We built Inukshuk Capital Management to serve the needs of clients looking for a unique approach – void of conflicts of interest, commission sales and pushed products. We began by putting our own money where our mouth is. With low fees and active risk management, we help families achieve financial longevity, that’s the bottom line.

Stay up-to-date on the latest developments by following us on LinkedIn here.

August 2023: Bad Grades

In this issue:

- Global Equity Market Performance

- Bad Grades

- Bad Banks

- Bad Analysis

- Wrapping Up

- Health is Wealth

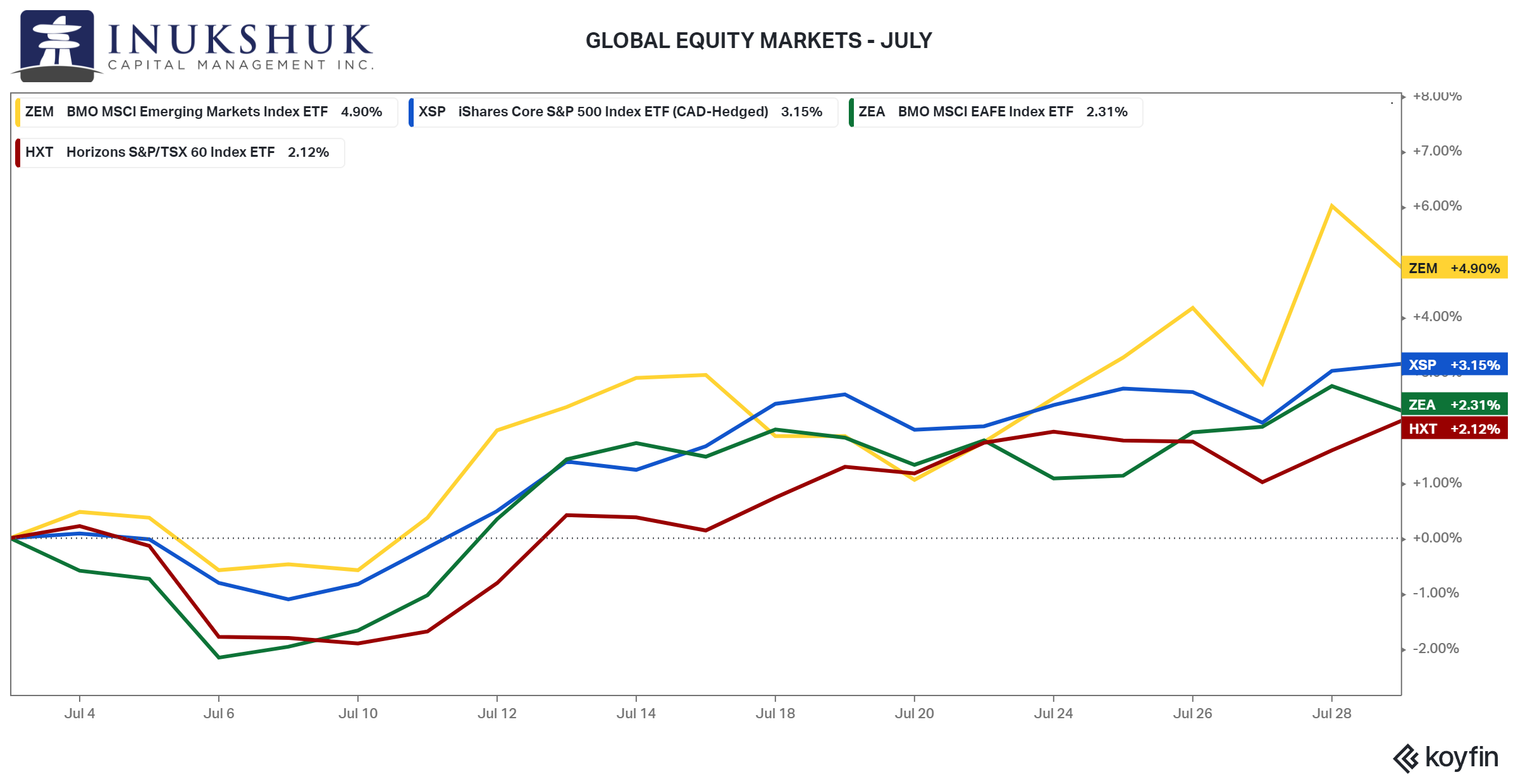

GLOBAL EQUITY MARKET PERFORMANCE

July was another strong month for equities. Emerging Markets were up an impressive 4.9%, more than doubling year-to-date returns. The S&P 500 gave up the lead after two strong months but still closed 3.2% higher. The S&P/TSX60 and MSCI EAFE (Europe, Asia the Far East and Australasia) both rallied just over 2.0%.

Our systems continue to remain fully long the S&P 500 and S&P/TSX60.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here .

BAD GRADES

There are three major credit ratings agencies: Fitch, Moody’s Investor Services and S&P Global Ratings. On August 1, Fitch downgraded U.S. debt, one level, from AAA to AA+ citing the following reasons for the decision in their press release:

… expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.

Anyone paying attention to the economic situation in the U.S. has known of most of these and other issues for years. In fact, S&P downgraded the U.S. twelve years ago. Only Moody’s has not.

According to Fortune Magazine, the only countries to maintain AAA status with all three agencies are: Germany, Denmark, Netherlands, Sweden, Norway, Switzerland, Luxembourg, Singapore and Australia. Canada is rated AAA by both Moody’s and S&P.

The prevailing view of investors and pundits is: this downgrade doesn’t matter. It may not, however in this business when everyone is thinking the same thing oftentimes something else happens. We have no idea what that may be but maybe some other countries will join the AA team.

As Fitch stated in its press release, credit ratings are a relative thing. Debts of sovereigns, agencies, corporations, and any other entity are priced against each other. So, if top tier rated countries are brought down a notch that means lower rated bonds have experienced a relative improvement that may come under review by ratings agencies.

This matters for a few reasons. Lower rated debt is priced to pay a higher yield so the cost of borrowing to corporations, for example, will be higher. As well, some fiduciaries, like pension funds, are required to adhere to limits on the amounts of certain levels of credit they are allowed to invest in. That means lower ratings could exclude potential investors if those investors have already maxed out their holdings of riskier bonds.

BAD BANKS

We have recently written about some of the regional banking issues occurring in the U.S. This was in the context of how difficult it is to predict outcomes based on information everyone has.

Maybe the ratings agencies are in ‘catch up’ mode. One week after Fitch stripped the U.S. of its AAA status, Moody’s chipped in on its side. According to Reuters, they:

…cut credit ratings of several small to mid-sized U.S. banks on Monday and said it may downgrade some of the nation’s biggest lenders, warning that the sector’s credit strength will likely be tested by funding risks and weaker profitability.

…six banking giants, including Bank of New York Mellon (BK.N), US Bancorp (USB.N), State Street (STT.N) and Truist Financial (TFC.N)…

This is in the wake of several large regional bank failures and the recent merger of two banks in California, PacWest and Banc of California. KRE, the S&P Regional Banking ETF was already down more than 15% in the first seven months of the year, Banc of California 9% and PacWest 59%.

So, is Moody’s catching up to reality and stating what everyone already knows or is this the beginning of something else?

BAD ANALYSIS

On the bright side, ratings agencies are notorious at being late to the party or outright wrong. There was much ‘blame-storming’ after the Global Financial Crisis (GFC). It was a confluence of events, but the ratings agencies certainly played a role. A different kind of role than in this case but the GFC aftermath did highlight the fact that they are not always the most reliable financial analysts, for various reasons. In that case they had rated mortgage-backed securities optimistically as AAA that turned out to be, not so much.

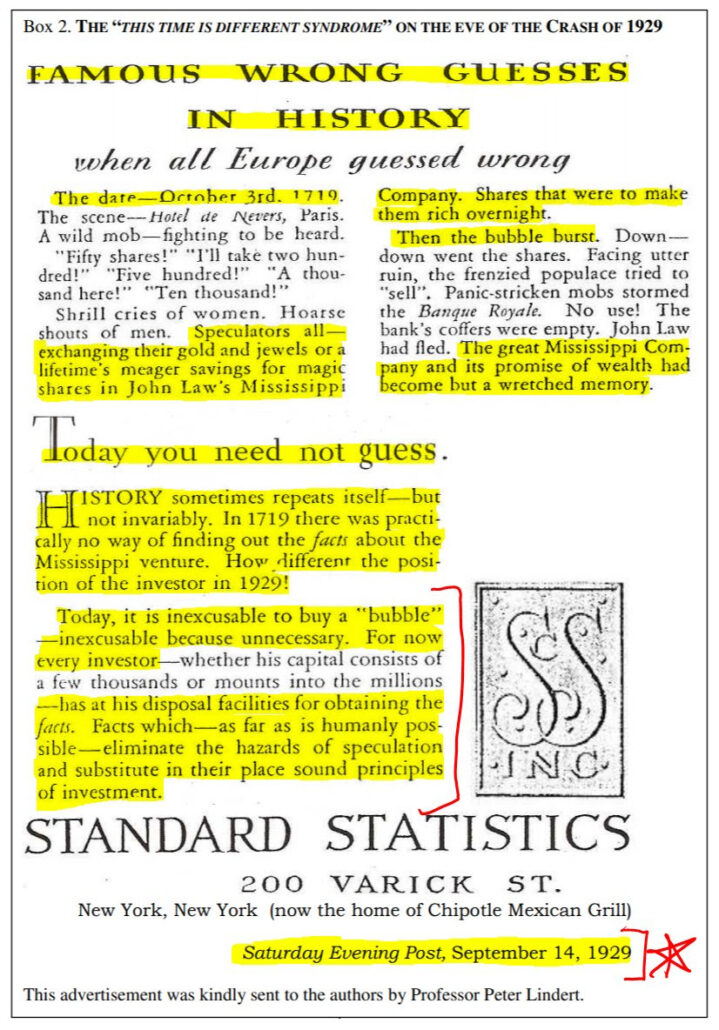

S&P Global Ratings has a long tradition of unreliability. Last week’s Investor Amnesia Newsletter featured an advertisement from S&P’s predecessor, Standard Statistics Company. The date was September 14, 1929, and it claimed:

Today, it is inexcusable to buy a bubble – inexcusable because unnecessary. For now every investor… has at his disposal facilities for obtaining the facts. Facts which… eliminate the hazards of speculation…

A few weeks later… the Great Crash.

Are ratings agencies the Costanza of markets?

WRAPPING UP

None of this means stocks can’t keep rallying. As noted above, our systems are 100% long. Some of us remember the summer of 2007 when the mortgage-backed securities market started to have some, umm, issues. Bear Stearns bailed out two of their funds in June that had suffered catastrophic losses. Later that year, in October, the S&P 500 made an all-time high.

What it does mean is it is important to have a risk management solution you can trust in order to mitigate the downside. Most of our clients’ portfolios have an equity component that is actively managed with our proprietary systems. That subset of index ETFs can go fully to cash or short-term money market ETFs and is designed to protect capital. Since inception in 2017 it has managed risk effectively during some fairly steep drawdowns.

We also have an allocation in most client accounts to a liquid alternative mutual fund we designed and manage. It was launched in January 2022 shortly after the S&P 500 made an all time high, proceeded to fall 27% and ended the year down 19%. The fund closed the year in positive territory.

So, maybe all of these downgrades mean nothing. Since we are not in the business of prediction we can not state if that is the case, or not. What we can do is observe, use our experience and follow our systems in a disciplined way.

Stay frosty.

HEALTH IS WEALTH

Top 10 Summer Superfoods: Harvesting Health From Seasonal Bounty

There is a lot to love about summer – the weather is warm, and the produce is delicious. With a limited outdoor growing season, I am always excited to enjoy the bounty of local goodness in the produce section of our grocery stores and farmer’s markets at this time of year. Just as investors diversify their portfolios, so too can we diversify our health through the local produce that summer offers. Here is a list of my top 10 superfoods of the season.

1. Cherries: Antioxidant Gems: Cherries offer a long list of antioxidants, including anthocyanin. Not only can they help soothe muscle soreness, but they also promote restful sleep, a crucial investment for well-being.

2. Nectarines and Peaches: Vitamin-Rich and Delicious: Nectarines and peaches bring a double dose of vitamins A and C to the table. They are a low-calorie fruit that is high in fibre, and they support healthy skin.

3. Berries Galore: Antioxidants at Their Peak: The jewels of summer (in my opinion) blueberries, raspberries, and blackberries boast high levels of antioxidants. These juicy treats enhance brain health, combat oxidative stress, and nurture our heart’s well-being.

4. Tomatoes: A Lycopene Boost: Tomatoes, a summer staple on many plates, are rich in lycopene, a potent antioxidant linked to reduced risk of chronic diseases. From sauces to salads, these red wonders are a super food to be enjoyed in a variety of ways.

5. Cucumbers: Hydration Heroes: Crisp cucumbers, with their high-water content, become hydration heroes during the scorching months. Investing in their hydrating properties not only refreshes the body but also supports digestion and skin health.

6. Lettuces: Nutrient-Packed Greens: Lettuces in all their varieties—from crunchy romaine to nutrient-packed spinach—are a multi-vitamin all to themselves – offering vitamins A, K, C, E, folate, iron, potassium, calcium, magnesium, phosphorous. They contribute essential vitamins and minerals, making them a foundation for a balanced diet.

7. Corn: Nutrient-Rich Summer Staple: Summer wouldn’t be complete without fresh corn, a nutrient-rich staple. Packed with fibre, vitamin B6, and potassium, this versatile delight adds a healthy and delicious element to your plate.

8. Zucchini: Versatile Nutritional Powerhouse: Zucchini, the versatile powerhouse, boasts low calories, vitamins A and C, and minerals like potassium and magnesium. Its adaptability in the kitchen offers endless possibilities.

9. Bell Peppers: Colourful Capsaicin Boost: Bell peppers, in their array of colours, offer a boost of vitamin C and antioxidants. Their capsaicin content adds a flavourful kick while supporting overall health.

10. Eggplant: Purple Nutrient Powerhouse: Eggplants, with their deep purple hues, house a trove of vitamins and minerals. In addition to their great taste, they help with digestive health, bone health, blood sugar control and they are anti-inflammatory.

Create salads that combine lettuces, cucumbers, and bell peppers for a colourful nutritional feast. Add berries to morning yogurt or oatmeal for an antioxidant-packed start to your day. Grill zucchini and eggplant as delectable side dishes. Blend corn into salsas or salads for a burst of flavour. And of course, savour the sweetness of cherries, nectarines, and peaches on their own or in your favourite summer salad.

As summer winds down, be sure to enjoy the abundance of local produce. By investing in the vibrancy and nourishment this list provides you are not only investing in your well-being but also making a strategic choice to embrace longevity —something that resonates deeply with me and hopefully all of you.

‘You have to sustain it, to maintain it’

Victoria Bannister

ICM Health Ambassador

Have a question? Contact us here

Challenging the status quo of the Canadian investment industry.