means the goal is: every year the value of the issued currency’s value should decline versus things humans need to buy.

None of any of this makes sense from a high level. Money is tricky. The practical part of using government currency in current social structures is that others in your Agora will accept the government-issued paper for the things you want. More importantly, the government requires that your tax payments be made with their own printed paper or its digital likeness.

What we see in Bitcoin is that it has no counterparty risk and is outside of government management. This is similar to why humans have always considered gold as meeting the requirements of exchange and value. Bitcoin just weighs less.

Let’s look at it from a ‘street smart’ perspective. All of the humans who have a stake in the current game rely on it to continue. Valid arguments are not offered in order to support why the current system is better than an alternative. Why would that be?

Central banks need trust in their money. Federal governments need you to play and then pay.

Academics often rely on central banks and various economic ministries and departments to make a living. Bankers need to have access to the central bank spigot and control the payments and lending system. Banks pay outlandish speaking fees to all of the above to reinforce the narrative that is best for them. Meanwhile, corporate management has no idea what any of these groups are talking about.

Finally, if you look at who is not involved in Bitcoin but claim they want to be in polls is remarkable. Maybe they are all lying. Maybe this is the top. We don’t know, but we are certainly exploring all aspects of Bitcoin itself and the underlying technology.

There is a famous quote attributed to Wayne Gretzky that has been used and abused in MBA schools and business presentations to the point of meaninglessness. In order to not dishonour the legacy of the Great One’s father Walter, who died two weeks ago, it will not be quoted here.

Instead, look at the picture up top. Our goal is to follow the trends we think are robust and to not fall through the ice, freeze and drown. That’s an easy thing to do if you are a kid skating on your backyard rink. When you are on a lake and you don’t necessarily know how strong the ice is and how deep and cold the water can be, you should have a plan. And that’s what we have.

HEALTH IS WEALTH

Dieting and Long-Term Control of Body Weight

Almost any diet will help us lose weight but keeping it off is the challenge.

For many of us, we have been eating more and moving less during Covid. We may have even developed some new habits when it comes to eating. As spring approaches and the pandemic comes to an end, we all look forward to reconnecting in person with our friends, family and favourite places. It is human nature to want to look and feel good, so we might find ourselves pursuing a diet. Unfortunately, dieting alone does not guarantee longevity when it comes to weight loss. While dieting can sometimes lead to successful weight loss in the short term, it is a notoriously unreliable way to regulate body weight over longer periods of time. There are psychological and physical mechanisms in place that add to the challenge of losing weight:

| Habits, routines | These are powerful forces that fight change. If we want to change our habits, we need to work against the mechanisms that created them. |

| Sensory enhancement | After only 24 hours of caloric reduction, everything smells and looks better, leading to powerful cravings |

| Decrease in basal metabolic rate | After 3 days of rapid dieting, the thyroid kicks in, decreasing the metabolic rate at which you burn energy |

| Food obsession | These mechanisms start to kick in at the 1 week point. You literally begin to dream about food. Your brain tries to induce you into eating |

| Eating induces eating | After about 1 month of dieting it becomes difficult to stop eating once you start, you want more. The act of eating stimulates more eating behaviour |

| Clinical depression | After about 3 months, nearly 30% of all dieters become clinically depressed – going back to their old ways. |

So what does a fitness professional do when she gains a few covid pounds? I start my plan immediately. I celebrate each personal victory when it comes to good food choices. I increase my daily activities, add an extra walk, dance around my living room, anything to incorporate movement. When I feel better, I make better choices.

Just remember, to sustain new habits, they must align with your lifestyle to have longevity.

In order to sustain it, you have to maintain it.

Victoria Bannister, ICM Health Ambassador

At Inukshuk Capital Management, we are firm believers in the connection between Health (physical, mental and spiritual) and Wealth.

Our ICM Health Ambassador is available to our clients for complimentary consultations. Contact us for more information.

Have a question? Contact us here.

Challenging the status quo of the Canadian investment industry.