At Inukshuk Capital Management, our focus is on building lasting relationships rooted in trust and collaboration. By focusing on active risk management and long-term value creation, we help families and institutions achieve financial sustainability.

Stay up-to-date on the latest developments by following us on LinkedIn here.

In this issue:

- Global Equity Market Performance

- Bonds

- Gold

- Wrapping Up

- Wealth Longevity – Staying Steady Through the Noise

Global Equity Market Performance

Last month a friend asked if there was any truth to the idea that March is generally a bad month for stocks. So, we took a look. Going back to 1928 we found that there were a few very bad results but overall, it didn’t stand out. This year it stood out. The S&P 500 had its ninth worst March. The Daylight Saving Time effect really kicked in.

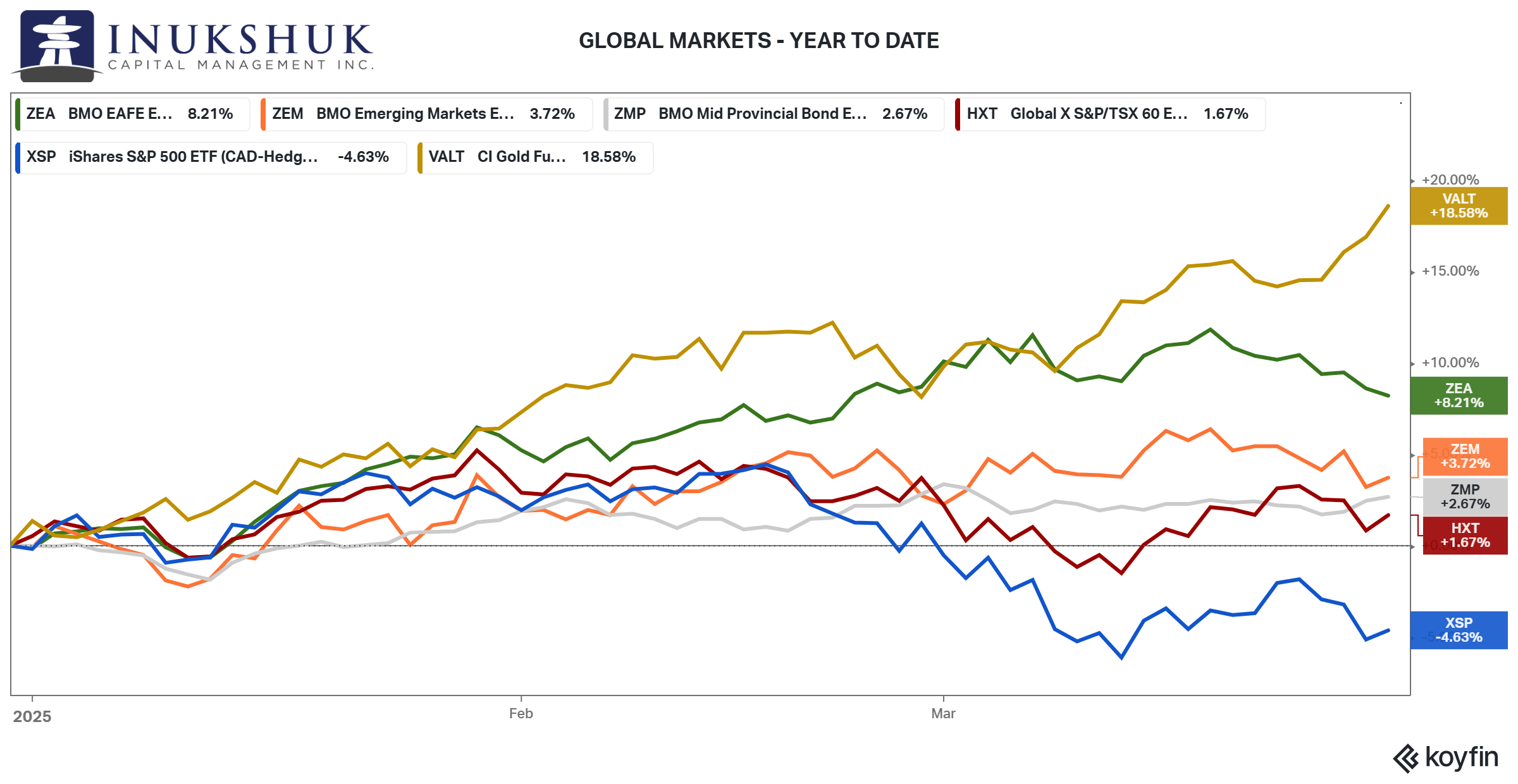

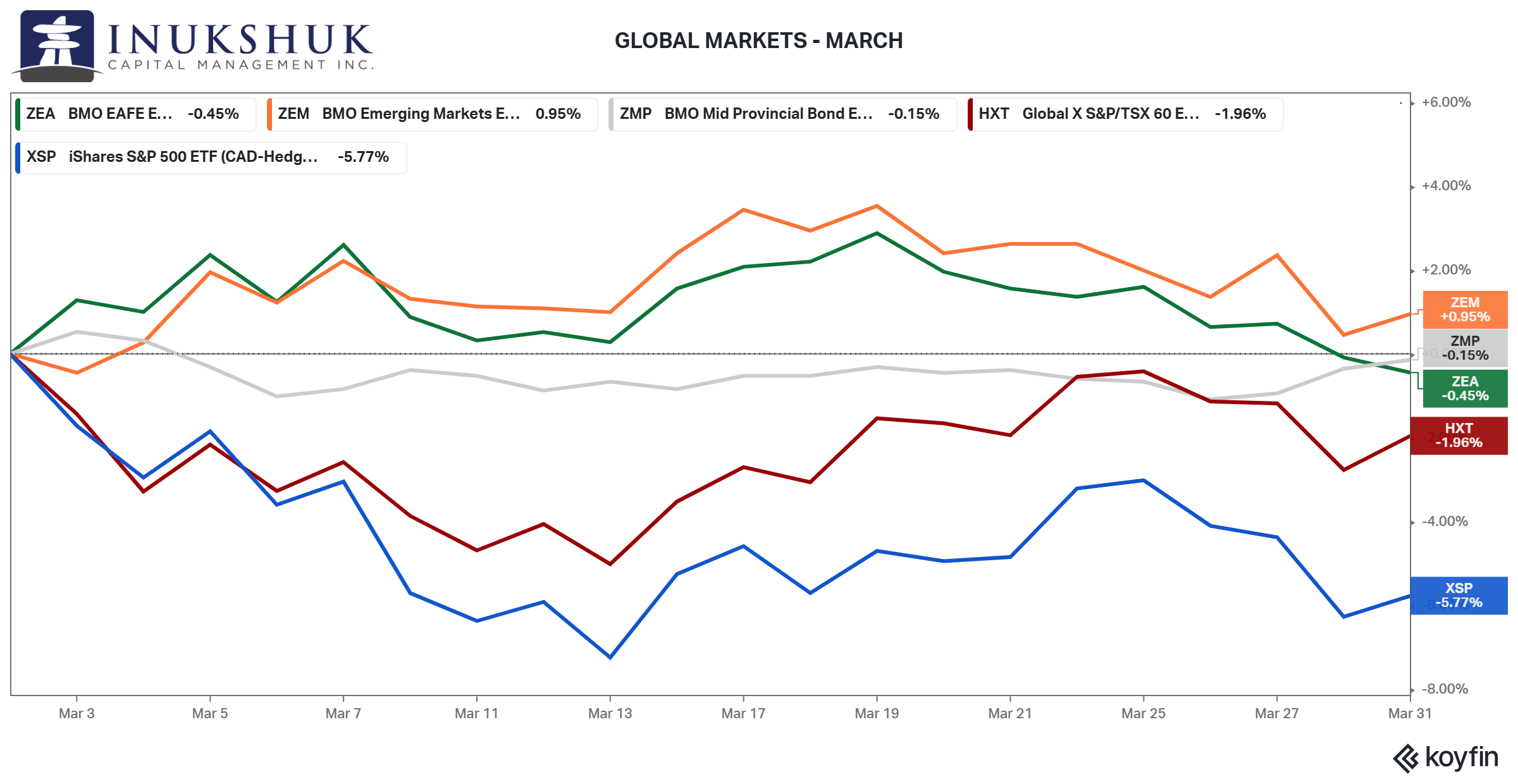

The MSCI Emerging Markets index was the only market we track to post a gain on the month. MSCI EAFE continued to outperform, however it was down almost 0.5%. North American equities did not fare as well, with the S&P/TSX almost 2% lower and the S&P 500 5.7%.

So far this year, to the end of March, the only index that is not up is the S&P 500.

So far this year, to the end of March, the only index that is not up is the S&P 500.

This is the third month in a row the S&P/TSX 60 has outperformed the S&P 500.

Our systems remained fully long both the S&P 500 and the S&P/TSX 60 into month end, however they switched to caution-mode the second week of April.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here

April has been a bit of a wild one, so far. It’s tricky writing a market letter when things are moving so fast. Note that all performance numbers are presented as of the end of the quarter.

The above charts (click to enlarge) include bonds and gold since this letter will look at the imperfect process of diversification. The goal is to attempt to do this while avoiding the use of the ‘T’ word. Not tiresome, the other one.

Bonds

As noted above, our systems reduced equity exposure last week. Systematic risk management is one type of diversification. Asset class diversification is another.

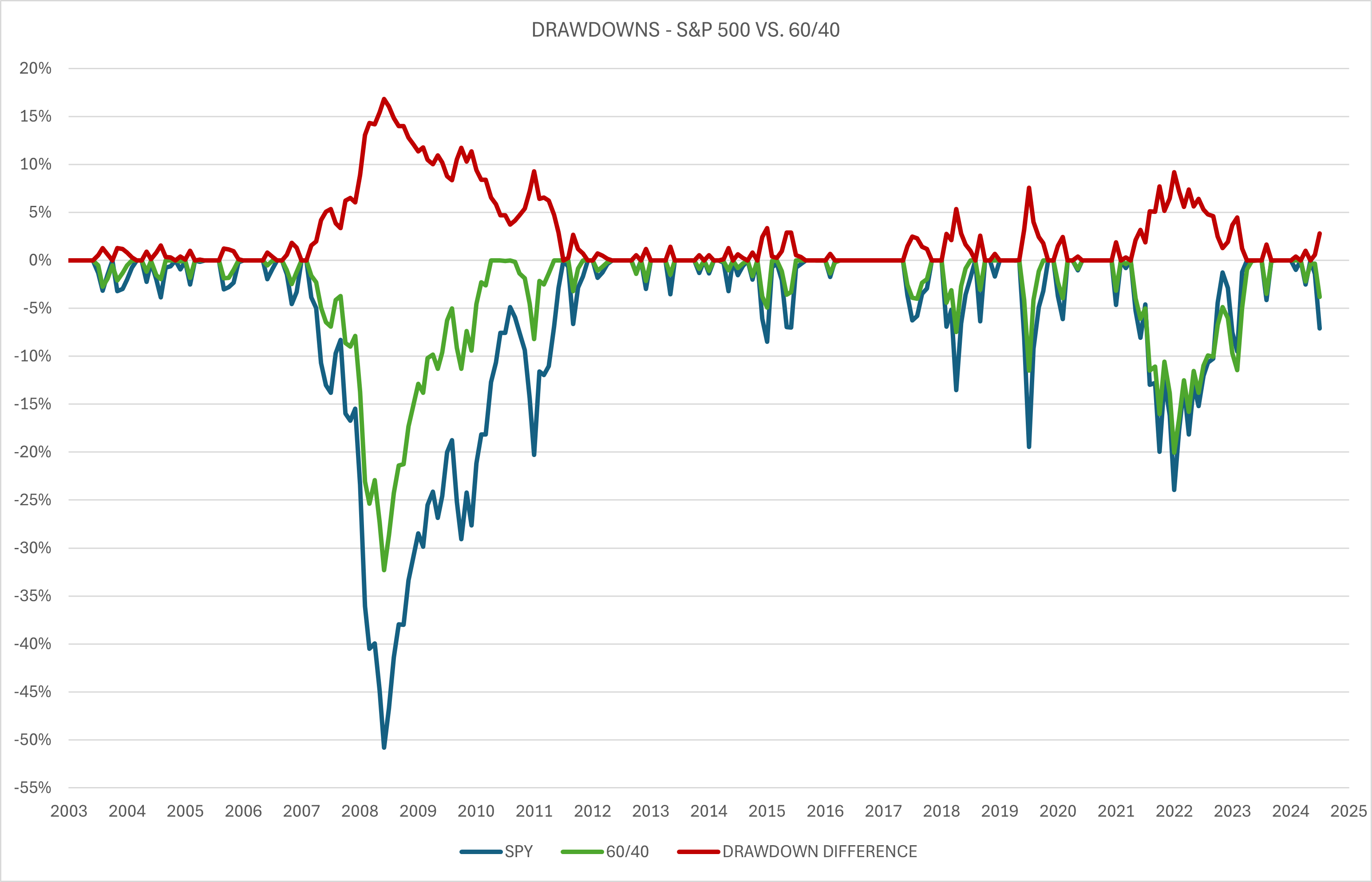

A year ago, we took a look at the traditional diversified ‘60/40’ stock/bond portfolio to try and answer the question: does it work?

This is what we found going back to 2003, when the first bond ETFs were launched in the U.S.

Using monthly data:

- Bonds and stocks go down together 17% of the time.

- How often do they go up together? Answer: 41%

- How often do they do the opposite? 42%

That is a simple way to determine if bonds diversify returns in a portfolio and it looks like they do.

Like everything in managing risk, there is a cost. Over the longer term, a 60/40 portfolio will underperform a stock-only portfolio. But when stocks sell off, bonds have a good chance of mitigating the performance pain.

In the data above, the peak-to-trough or drawdown of a 60/40 portfolio was 32%. The S&P 500 had a 50% drawdown at the same time, during the Global Financial Crisis, 2008 to 2009.

The following chart shows when a balanced 60/40 portfolio does better than stocks.

When the red line is above zero, that means bonds are doing their job. It doesn’t always work, but so far this year it has.

Good diversifiers have a positive expected return with little correlation to other assets. As you can see in the second chart above, ‘Global Markets – Year to Date’, gold is meeting those expectations.

Gold

Gold is up 19% this year. Like bonds, gold doesn’t always work as a diversifier. It has been a great diversifier this year. But that is not always the case.

One memorable instance is after the Lehman Brothers collapse in September of 2008. Its initial reaction was up, then it fell 20%. However, from that date until the S&P 500 low March 9, 2009, it was up more than 20%.

More recently, in 2022, when inflation was Mister Market’s bogeyman, it fell 7% while the stock market went down 24%. Outperformance, but not in the way one would like.

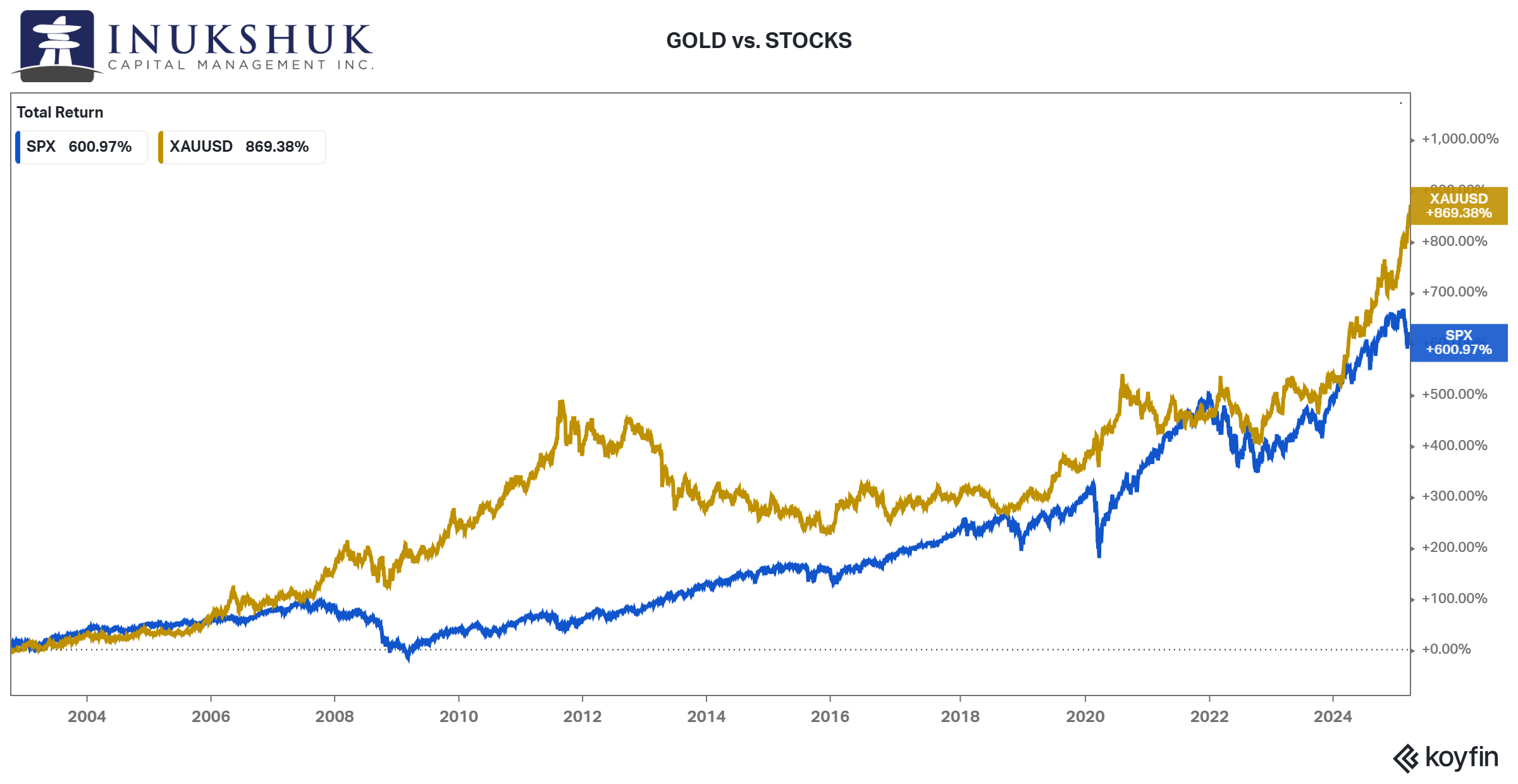

It does, however, have a low correlation with the S&P 500 at 0.08. And it does have an expected positive return. And lately, that return has exceeded that of the biggest equity index on the planet.

Going back more than 20 years, gold has done well.

We picked the start date of that chart in order to bias the performance measure in favour of stocks. That date is October 4, 2002, the bottom in the S&P 500 after the dot com debacle.

Good diversifier. A small allocation can have an outsized effect on a portfolio.

Wrapping Up

Everyone has a different preference for risk versus reward. There is no perfect diversifier, but combining different assets with different strategies can reduce volatility and drawdowns.

Diversification can also reduce returns compared to a stock-only portfolio. Insurance has a price. Depending on where an investor lies on the risk/reward spectrum, a portfolio can be constructed, based on the information available, that attempts to meet their goals.

We base our allocations on the past return profiles of each asset class. Note the word ‘past’. Correlations can change in any one day or month. What we use is the data that is available to test assets, strategies and portfolios over long periods of time.

It’s important to realize that investment strategies are dependant on time. Anything can happen at any moment, but sticking to a plan is key.

The newly minted 500-million-dollar man, Vladamir Guerrero Jr. at 26, might be very risk-seeking looking for high returns. Or he may not want to lose anything.

Everyone is different.

As the late great Norm Macdonald once joked:

It’s not clear the Easter bunny has taken that advice. We think investors should.

Enjoy the holiday weekend.

Now let’s look at a few important points for what this process means practically.

Wealth Longevity – Staying Steady Through the Noise

Market volatility picked up in April, prompting our systems to shift into caution-mode mid-month. This is a reflection of our rules-based approach that dynamically adjusts risk exposure based on trend and momentum signals.

From a practical standpoint, diversification remains a key theme. While not flawless, mixing asset classes like bonds and gold has helped mitigate portfolio drawdowns this year. For example, the traditional 60/40 stock/bond portfolio—though it tends to underperform in bull markets—has historically provided downside protection, especially during periods like the 2008 financial crisis. Gold, too, has offered diversification benefits, up 19% year-to-date, though its performance varies across cycles.

The key is recognizing that no single asset or strategy works all the time—but combining uncorrelated assets with positive long-term return profiles can smooth out volatility.

Our focus remains on managing risk while staying aligned with your long-term goals.

Have a question? Contact us here

Challenging the status quo of the Canadian investment industry.