Robert McAffee

Lift of the Morning Fog

We built Inukshuk Capital Management to serve the needs of clients looking for a unique approach – void of conflicts of interest, commission sales and pushed products. We began by putting our own money where our mouth is. With low fees and active risk management, we help families achieve financial longevity, that’s the bottom line.

Stay up-to-date on the latest developments by following us on LinkedIn here.

August 2021- Please Allow Me to Introduce Myself

In this issue:

- Global Equity Markets

- Jumpin Jack Flashing

- Internetting

- Money Moving

- Bitcoining

- Lightning

- Striking

- Guessing

- Concluding

- Health is Wealth

GLOBAL EQUITY MARKETS

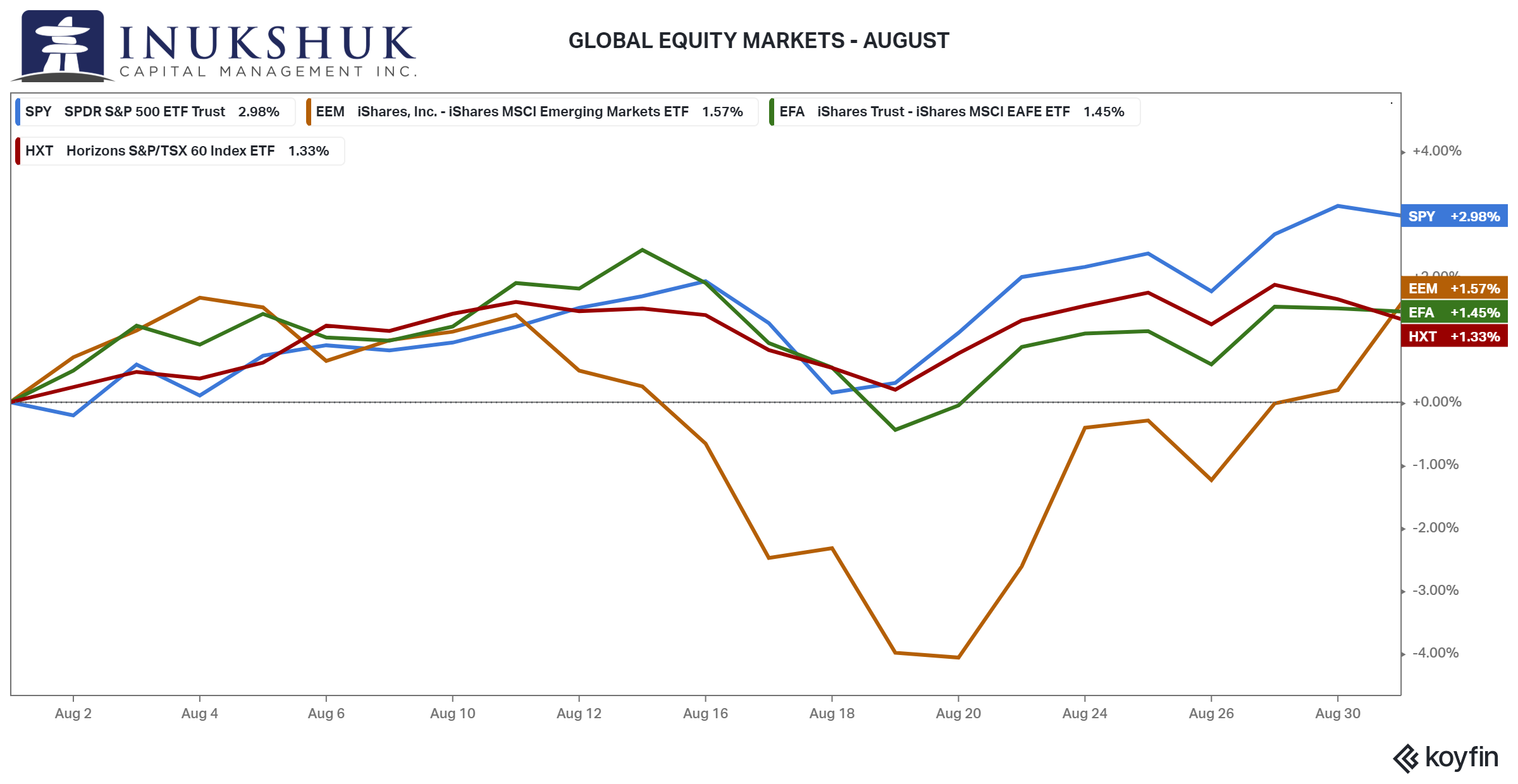

After a brief hiccup mid-month, across the equity indexes we study and actively trade, the S&P 500 continued to notch new highs, with a gain of almost 3% on the month. MSCI EAFE (Europe, Australasia and the Far East) the S&P/TSX60 and Emerging Markets (EM) were all neck-and-neck however, the latter did not breach the highs made earlier this year, despite an impressive rally after being down 4% in the first three weeks.

ICM’s positioning across equity markets has been paired back as our systems continue to remain cautious. We have invested some of this cash in mid-term government bonds. This is in addition to the long-term government bond position we took a few months back. Let’s see what happens next.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here

JUMPIN JACK FLASHING

The team at Inukshuk has a resident music geek, but most all of us will (should) agree that the Rolling Stones are one of the best bands, ever. Unfortunately, in late August, Charlie Watts, the Stones’ drummer since 1963, died. He was 80. A unique drummer that most professional drummers say is the greatest. The message to the kids is a bit confusing, considering the lifestyle he led versus Keef.

If you grew up camping or tripping or whatever outside, you might have associated the word flash with lightning. That’s if you are relatively sane. Jumpin’ is a reasonable connection if you are startled, or electrocuted. Jack, on the other hand, might involve some creepy person we were all reminded, as kids, to stay away from. No one is quite sure who Jack is, but let’s leave that alone. It’s too easy.

This note will be going down a bit of a less disturbing path – that is, unless you happen to be in the business of making money from humans moving money around the world.

INTERNETTING

To set up some context it would be a good idea to review the history of the internet.

In the early 1960s, there were some very intelligent people working on how to connect machines around the world in order to share information. This idea had many complications but huge implications. Some of the first work was out of DARPA, The Defense Advanced Research Projects Agency, the research arm of the U.S. Department of Defense, whose mission statement is: to make pivotal investments in breakthrough technologies for national security. That might be called a hint.

The first open network program to send packets of information was called “Internetting”. Good trivia for the oldsters to try on cheeky youngsters. The idea was to have a shared network upon which applications could be developed that could accomplish the exchange of any type of information.

One of the first, and very useful, applications was email. The first email was sent between two machines in 1972. Things escalated quickly as this was also a way to share more information across the globe between the people who were developing the network. Hosts (think PCs) were overwhelmed and becoming ubiquitous, so a new system of addresses was developed: the Domain Name System (DNS). An example is www.inukshukcapital.com.

In 1989, computer scientist Tim Berners-Lee created the World Wide Web and the next year the first server and browser named: WorldWideWeb. Go figure, eh. So now all the underlying guts were hidden, and the interface was something a non-scientist could use in an easy manner. Fun fact: the “Internet” was formalized as a name for the network in 1995.

To skip over a library of history to the present day, and sum it up, the World Wide Web, as we know it now, was initially a very complicated place that was dominated by academic institutions and their sometimes government and agency partners. This was layer one. Some readers may recall sitting in the dungeons of a university typing in seemingly meaningless letters and numbers in order to access the mainframe and then to other outside sites in order to collect information to study. Or dialling into AOL and listening to the screech of routers trying to talk to each other over landlines.

The history of the www is sometimes described as Web 1.0 and then Web 2.0. The www we know now is layer two. There will be a Web 3.0, and more. But what that will look like and why it matters to anyone, is an important question.

MONEY MOVING

Way back in 1856 a telegraph company named Western Union, was created though a merger. Its primary business was sending telegrams within various local regions around the United States. It sent the first transcontinental telegram in 1861. They accomplished this by acquiring smaller regional services and making agreements with competitors to share physical lines. They built a network. By 1866, Western Union produced the first stock market ticker. And in 1871, the first wire money transfer. This became known as simply, a ‘wire’. Western Union is now the second largest global money transfer network on the planet.

Fun fact: in the mid 1850s several telegraph cables were laid under the Atlantic to connect North America to England. Naturally, the sterling/dollar exchange rate was nicknamed ‘cable’.

Information, communication, time and money are all associated. This is nothing new.

BITCOINING

The note we put out that included a section on bitcoin a few months ago Same As It Ever Was discussed the idea of money as a concept, but also in an historical context. The key points are: First, it must be a store of value and then, enough humans must think there are enough of them who believe that others will accept this thing as a fair exchange for goods and services. A network. But wait, there’s more.

Bitcoin is a network, as well as a version of a currency. Millions of machines are talking to each other and transacting and keeping records, constantly. You don’t necessarily have to understand the technology behind it to grasp the idea that keeping and transferring information is compatible with the idea of money. The House of Medici, the grandparents of banking and the ledger system would attest to this. But while Western Union owned their network and could move information (money) from one place to the next, no one owns bitcoin, an open network. Just like the original internet.

So how can anyone trust this bitcoin network? The simple answer is no one has to trust anyone for it to work.

During the Allies D-Day invasion of Normandy a verbal code was determined to figure out who might be on the other side of the hedgerow when they got there. The call sign was “flash” and the password response was “thunder”. Things have advanced a bit since then. In that network your best chance of survival was to determine whether it would be a friendly ‘transaction’ or the opposite. These days, to stretch the metaphor a bit, in transactional terms, there is technology that works based on no trust whatsoever and the interactions are, let’s say – very complicated. That’s what the technology of bitcoin does. This underlying technology is layer one, which uses a protocol called blockchain technology, also known as distributed ledger, and the bitcoin blockchain was the first of its kind.

LIGHTNING

This is where things get very interesting. The Lightning Network is the next layer of bitcoin. This is layer two that sits ‘off-chain’ on top of the bitcoin blockchain. Recall Web 2.0 and try to think in the same way.

The problem with bitcoin, in the sense of improving on the speed and cost of moving information (money) around the world is that, in today’s terms, it is a bit clunky. But clunky might be a good thing if you were to build upon that foundation. Clunky can also be sturdy, heavy and maybe reliable. As the Terminator said in the movie Terminator Genisys: I might be older, but not obsolete. Ok, we have some sci-fi movie geeks in the house as well.

Due to the nature of humans in their constant need (want?) to improve things, while the old iron horse is fairly solid, we always seem to think there is a better way. At least as far as we know, from history – and yes, humans can and will take some of these ‘improvements’ to terrifying heights. The guess is, in this instance, this is not terrible.

The Lightning Network, as a layer over bitcoin, solves many problems that humans want to solve regarding the movement of money around the world. If the original open network is a bit slow and expensive to run, but the architecture is good in design and is solid, functional and robust, there is something to build on.

Like all networks, Lightning requires a kind of mass to make it work. The more nodes in a network the better it will function. Western Union didn’t magically float dollar notes through the air so that crazy Uncle Market Plunger, who made a killing in U.S. Steel stock, could send his nephew Peter, in Schenectady a few bucks for his birthday. They had cash on hand. And if there were enough people sending and receiving dollars at any one location in the network, it might net out.

Maybe Auntie Shirley killed it at the horse races in Saratoga Springs that weekend and wanted to send her niece Agnes, at Syracuse, the same amount of dollars, so she could buy herself some pencils and something nice. So, Auntie went to the same storefront as the kid in Schenectady and put her money down. The resulting effect would be Western Union didn’t have to have vaults of cash sitting at every Western Union storefront, just enough. This is analogous to how Lightning works.

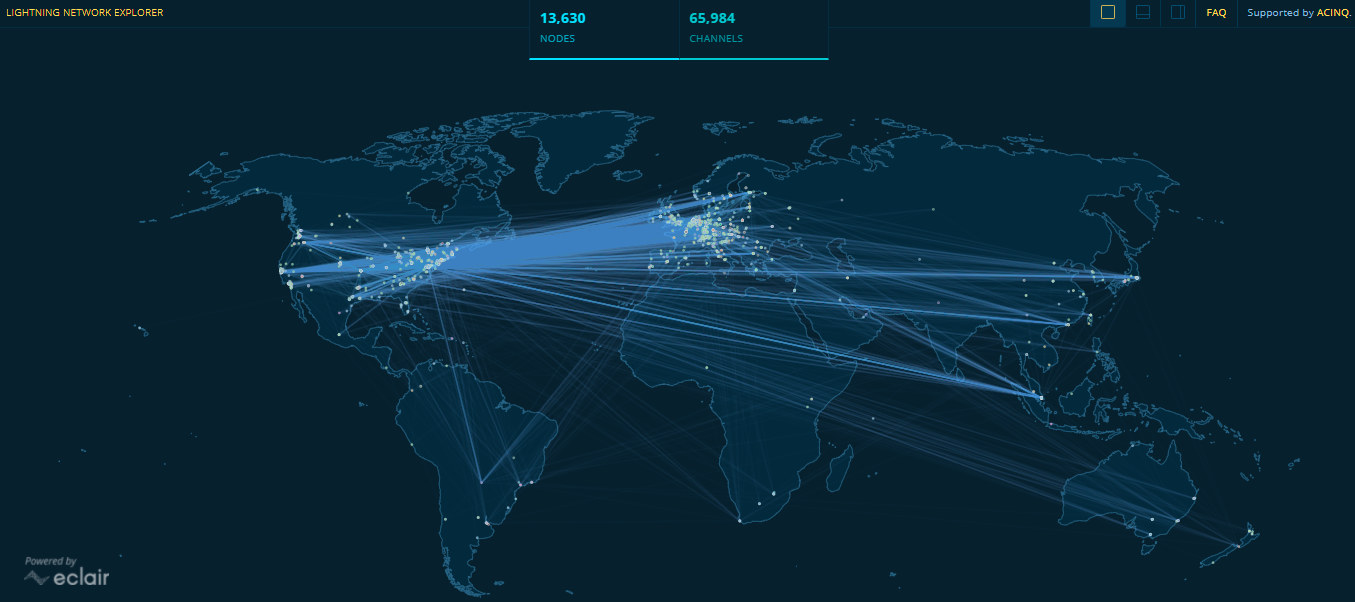

This is a capture of the Lightning Network as of this writing.

Source: https://1ml.com

What that is are the many nodes and the transactions occurring between them. Network growth and scale are a very difficult concept, for everyone. The prediction rate of any network’s success is low. You want many nodes, but not too many very big ones and not too many small ones. It’s complicated, and we are not smart enough to understand how to measure a potential success rate, but there it is.

Here is this relatively young network’s geographic connection distribution.

Looks global, eh?

STRIKING

All the above is fairly straightforward if you have the same kind of knowledge as the developers of these networks. Most of us don’t – as in almost all of us. But on the Lightning Network, very smart humans are building applications that normies can use on their phone. There are many apps, so no deep dive here, but Strike is an excellent example. It also fits into the theme of this note, which is cool.

Strike is an application that works on a phone that allows people to send and receive tiny amounts of bitcoin, for no cost – instantly. These units are called satoshis or sats. Bitcoin is 100 million sats. This is the smallest unit bitcoin can be divisible by. For example, if you had 100 sats in your phone app ‘wallet’ and bitcoin was trading at $50,000 that would be worth five cents.

One interesting thing the developer of Strike did was set up a trial in a small town in El Salvador. This was while the sole currency approved by the state was the U.S. dollar. That changed on September 7, when a law came into effect acknowledging that bitcoin is a legitimate payment method.

The trial – which is no longer a trial and now a way many people in that town transact or exchange ‘money’ for any reason – seems to have been a test run for the official government app, Chivo. While not built on Lightning, Chivo is able to transact small payments at no cost, as well as interact with other wallets, such as Strike. And it can immediately convert and transact into the other official currency, the U.S. dollar.

Of course, the usual actors, the World Bank and the International Monetary Fund and many of the established gatekeepers are not very enthusiastic about this development regarding the use of bitcoin.

The common refrains are:

- It’s too volatile

- Criminals can use it

- The monetary system won’t be controlled

Those arguments are easily defeated by understanding how things work.

- The volatility of bitcoin to the U.S. dollar does not matter if you can create U.S. dollars from sats whenever you want and the government will accept either as currency for any kind of payment. It’s almost as if the ‘experts’ are unaware of how exchange rates work. Further, if sats are valued as sats, then that is what that coffee is worth. And after you close the coffee shop down and go by the grocery store to get something to cook for dinner, priced in sats, the U.S. dollar doesn’t enter into equation.

- Criminals use high value paper notes and there is a huge amount of sketchy money movement now, on the old-school payments networks, despite all of the efforts of governments around the world to contain it. Kim Jong-un doesn’t buy his favourite champagne and caviar with North Korean won. Who wants that?

- El Salvador has no monetary policy control. As it stands, they are subject to U.S. monetary policy by default. What is defined as expert opinion seems to be a gatekeeper anxiety issue. A recent CNBC story figured Western Union will lose up to $400 million in remittance fees, annually, if everyone in El Salvador switches to Chivo or other similar applications. The horror of a developing country’s citizens saving massive amounts of money is troublesome to a certain kind of bureaucrat.

The first accelerator for bitcoin’s wide-spread application may well be remittances. Remittances to less developed countries from countries like Canada are a massive part of the economy in places like El Salvador. For El Salvador it is estimated that remittances are on the scale of 23% of gross domestic product. The fees to send money to these countries from Canada can be anywhere from 6% to 25% of the amount. Then the recipient has to go to a Western Union location and collect the cash which entails a whole other number of issues, if you use your imagination.

GUESSING

There is a theme that seems to come up repeatedly in these notes—lots of things change but humans continue to do the same things, good and bad, in similar but slightly different ways. Whatever we create seems to follow patterns we may or may not understand fully. Or care to. It may depend on your personality.

Anyhoo, a couple of survivors, thrivers and creators made a song—one of the best ever— that kinda describes one side of this tendency. And luckily, it is probably the most percussion-intensive tune the Rolling Stones ever produced. Cheers to Charlie, the man who was not Mick’s drummer, but relied on his singer so he could play.

Pleased to meet you

Hope you guessed my name, oh yeah

But what’s confusing you

Is just the nature of my game

Guess whatever you want. We should all try to lift the fog and think a bit differently. The fog is everywhere. Which is a bit surprising, considering the ‘game’ hasn’t changed much.

CONCLUDING

Historic and current technologies seem to be very similar in intent. Information, communication and time seem to always involve some kind of money. The Medicis had paper ledgers. Western Union created a network for communication that morphed into a money transfer system. Bitcoin is at least both of these things. Lightning is similar to layer two of the internet. If you use your imagination it’s possible to see where these networks may take us.

HEALTH IS WEALTH

Understanding Protein

“Protein comes from the Greek word proteins meaning primary, or holding the first place. A Dutch chemist Gerard Johann Mulder coined the word protein in 1838.

Protein is found throughout the body—in muscles, bones, skin, hair, and virtually every other body part or tissue. We need protein for growth and repair.

Proteins have a particular role in nutrition. Proteins are used by the body to maintain a unique structure. Structures are very important to the way the body functions. Having a unique structure allows one part of the body to communicate to another part. When a substance is released, there is a discrete receptor for that protein. We use these proteins all over. We use them as transporters to facilitate communication between neurons, hormones, enzymes, and antibodies. It is the unique structure of proteins that allows this communication to occur.

A complete protein is a protein that contains all nine essential amino acids required by the human body. The quality of a protein is defined by how many of these essential amino acids it contains. While meats are often complete proteins on their own, there are ways to combine other foods to make complete proteins. Complementing proteins are two foods that, alone, are incomplete proteins, but can be combined to create a complete protein (Beans and rice, or peanut butter and bread, for example).

Supplementing proteins combine one incomplete protein with a complete protein to elevate the profile of the incomplete protein (macaroni and cheese, or cereal and milk, for example).

It is important to note that if we do not need to eat a complete protein with every meal, or even every day, our bodies access “pools” of these amino acids that we have consumed over the last few days and which are stored in our livers.

Source: e-Cornell 2018

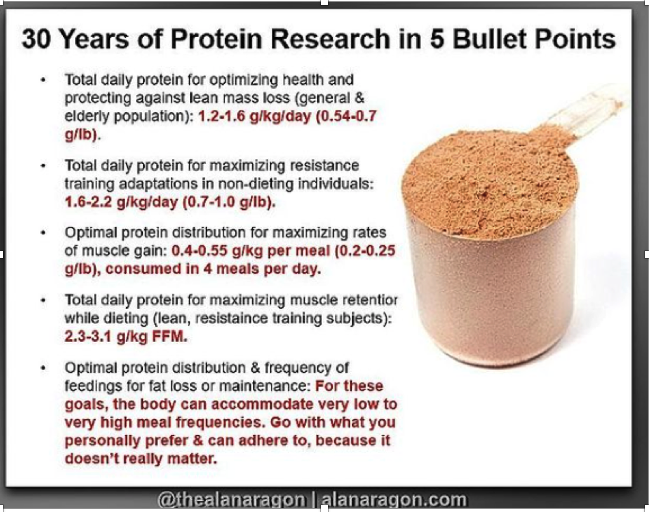

How much protein do we need?

‘To sustain it, you must maintain it.’

Victoria Bannister, ICM Health Ambassador

At Inukshuk Capital Management, we are firm believers in the connection between Health (physical, mental and spiritual) and Wealth.

Our ICM Health Ambassador is available to our clients for complimentary consultations. Contact us for more information.

Have a question? Contact us here.

Challenging the status quo of the Canadian investment industry.