At Inukshuk Capital Management, our focus is on building lasting relationships rooted in trust and collaboration. By focusing on active risk management and long-term value creation, we help families and institutions achieve financial sustainability.

Stay up-to-date on the latest developments by following us on LinkedIn here.

In this issue:

- Global Equity Market Performance

- Stonks

- Retail

- Lead Change

- Highs

- August So Far

- Wrapping Up

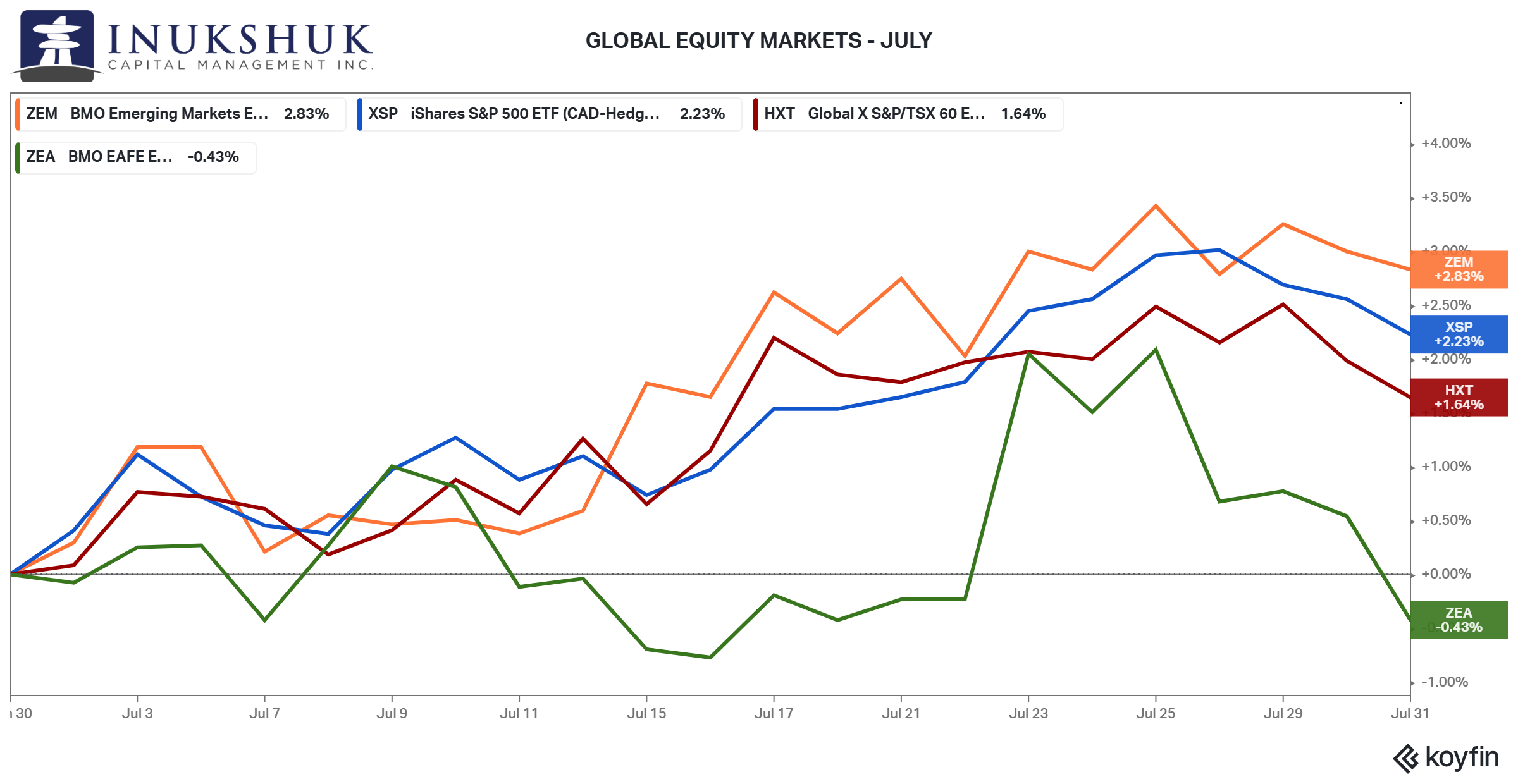

Global Equity Market Performance

For the second month in a row, MSCI Emerging Markets outperformed all the global stock indexes we track, gaining 2.8%. The other three markets put in the same ranked performance as June. The S&P 500 and S&P/TSX 60 rallied 2.2% and 1.6% respectively. MSCI EAFE was the only loser, down 0.4%.

As of this writing, the second week of August, our systems are indicating positive momentum in all four of these equity indexes.

As of this writing, the second week of August, our systems are indicating positive momentum in all four of these equity indexes.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here.

In this letter we are going to look at retail traders’ growing role, their market impact, and echoes of past speculative booms.

Stonks

The old ‘sell in May’ strategy continues to disappoint.

In last month’s letter we noted some research that quantified the success of buying dips in the Nasdaq 100. That strategy is working.

There are indications that retail investors are participating with some success.

A recent note from Raymond James highlighted the return of the ‘meme’ stocks or stonks as the kids on Reddit like to say. From that note, a chart of the UBS MEME Index (yes, such a thing exists) shows recent price action that is similar but less dramatic than in 2021.

GameStop and AMC Entertainment were hyped on social media and rallied from a few dollars to hundreds of dollars per share. They’re now down 80% and 99% from their highs.

Marcel Ferreri, the author of the note, highlighted some interesting facts. The average decline from the peak was 87%. Bitcoin is overlayed on that chart because he also found some research which suggests that profits from meme stocks tend to flow into bitcoin.

None of the above is predictive, however the odds are that holding these typically financially weak companies for the long term is not a profitable strategy.

Institutional traders don’t often participate in this playground. In 2021 a few got caught on the wrong side of the squeeze. It’s not clear how much was lost but one fund, Melvin Capital, was bailed out by Citadel LLC, a fund management and investment firm, to the tune of $2 billion.

This is just one example of the rise of the retail trader.

Retail

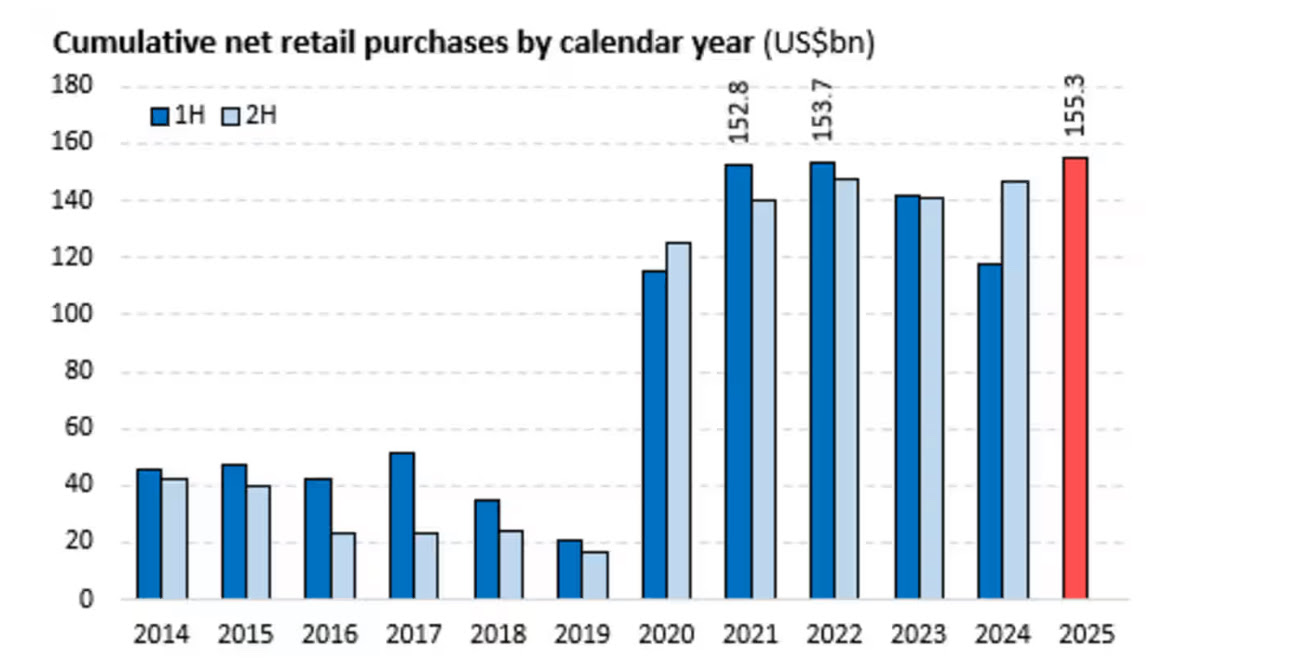

A broader example is the dollar value of retail investor buying. In a recent note Accelerate, a fund manager, presented a JP Morgan chart showing the dramatic increase in participation since 2020.

They wrote: Since the onset of the COVID-19 pandemic, retail investors have become a significant presence in the stock market. Over the past five years, trading flows have increased 400% among 18-25 year-olds, while flows from lower-income households (below $35,000) rose nearly 450%.

These events are reminiscent of the late 1980s and early 1990s, when the term ‘day trader’ was coined. The dot-com boom fueled speculation. Some of the tech stocks which benefitted from this were the same companies that enabled easy access to information and drove down trading costs.

That’s what is happening in U.S. markets. What’s going in Canada?

Lead Change

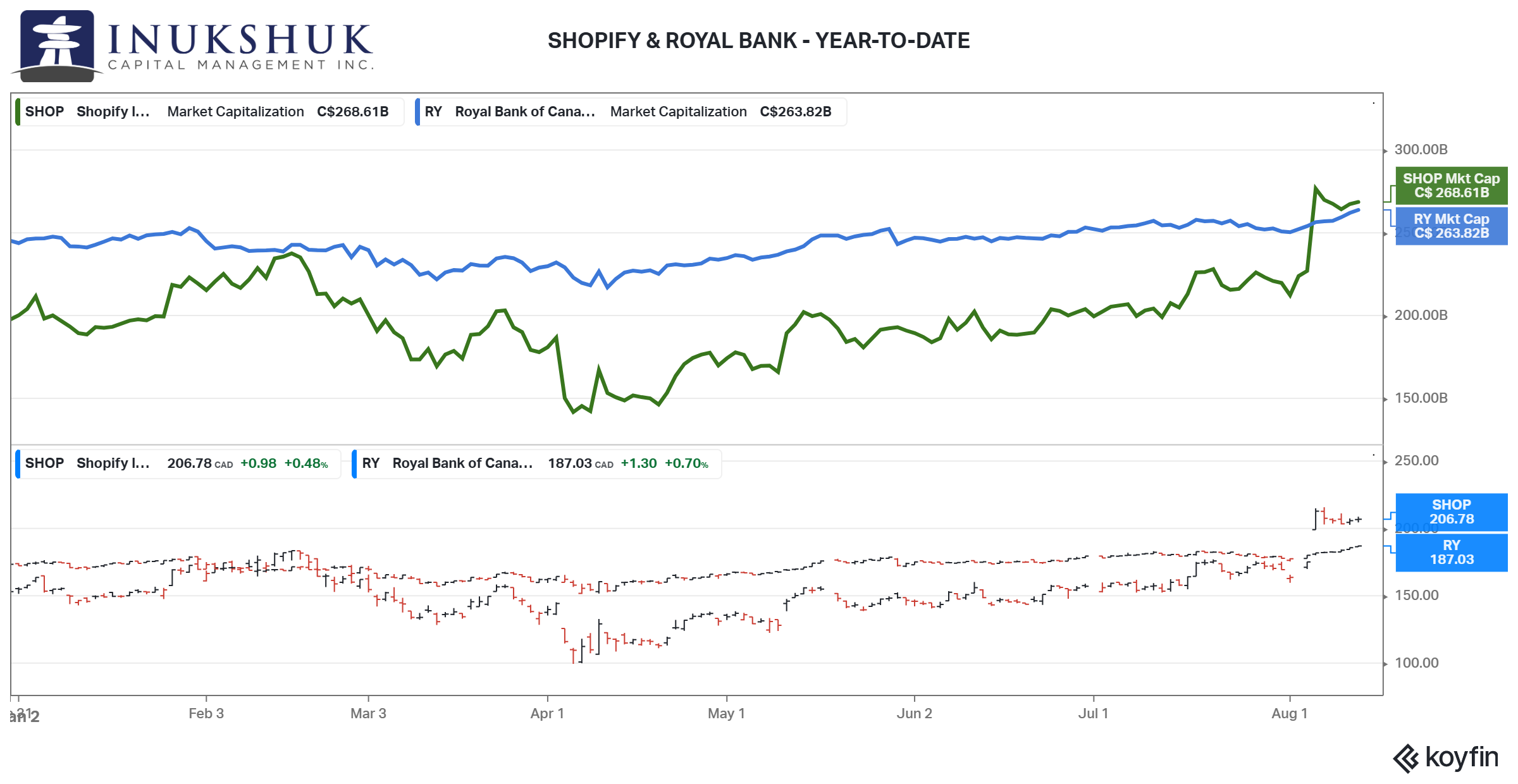

On August 6, Shopify, an e-commerce giant (had to be), became the largest by market capitalization in Canada, overtaking Royal Bank. As of August 13, its market cap was $5 billion more than Royal at $268 billion. For context, Shopify’s trailing 12-month revenues are just over $10 billion. Royal’s are $58 billion.

Together, they account for just over 16% of the S&P/TSX 60 index’s market cap.

We’re old enough to remember when Nortel, another tech company, represented more than a third of the TSE Composite Index.

As they say: history rarely repeats, but it does rhyme.

Highs

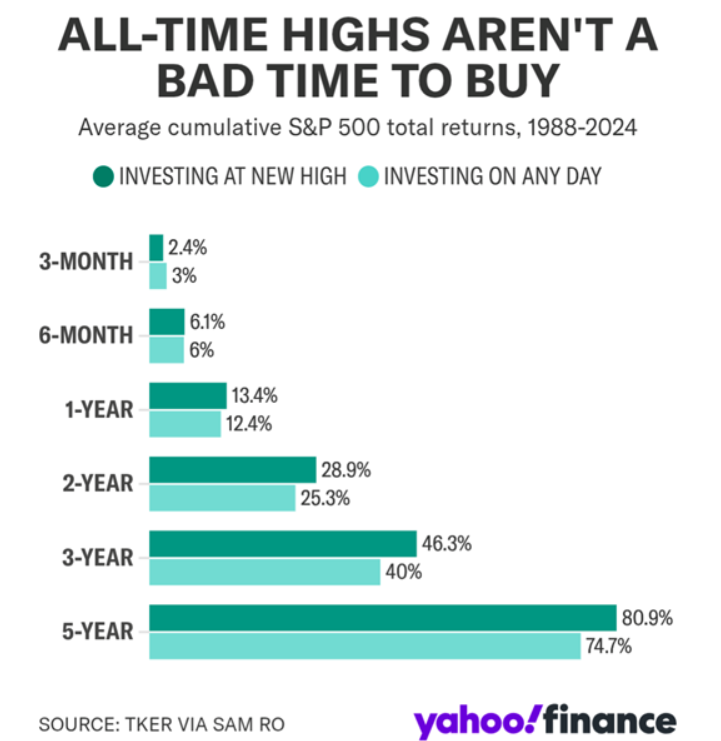

The S&P 500 continues to make new highs.

Sam Ro, Editor of Tker, a financial newsletter recently shared an interesting fact: Over 6-month, 1-year, 2-year, 3-year, and 5-year periods, the S&P 500 on average has generated positive returns. But as this data from JPMorgan Asset Management shows, investing specifically at all-time highs has actually generated higher average returns over these time horizons.

The dip-buyers, high-buyers and everyone in between profits in an up-trend. So, we’ve got that going for us.

August So Far

On August 12, China announced a 75% tariff on Canadian canola products. That seemed to come out of nowhere.

The same day, Perplexity, a private AI company, offered to buy Google’s web browser, Chrome for USD 35 billion. This is despite Perplexity having a valuation of USD 18 billion at the time of its latest funding round. This could be a publicity stunt or perhaps Google’s recent anti-trust issues are a motivator.

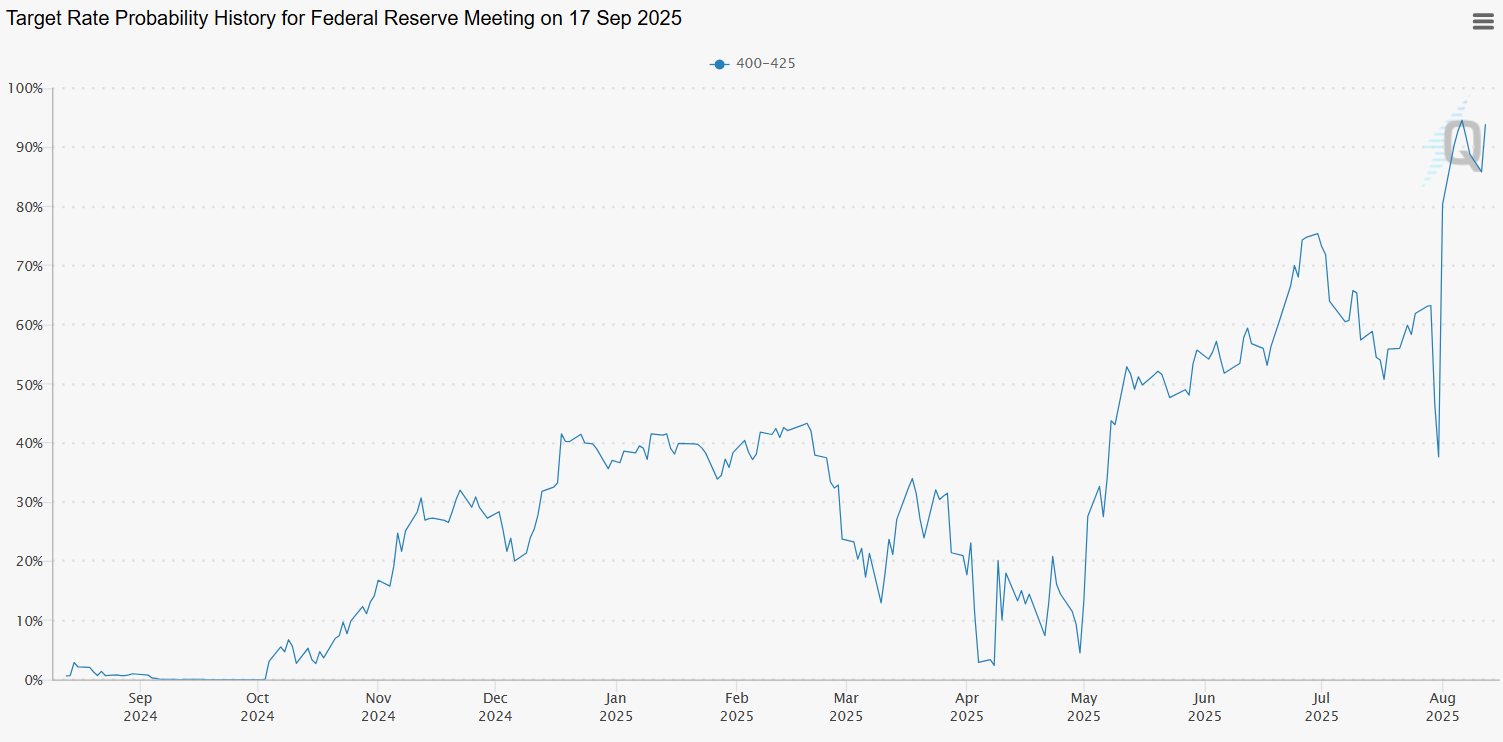

President Trump and more recently treasury secretary Bessent have called on the Fed to lower interest rates, significantly. Since May the odds of a rate cut in September have jumped from around 10% to over 90%.

Source: CME Group FedWatch

On August 13, Trump called for the target to be “3 to 4 (percentage) points lower” and on the same day Bessent said: “We should be 150-175 basis points lower…”.

President Trump will meet with President Putin in Alaska on August 15 to discuss ending the war in Ukraine.

If a deal can be made, that would be good. What it means for markets is anyone’s guess.

Wrapping Up

As the saying goes: no one rings a bell at the top. It’s impossible to accurately pick tops.

Alan Greenspan warned of “irrational exuberance” on December 6, 1996. The S&P doubled over the next four years.

We want to reiterate: the facts covered above are not in any way predictive.

Nonetheless, it is an interesting study in human behaviour. The late 1990s don’t seem all that long ago to us. Note the demographic of those buying as reported by JP Morgan. The oldest was born in 2000.

Our systems show positive momentum across the global markets we cover. So that’s how we’re positioned.

Enjoy the rest of the summer and we’ll stay frosty.

Have a question? Contact us here

Challenging the status quo of the Canadian investment industry.