Inukshuk Capital Management (ICM) is a multi-asset class, high-net-worth wealth management firm that challenges the status quo. We believe Exchange Traded Funds are the best way to build bespoke portfolios.

We are pleased to share our monthly newsletter which contains information on our ETF portfolios, as well as market commentary and other relevant news.

Stay up-to-date on the latest developments by following us on LinkedIn here.

August 2020 – THE ‘YEAR OF FIRSTS’

In this issue:

- Trends and reversals

- Firsts

- The average Dow

- What to do with stock volatility

- ESG is the new value(s) investing

- Health is Wealth

GLOBAL TRENDS IN STOCKS PERSIST, WITH MOMENTS OF PANIC

The four major equity indexes we systematically trade all made post-crash highs in the last week of August. The S&P 500 continued to outperform in the first week of September making new all-time highs, but has since pulled back along with the rest of global markets after a fairly violent selloff in technology.

So far, as these trends persist, we remain fully invested in the TSX and Emerging Markets (EM) and our systems have been adding to S&P 500 and MSCI EAFE positions in our active asset allocation portfolios. As of this writing we are still underweight the latter two markets.

While the TSX, EM and S&P 500 managed to get into positive territory on the year, only the S&P 500 has been able to hang onto its gains. MSCI EAFE, the most geographically diversified developed index, has not managed to get above the year’s starting level and is now down just over 5% in 2020.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here.

A YEAR OF FIRSTS

Much of the performance in equity indexes can be attributed to very large-capitalization stocks focussed on technology. The implications of this go both ways and have resulted in some curious outcomes. In a note to institutional investors last week, Blackrock’s iShares research team noted that Apple’s (AAPL) market capitalization, over $2 trillion at the time, was briefly greater than that of the entire Russell 2000 index – which represents the performance of 2000 small-capitalization stocks in the U.S. This has never happened before.

On September 3, 2020, when AAPL dropped 8%, $180 billion in equity value disappeared. That is the greatest single-day loss in market capitalization that has ever occurred.

AAPL is a component of both the Dow Jones Industrial Average and the S&P 500. The S&P 500 represents roughly 80% of all equity market value in the U.S. and AAPL accounts for around 7% of that value. The concentration in individual technology names will continue to drive the headlines of U.S. equity index performance.

THE AVERAGE DOW JONES

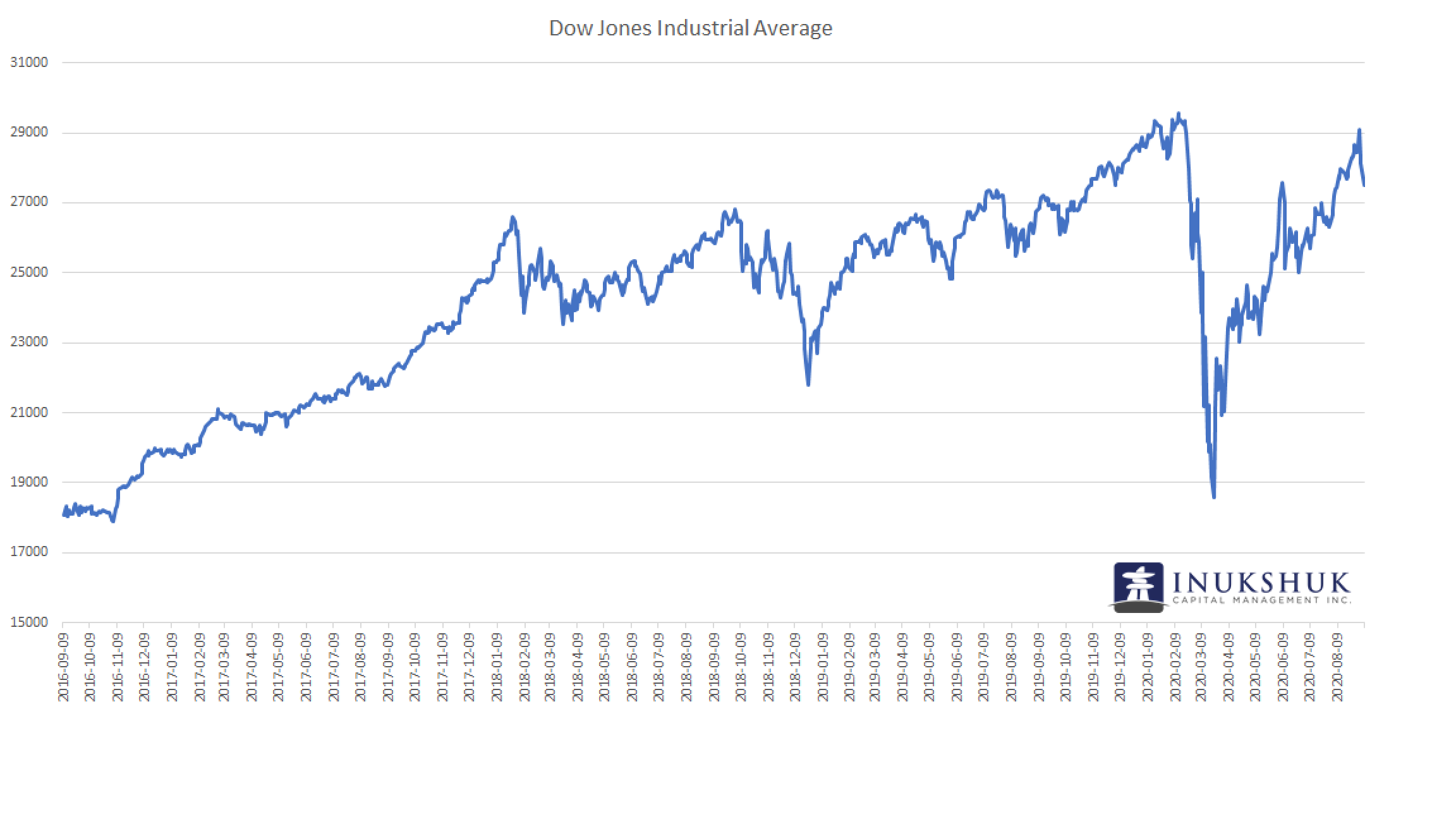

We don’t trade the Dow but many investors look at that index of 30 stocks as the bellwether of the U.S. equity market, probably because it has been published since 1896. Much of our tactical asset allocation process is driven by price, so we analyze many stock index charts – even the ones we don’t actively trade. Looking back a few years at the Dow puts much of the recent index performance in perspective.

For example, if you were unlucky enough to buy the Dow at its then all-time high of 26,616 on January 26, 2018 and managed to hang on, you might also be interested in virtual roller-coasters. Within a few weeks you would have lost 10%. Heading into the fall of the same year you may have been planning for a prosperous holiday celebration as the index made a slightly higher high. It then fell almost 20% by Christmas Eve. Just over a year later, in February 2020, the Dow had rallied back and notched an all-time high at 29,568 and you were counting your 11% reward for such steadfast investing discipline. It then collapsed 38% over the next 6 weeks and has since rallied back to as high as 29,199. The end result as of September 11th – you have made a price gain of 3.9% over 32 months, as well as some added weight-gain or loss, depending on how you deal with stress.

Our systematic strategies are designed to avoid large drawdowns, or ‘peak-to-trough’ moves. As we began raising cash in February driven by our systematic strategies, our extensive research led us to investing some of that capital in strategies that provide an opportunity to earn tax-efficient income and potential capital gains. And since this is a year of firsts, why wouldn’t we dig into what is going on around the stock market.

Our systematic strategies are designed to avoid large drawdowns, or ‘peak-to-trough’ moves. As we began raising cash in February driven by our systematic strategies, our extensive research led us to investing some of that capital in strategies that provide an opportunity to earn tax-efficient income and potential capital gains. And since this is a year of firsts, why wouldn’t we dig into what is going on around the stock market.

VOLATILITY AS INCOME

Over the past few months we have highlighted the actions of central banks and trends in government bond yields. It is getting very difficult to earn decent income anywhere in government bond markets. On September 9, 2020, 3-year New Zealand government bonds were trading at negative yields as the RBNZ hinted it may explore a negative interest rate policy. The Bank of Canada hasn’t yet indicated an interest in this idea and neither has the Federal Reserve. But it seems to be catching on – the European Central Bank and the Bank of Japan have been implementing negative rate policies for several years.

Income is becoming scarce. In order to earn it, the various policies of the monetary authorities have been pushing investors farther out the risk curve. In other words, if you require investment income you have to take more risk, whether it is credit-related or otherwise. Yield spreads between large-capitalization stocks that reliably pay dividends versus ‘risk free’ rates have widened as central banks around the world have cut policy rates dramatically. At the same time, we want to avoid the high-yield debt market due to concerns about default rates on lower credits.

Selling call options on stocks can earn capital gains income that is equal to or greater than the dividends companies pay. We’ve done extensive work on this strategy, but like every investment strategy it comes with risks. We believe the risks are consistent with the potential reward and have uncovered a number of ETFs that allow us to put on this trade.

This opportunity may or may not persist. In the spirit of this ‘year of firsts’, implied stock volatility has remained high even as various equity indexes are making new highs or have recovered substantially from the lows. This is not ‘normal’. Expected volatility in stocks is a large component of the price of an option, along with the time to expiry and the strike price. Think of volatility as the price of insurance – either the price of fear to protect your holdings with a put, or the price of FOMO on the upside with a call.

For the equity income component of our portfolios, investing in ETFs that write calls on individual stock holdings using different strategies can mitigate some of the downside risk and generate very compelling income.

To learn more about the ICM Enhanced Income Opportunities portfolio, please contact us.

ESG IS THE NEW VALUE(S) INVESTING

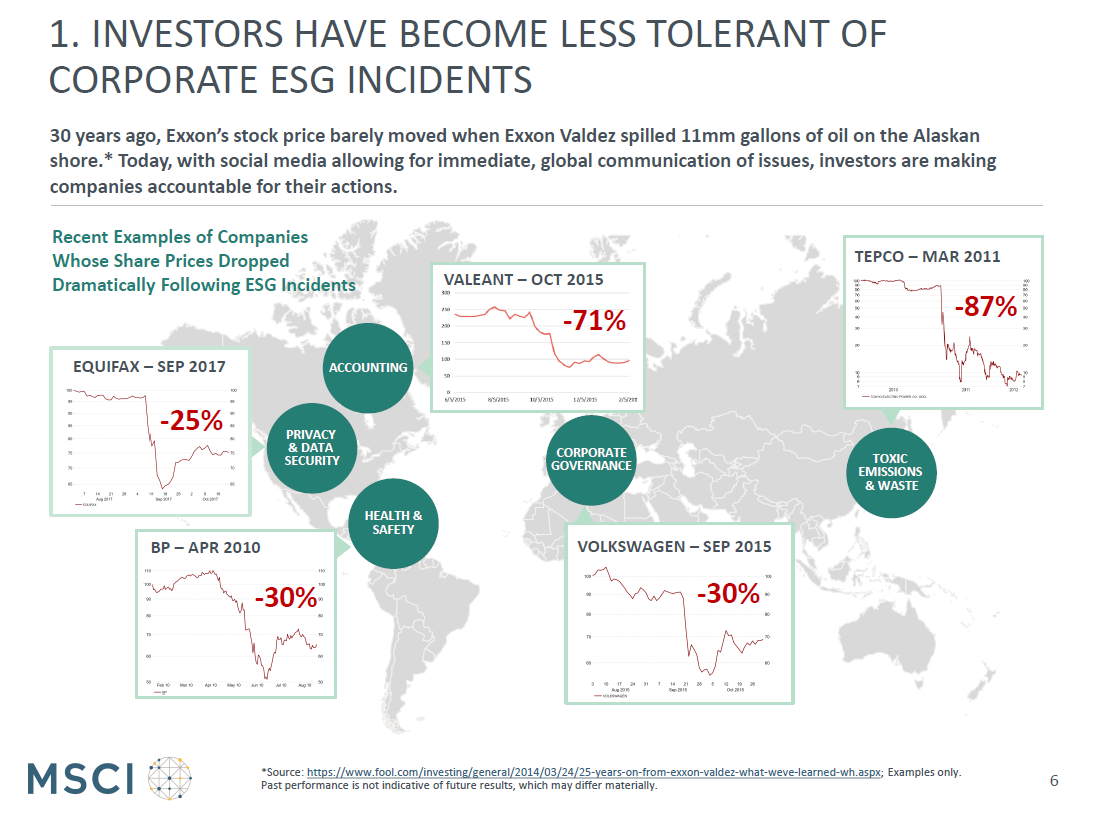

Another way to mitigate risk is something we highlighted in the last newsletter. ESG investing is becoming more of a factor in stock performance. The team at BMO ETFs shared a map with us, produced by MSCI, highlighting market responses to specific corporate events. Compared to decades ago, recent instances of corporate environmental and governance lapses have resulted in punishing stock price moves.

The ability to invest in an ESG-friendly manner is becoming simpler and less expensive than it was just a year ago and we believe this trend will persist.

If you would like to discuss ways of making your portfolio more focused on ESG or learn more about this emerging practice, please contact us.

HEALTH IS WEALTH

At Inukshuk Capital Management, we are firm believers in the connection between Health (physical, mental and spiritual) and Wealth. As the fall season approaches, we will be launching a new series of Health is Wealth events dedicated to people who feel the same way. If you would like to receive invitations to our complimentary, and for the foreseeable future, ‘virtual’ Health is Wealth events, please click here to join our Health is Wealth mailing list.

Have a question? Contact us here.

Inukshuk Capital Management actively and systematically manages asset allocation, using time-tested proprietary technology, to achieve financial longevity for our clients.