Strangers in the Street

We built Inukshuk Capital Management to serve the needs of clients looking for a unique approach – void of conflicts of interest, commission sales and pushed products. We began by putting our own money where our mouth is. With low fees and active risk management, we help families achieve financial longevity, that’s the bottom line.

Stay up-to-date on the latest developments by following us on LinkedIn here.

April 2023: The Waiting is the Hardest Part

In this issue:

- Global Equity Market Performance – March

- Abstract: Reserve Currencies and De-dollarization

- Health is Wealth

- Bretton Woods

- Headlines

- Historical Context

- The Big Game

- The Big Dollar

- Wrapping Up

GLOBAL EQUITY MARKET PERFORMANCE – MARCH

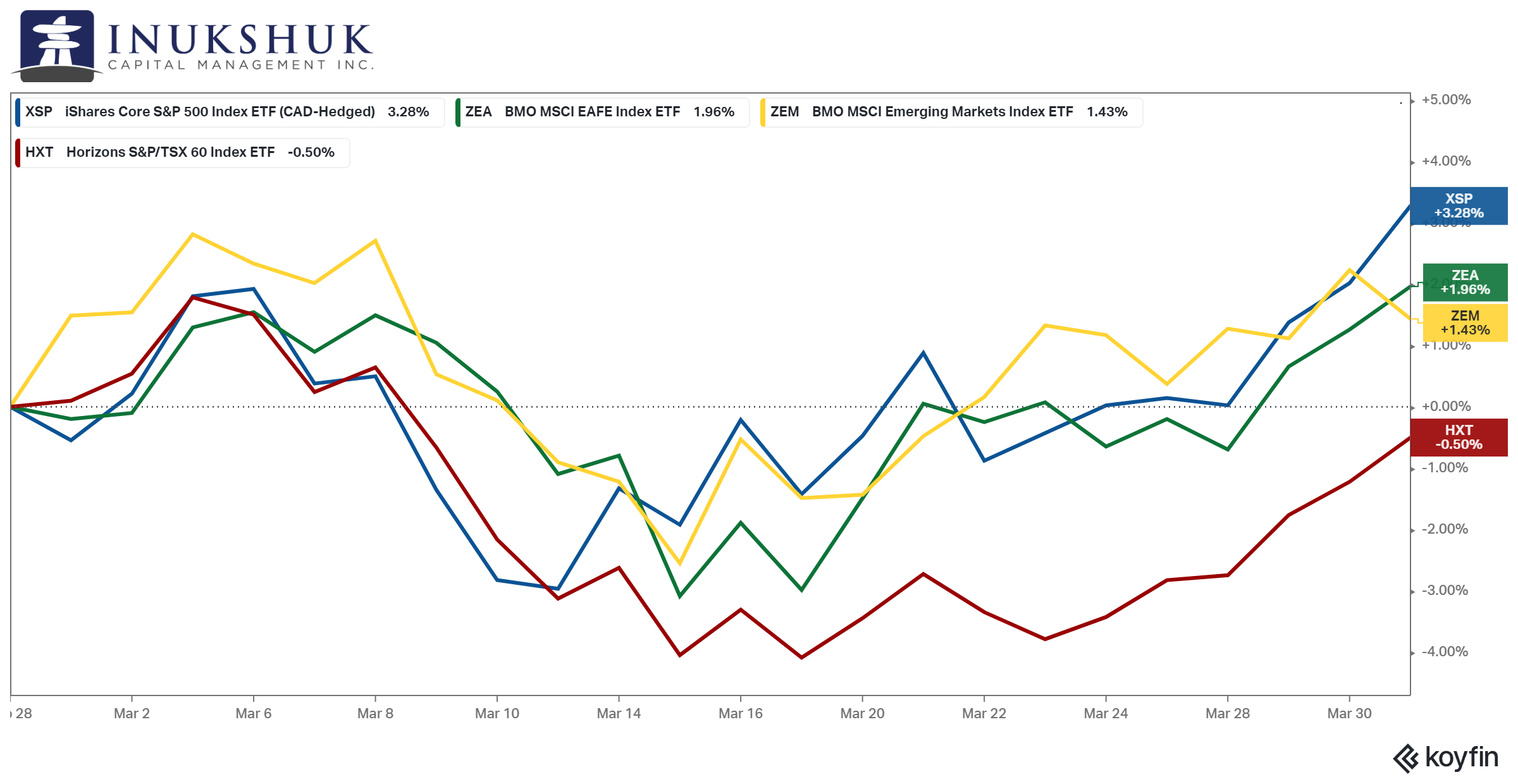

The S&P 500 lead the pack in March supported by the mega-cap tech stocks that dominate the index. MSCI EAFE (Europe, Asia the Far East and Australasia) maintained its strength and MSCI Emerging Markets (EM) bounced back, but not enough to erase February’s losses. Canada’s S&P/TSX60 index was down slightly, mostly due to the big banks having a bad month.

No additional regional banks in the U.S. collapsed in March, although just after our last newsletter went out, Credit Suisse (CS), the second largest bank in Switzerland, and the 45th largest in the world, imploded. UBS bought it for around USD 0.80 per share, or 3 billion Swiss francs. For perspective, prior to the world shutting down in 2020, CS stock traded at a price of around USD 14.00.

Our systems remain long the S&P 500, S&P/TSX60 and Emerging Markets.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here .

We always welcome feedback and suggestions for the format of this letter and its contents. This version will outline the ‘latest thing’ in markets that has the attention of those trying to figure out what is next. The question: is de-dollarization an imminent problem?

As well, some readers have requested a shorter version, or summary of the note. Here it is.

ABSTRACT:RESERVE CURRENCIES AND DE-DOLLARIZATION

Prior to the Great War, Great Britain’s pound sterling was what the U.S. dollar is now. Over the years after the war, the pound became less important. And in 1944 an agreement was made in Bretton Woods, New Hampshire, to establish the dollar as the international reserve currency, backed by gold.

The U.S. dollar is the dominant vehicle for settling global trade payments and is the primary currency for the vast majority of derivative products and commodities. It is considered the reserve currency for all central banks. These amounts are trillions upon trillions. If things keep trending this way we’re gonna need a bigger boat – or, in the least, something with less zeros.

There have been many stories published on this topic recently. These are primarily focussed on how some countries are considering a new regime where they are not dependant on using the dollar. That is what is meant by ‘de-dollarization’. It’s important to remember when reading these reports that there are many reasons why the various actors would publicly broadcast their positions. Think of the games we play, whether it is chess or poker, tactics and strategies will vary across players who are all trying to improve their chances of winning.

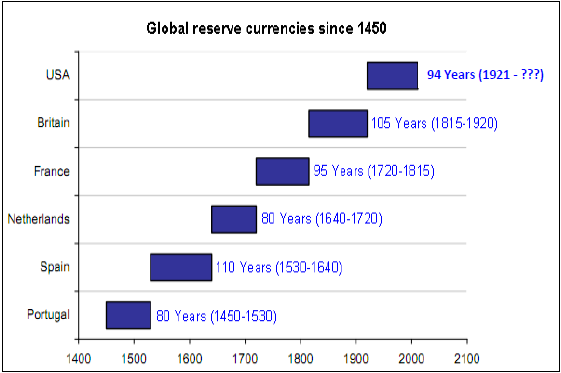

A currency’s status will change over time. There are lots of reasons for this – trade relationships, political allegiances, economic power, etc. In 2014, Jeff Gundlach of DoubleLine Capital presented this chart of the history of reserve currencies going back to 1450.

Historically, wars cause changes in what were once considered the norm with respect to international trade and financial relationships. The second side of that coin is that fights over trade and currencies can result in wars. That is a sort of ‘chicken and egg’ situation. It seems the third side of the coin is where we are as of now, considering:

- There is at least one ‘hot’ war going on amongst powerful nations

- Dissatisfied ‘customers’ of the dollar exist and may be growing

- All wars are not necessarily of the ‘hot’ variety and global trade tensions are high

As is clear from the above chart, reserve status of a currency does not last forever – a change is to be expected. Investment management requires a process that includes all the variables that impact expected returns and risks to capital. That’s why ICM is constantly in the business of research, whether it is quantitative, historical, current, or all three.

If you would like to explore this topic in more detail and figure out what Tom Petty has to do with all of this, please read on after Victoria’s writing on posture.

HEALTH IS WEALTH

Posture

Poor posture is a common problem that affects people of all ages and backgrounds. In fact, according to a survey conducted by the American Chiropractic Association, more than half of all Americans report experiencing back pain each year, and poor posture is a contributing factor. Additionally, poor posture can lead to reduced lung capacity, increased risk of falls, and other health problems, it can even contribute to snoring.

As a personal trainer and Pilates instructor, I see the effects of poor posture daily. Many of my clients come to me with complaints of chronic pain or discomfort, and in many cases, poor posture is a contributing factor. That’s why I believe it’s important to raise awareness about the importance of good posture and offer some handy tips for checking and improving your posture throughout the day.

Here are some practical tips to help you check and improve your posture:

1. Be mindful of your posture throughout the day. Whether you’re sitting at a desk, standing in line, or walking down the street, take a moment to check your posture. Make sure your head is aligned with your spine, your shoulders are relaxed, and your feet are planted firmly on the ground.

2. Strengthen your core muscles. Strong core muscles can help support good posture by providing stability to the spine and pelvis. Consider incorporating exercises such as planks and bridges into your fitness routine to help strengthen your core muscles.

3. Stretch regularly. Tight muscles can contribute to poor posture, so be sure to stretch regularly to help maintain flexibility and mobility. Consider incorporating stretches for your neck, shoulders, and back into your daily routine.

4. Seek professional help if needed. If you’re experiencing chronic pain or discomfort related to poor posture, consider seeking help from a healthcare professional such as a physical therapist or chiropractor. They can help identify any underlying issues and provide guidance on exercises and stretches to help improve your posture.

5. Consider using posture correctors. There are many posture correctors on the market that can help you improve your posture. These devices work by gently pulling your shoulders back and aligning your spine. While they can be helpful, it’s important to use them in conjunction with exercises and stretches to help strengthen your muscles and improve your posture over time.

By taking these simple steps, you can improve your posture and support your overall health and well-being. Remember, good posture is not just about looking good; it’s about feeling good and living a healthy, active life. So why not start today and take the first step towards better health ?

‘You have to sustain it, to maintain it’

Victoria Bannister

ICM Health Ambassador

BRETTON WOODS

The U.S. dollar used to be backed by gold at $35 an ounce. It then became the official reserve currency of the world in 1944 in an agreement reached at a conference in Bretton Woods, New Hampshire. That’s where the Bretton Woods System moniker comes from. By the 1960s the U.S. was running up large balance of payments deficits. They were importing more than they sold.

Trading nations did not like the situation. They didn’t want to hold so many excess dollars and wanted to exchange them for gold. But there was not enough gold, so in 1971 President Nixon closed the gold window – no gold for you. That means that the entire global currency system, dependent on dollars, is based on nothing other than faith that you can pay for stuff with it and it will be accepted and the goods delivered.

HEADLINES

Here is a sample of recent reporting on the issue at hand.

Saudi Arabia is in active talks with Beijing to price some of its oil sales to China in yuan, people familiar with the matter said, a move that would dent the U.S. dollar’s dominance of the global petroleum market…

Wall Street Journal, March 15, 2023

China and Brazil have reached a deal to trade in their own currencies, ditching the US dollar as an intermediary, the Brazilian government said Wednesday, Beijing’s latest salvo against the almighty greenback.

AFP – Agence France Presse, March 29, 2023

Russia is looking to settle all its trade with India in rupees and rubles to boost “stability” for its companies and eliminate “losses” incurred from using dollars and euros, according to a report by Indian web news portal Firstpost.

Asia Times, March 31, 2023

The U.S. has rallied its European allies behind a $60-a-barrel cap on purchases of Russian crude oil, but one of Washington’s closest allies in Asia is now buying oil at prices above the cap.

Wall Street Journal, April 2, 2023

Europe must reduce its dependency on the United States and avoid getting dragged into a confrontation between China and the U.S. over Taiwan, French President Emmanuel Macron said in an interview on his plane back from a three-day state visit to China.

Speaking with POLITICO after spending around six hours with Chinese President Xi Jinping during his trip, Macron emphasized his pet theory of “strategic autonomy” for Europe, presumably led by France, to become a “third superpower.”

POLITICO, April 9, 2023

Note: these kinds of ideas have been bouncing around for decades. But, things seem to be percolating recently. These are serious countries with serious grievances that are not all that fond of the rules as written and are not supportive of the latest in U.S. foreign policy excursions.

Most of us here at ICM recall the imminent demise of the big dollar predicted by many in the 1990s and on, from financial crisis to financial crisis. Cynicism is one valuable component of thought for those who wish to survive and profit in financial markets – or even in day-to-day life. Keeping that in mind while also reading history and using your imagination, these seem to be developments that should not be ignored, despite decades-long predictions that never come true.

HISTORICAL CONTEXT

Much of what happens is not necessarily new. History is riddled with fallen empire stories. The Roman Empire is a good example.

They did it all:

- Controlled much of the western world

- Dominated trade with military power

- Issued the currency of record

- Debased said currency

- Consumed itself in endless wars

- Collapsed

Note that in almost all of these historical records the means of exchange, the dominating currency, becomes unreliable or out of favour. Not just Rome.

Recall the above chart from DoubleLine. Italy, Portugal, Spain, the Netherlands, France and Britain are all highly developed economies and great places to live and visit. It’s another whole topic as to why Germany is not on the list. Regardless of the many advantages to being a citizen of a country whose currency has reserve status, the loss of it doesn’t appear tragic over longer periods of time.

THE BIG GAME

There are dangers in using history to understand current conditions when trying to figure out what might happen in the future. It’s more of an art than a science and it is based on the principal that humans do not change – we just succeed and make mistakes, the same ones, in different ways. It’s a useful approach for that reason, as long as the historical and cultural context is understood and considered to be relevant to what is happening now.

A good example is when you read pundits talking about the stresses between the western world and Iran. Iran is part of the group of nations who do not like the current situation with respect to the U.S and has been deepening its financial ties to China and Russia. Interestingly, China just negotiated a peace deal between Iran and Saudi Arabia who have been enemies for a very long time.

Iran is Persia. Persia has a long and rich history and is the origin of much knowledge. Some of the commentator class will say, regarding U.S. foreign policy: you know, the Persians invented chess and the U.S. does not play chess. The problem with this line of thought is: Persians invented chess and play poker (it’s not certain they invented poker). And, the Chinese invented playing cards. All of the above know how to play both.

To stretch the game analogy a bit – think of a poker game. The house issues the chips used at the table. In this game, one of the players can create the money (dollars) that is equivalent in value to the chips.

This means that those who want to play must sell their currency to buy dollars to pay for the chips. If they don’t want to do that, they may create a side-game. They are still at the big table but they can agree to buy and sell chips by exchanging their currency with each other directly.

Fewer dollars are now changing hands, but the game remains the same. And if one of those player’s currencies becomes more desirable than dollars, for whatever reason, that currency might become the means of exchange – the house might accept that money as payment for chips.

If any one of the players thinks that the money-creating player is abusing their status they could leave the room. In general, everyone including the money-creator have an interest in keeping the game going.

Let’s be more specific. Imagine that the Chinese player’s currency, the yuan, becomes popular. But some of the players are a little hesitant to hold that money because of the various restrictions around its use. In reality, this is the case. China does not have an open capital account. This means they can control who can buy and sell yuan, at what price and in what quantity. The money used within China is different than that used outside China. The concerns of the players are valid. What if you’ve won a pile of yuan, want to sell it for dollars so you can buy the house’s chips to bet on the ballgame at the sports book and the Chinese player says – no dollars for you.

THE BIG DOLLAR

You can see the advantages of agreeing to use the dollar because a dollar anywhere in the world is a dollar. If you ask an American citizen what the value of a dollar is, many will respond: a dollar? If you ask Mrs. Watanabe in Tokyo what a dollar is worth they will look at their phone and say: 134.39 yen. That’s a cultural difference that exists and is important when trying to understand what money is.

There are conditions in place, currently, that favour the use of the ‘Big Dollar’. It is somewhat protected by the nature of the game and the behaviours and practices of the other players.

The Bank for International Settlements (BIS) Quarterly Review, published December 2022, has some helpful statistics to understand the role of the dollar. The BIS is owned by 95% of the national central banks. Its mission statement is: to support central banks’ pursuit of monetary and financial stability through international cooperation, and to act as a bank for central banks.

The main uses of the dollar, outside of the requirement of U.S. citizens to use it to pay taxes are:

- Foreign exchange (FX) transactions: 90% or $6.6 trillion per day of all FX transactions has the dollar on one side of the trade. This is up from $5.8 trillion in 2019.

- International Debt Markets: 88% of international debt issued by non-U.S. residents and 65% of non-resident bank loans are denominated in dollars.

- Global Trade and Payments: roughly 50% of all trade is invoiced in dollars while the U.S. accounts for only 10% of all international trade.

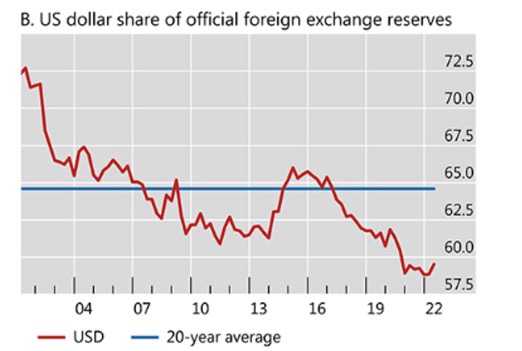

- Foreign Exchange Reserves: central bank holdings of dollars comprise just under 60% of all reserves.

The last point is interesting as this is the lowest share in the past 20 years. It is below the average of 65% and down from 72% in 2002.

Central bankers determine what they hold as reserves. So it appears there has been a change in preferences over the past two decades. The creation of euro had something to do with this in the early 2000s. But more recently the trend is down. That is worth paying attention to but not reason to panic. The above statistics show that the dollar is like the grease for the machinery of international finance. (Fun fact: the term for graft in Hong Kong is ‘fragrant grease’).

Can that change? Sure it can, that is historical precedent but it’s not likely to happen in an instant.

WRAPPING UP

Our role as portfolio managers involves many different aspects of research and analysis. Our systems are based on historical price data going back decades. We use these signals to manage asset allocation. Our thinking – the price history of large liquid markets contains the most valuable information in constructing robust systematic processes.

They are updated every day. By constantly monitoring trends in global markets we can quantify how those trends evolve. Often we don’t know, specifically, why prices are doing what they are doing. We may have an idea, because we study history and read as much as we can in order to stay current on events, ideas and possible new trends in things that may later be reflected in prices.

Knowledge and experience help in this process because much of what is broadcast is noise or backward-looking explanations of an event’s causes. The reason there is so much of this content is that people want an explanation for everything. Where there is demand, supply will be created – even if it makes no sense.

An actual example we experienced in early 2020 provides some insight into how this works. In late January and early February of that year, the first solid sell signals went off in MSCI Emerging Markets. Then the same thing happened in late February for both the S&P/TSX60 and MSCI EAFE. In the first week of March the S&P500 triggered sell signals along with every other market. By mid-March we had no equity exposure in our active program. We don’t manage money on a hunch. It’s a rules-based process. Even though that is the case, it is sometimes uncomfortable to hit the ‘sell button’.

We did know there was some kind of flu going around in China in early January. But that doesn’t stand on its own as some deep insight. We also knew via some of our information sources that since mid-January there were significant supply chain issues as suppliers of materials from China could not get them to North America in a timely manner. Then, on March 3, when the Federal Reserve hit the panic button and cut the target interest rate from 1.50% to 1.00% it was clear that our systems had been on to something. Hitting ‘sell’ was less difficult to do.

The point of this story is not to brag. The points is – because we have been through so many panics and hysterias, built models to systematically manage assets and are constantly seeking relevant current information, we may have developed what can combine to be called knowledge – we avoided much of that disaster.

To get back to de-dollarization, it is likely we will sense some kind of clue as to how it is progressing, if at all. That is because of the work we do. One thing we have learned is some of the best trades are the ones you do not do. You prepare and study so that when the excrement hits the air conditioner you have a plan and know how to execute.

That’s not exactly what Tom Petty was referring to in the song “The Waiting”, but who cares, it’s a good one.

The waiting is the hardest part

Every day you see one more card

You take it on faith, you take it to the heart

The waiting is the hardest part

Have a question? Contact us here

Challenging the status quo of the Canadian investment industry.