In a previous article, we examined how the overwhelming majority of actively-managed investment funds fail to beat their benchmarks and achieve alpha. For example, over the 5-year period ending in December 2021, nearly 75% of actively-managed US large-cap equity funds failed to beat the return of the S&P 500. This is not a cherry-picked stat, rather as the S&P DJI’s SPIVA Scorecards reveal this under-performance by actively-managed funds is seen across the globe and across asset sectors. The ability to consistently beat the market is a skill that very few fund managers possess.

But while the vast majority of fund managers fail in their pursuit of alpha, not all do, and this leads to the question if perhaps the task of an investor is to find the high-performing funds and to invest in these. Before taking such an approach it is important to be aware of another well-established trend in the investment industry and this is the lack of persistence in alpha. Most funds that outperform do so on a short-term basis and are not capable of out-performance over multiple consecutive years. For this reason, chasing returns can lead to very poor results.

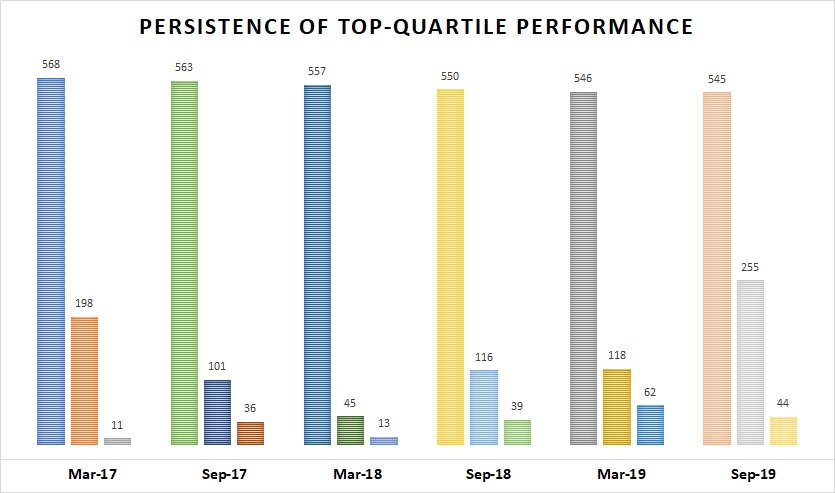

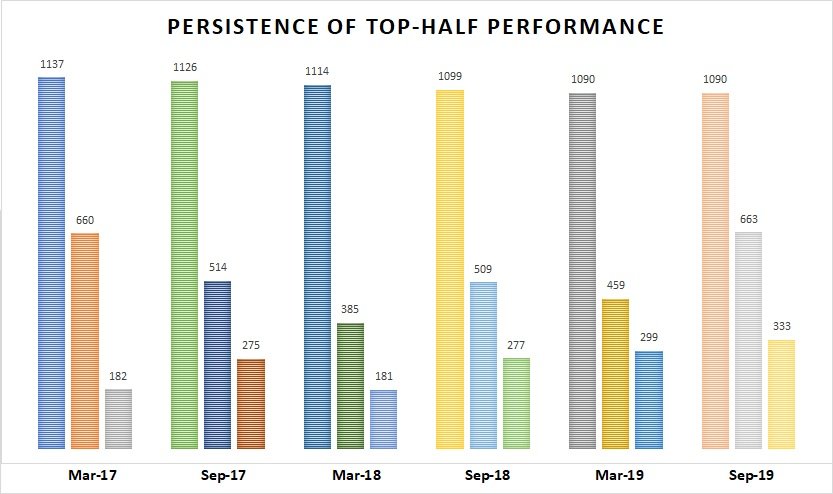

The charts shown below provide evidence to support this assertion. The data for these charts come from the last 6 SPIVA Persistence Scorecards. These scorecards collect the returns of active funds over 12-month periods and then rank them into quartiles based on performance. The data we are going to look at is for US equity funds (large-, small-, mid- and multi-cap).

Remaining as a Top-Performer for Multiple-Years – A Rare and Difficult Feat For Active Fund Managers

The following chart represents six 3-year periods of study, each period of study ending at the date shown on the X-axis. The first bar in each set (the tallest of the 3) shows the number of funds in the top quartile of performers after the first year of study, the second bar shows how many of these funds remain as top-quartile performers in year 2, while the final bar, the smallest in each set, shows the number of funds who persist as top-quartile performers for 3-years running.

Even Sustaining Mediocre Performance is a Challenging Task for Active Managers

Remaining as a top-quartile performer may be asking a lot of a fund manager, but most actively-managed funds cannot even remain in the top-half of performers for multiple years in the row. The following chart is to be read in the same manner as the one above, but this time it shows the persistence of remaining as a top-half of performers.

Given that the vast majority of active investment managers under-perform the market, coupled with the fact that those who do achieve alpha, rarely do so with any consistency suggests that most investors would be further ahead by simply gaining broad exposure to the underlying markets themselves. For this reason, ICM uses ETFs to provide clients with diversified, global exposure to equity, bond and commodity markets and does not try to outperform these markets through stock-picking. Such an approach allows for participation in the upside of bull markets while our proprietary risk management systems help protect against the downsides of a bear market. Furthermore, investing in ETFs offers the advantages of daily-liquidity, low fees, no lock-up periods, tax efficiency, and the avoidance of commission-based incentive models.