We built Inukshuk Capital Management to serve the needs of clients looking for a unique approach – void of conflicts of interest, commission sales and pushed products. We began by putting our own money where our mouth is. With low fees and active risk management, we help families achieve financial longevity, that’s the bottom line.

Stay up-to-date on the latest developments by following us on LinkedIn here.

October 2022: Boots

In this issue:

- Global Equity Market Performance – September

- Stocks and Bonds- Year to Date

- Inflation – again

- Adventures in Monetary Policy

- Crisis – again

- Consequences

- Housing Affordability

- Summing Up

- Health is Wealth

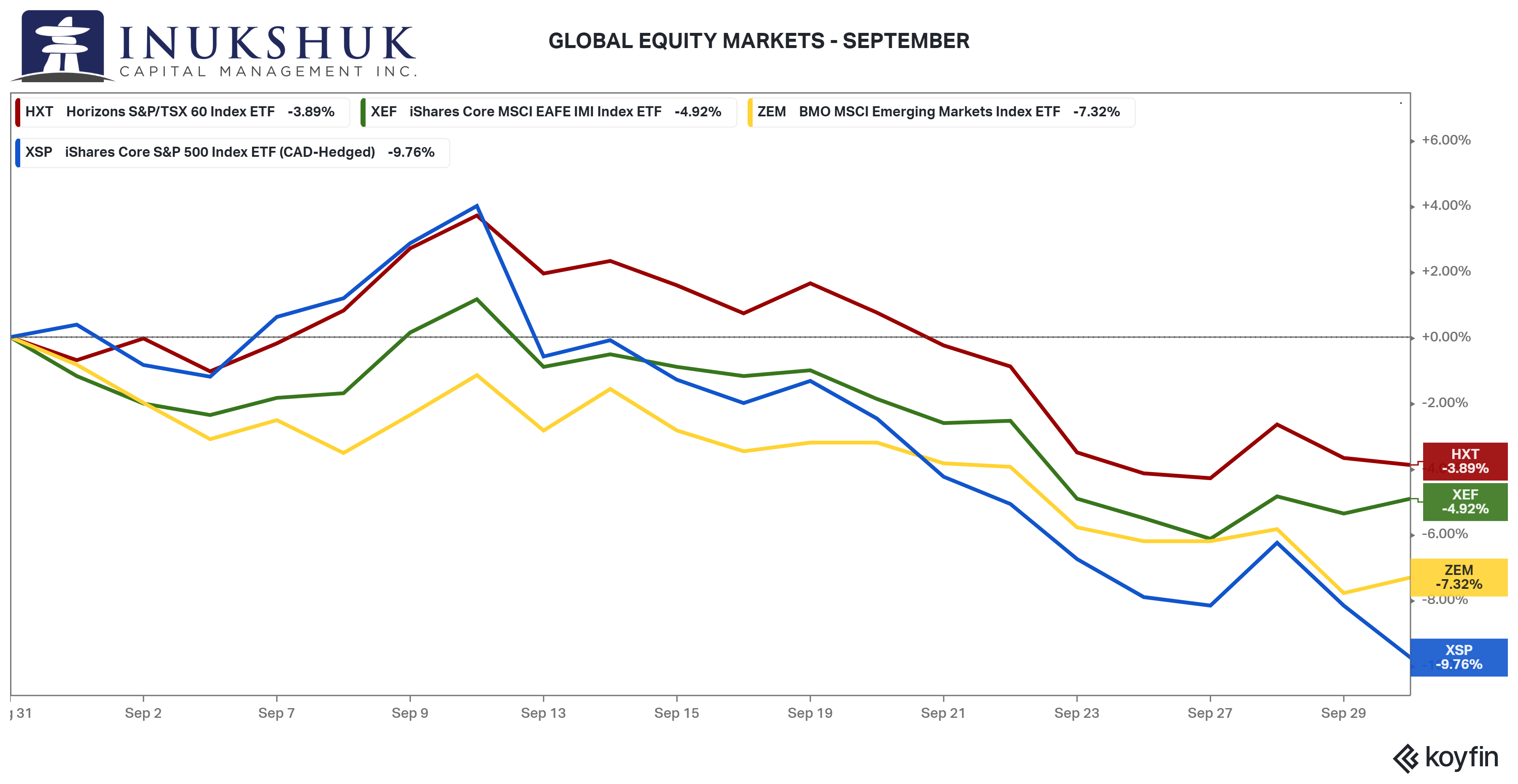

GLOBAL EQUITY MARKET PERFORMANCE – SEPTEMBER

This was one of the worst months for stocks in history. According to the data we have going back to 1950, the S&P 500 has only had two worse Septembers – 1974 (11.9%) and 2002 (11.0%).

The S&P 500 was down almost 10% after giving up a 4% gain early in the month. That is very similar to what happened in August, in terms of the round trip. But in the last two days of September alone, the largest equity index on the planet lost 4% of its value, undercut the low made in June and closed at its lowest level on the year. If you add all of that up, the S&P 500 is down 17% six weeks after the summer rally failed in mid-August. That means it ended Q3 down 24% on the year.

Our systems have not shown any positive signals since the brief instances in emerging markets and the S&P 500 in August and are now completely flat across the board.

If you would like to stay current on our measures of trend and momentum in the markets we follow, please click here

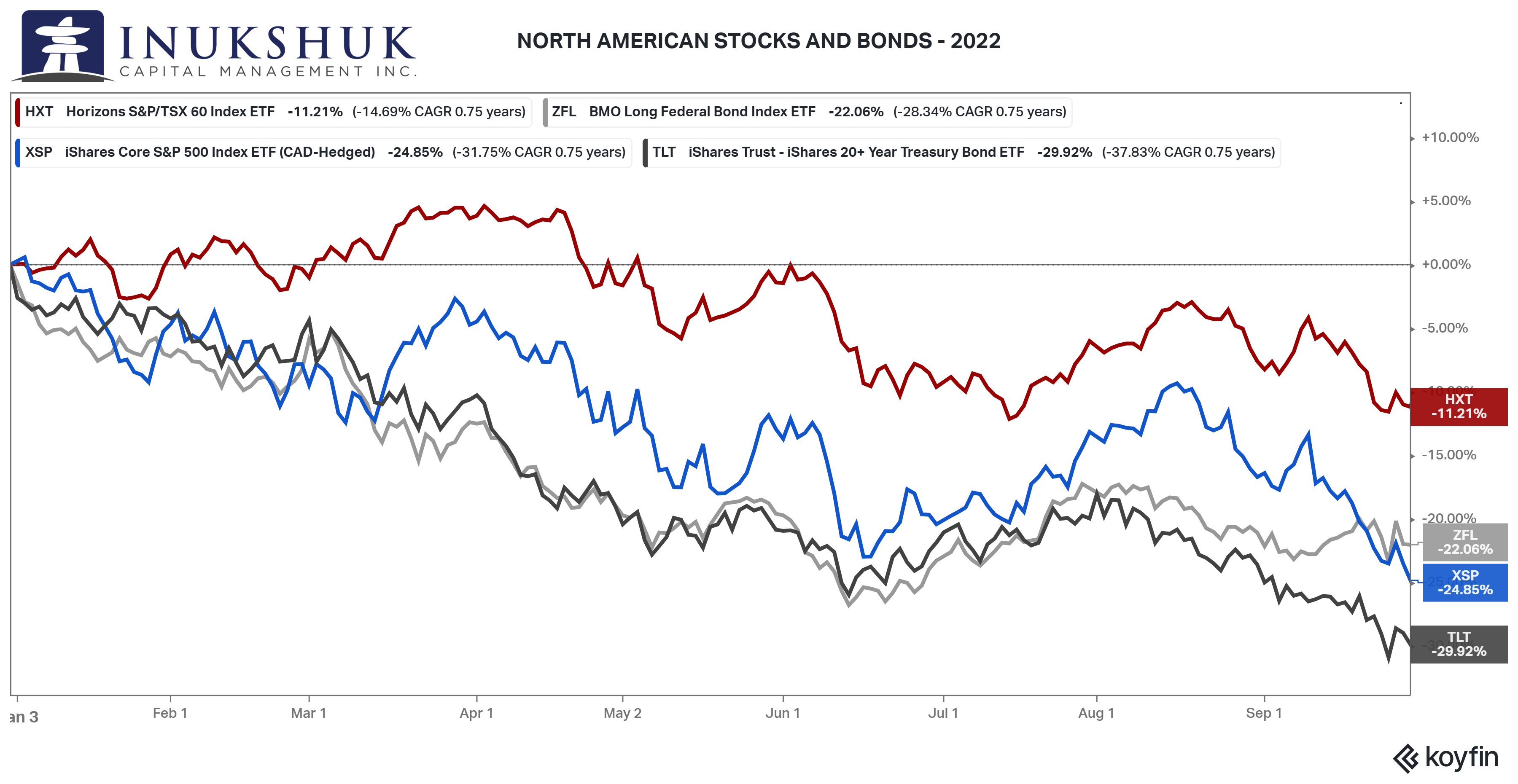

STOCKS AND BONDS – YEAR TO DATE

The time-tested asset mix of equities and fixed income has failed portfolio managers this year.

Long-term government bonds have performed worse than equity markets in their respective countries. In Canada, the long-term bond ETF ZFL is down almost twice as much as the S&P/TSX60.

There are many ways to diversify to try and manage market risk. Recently, we have used some of the cash that is available from our active risk management component of client portfolios to invest in alternative strategies that have low correlation to both equities and fixed income. Until the equity markets show enough life to generate buy signals in the broader indexes, cash and alternatives are a good place to be.

INFLATION – AGAIN

Last month’s note covered inflation from the consumer’s perspective. It’s a tricky subject but the facts are that we couldn’t have got to where we are without massive fiscal and monetary expansion. The last explosive round was fuelled by the authorities trying to stave off a financial panic due to the pandemic.

Since the U.S. is the biggest economy in the world, and our neighbour, it is worthwhile looking at what their policies have been. Canada’s policy decisions are influenced by the U.S. because of the links we have with its economy. We are very much connected.

ADVENTURES IN MONETARY POLICY

Back in 1987, Alan Greenspan was just kicking off his almost 20-year tenure as the Chairman of the Federal Reserve. Note that his nomination and re-appointment to the role included presidents of both parties. They must have liked his style.

Two months into the job, the stock market had an epic crash and his decision was to support markets with liquidity from the Fed. In 1998, he did the same thing when Long Term Capital Management, a highly levered hedge fund, was spiralling into the abyss and threatened to take some investment banks down with it. Some of which were investors in the fund.

In 1999, spooked by the potential impending collapse of the world due to the Y2K bug purported to be in many computer systems’ code, the Fed pumped massive amounts of liquidity into the system. The Nasdaq 100 rallied almost 50% in the last two months of the year. Shortly after the non-event of Y2K, the dot com bubble burst as Greenspan was cutting rates.

Then the tragedy of 9/11 happened and the Fed pulled out all the stops. The official target rate was cut, eventually hit 1.00% and stayed there until May 2004. In trying to normalize the interest rate situation, the Fed raised rates up to 5.25% by July 2006 then stayed put, until one of the biggest financial catastrophes in recorded history started brewing in August 2007. Looks like Greenspan got out of Dodge at just the right time.

His successor, ‘Helicopter’ Ben Bernanke set a new standard in monetary intervention aligned with the treasury. The authorities ‘fixed’ the financial meltdown by writing a $700 billion cheque while the Fed bought every asset they could. This is relevant to our current situation because that is what happened in 2020.

An important point of this short history is: in every case except for 9/11, Greenspan, and then Bernanke saved markets that were declining from record highs. The latest Chairman did the same in 2020. This has become known as: ‘The Greenspan Put’, now the ‘Fed Put’. Meaning, the Fed will bail you out if you get into trouble. This is a classic moral hazard and the consequences of this type of policy reaction are something we are living with to this day.

CRISIS – AGAIN

Here we are, after 35 years of central bank ‘innovation’ and humans are suffering from the actions of policy makers, again. As we’ve noted, the central banks and treasuries of the world went into high-speed mode in the spring of 2020. They were buying every asset they could and federal governments were spending money in unprecedented amounts.

There is a solid argument to be made that these policy makers may have no idea what they are doing. And they may be unaware of why this cycle keeps repeating itself. Now to solve the problem they helped create, central banks are hiking interest rates into a global recession and attempting to unwind the asset purchases they’ve made over the past many years. How’s that gonna work out?

Let’s see.

On September 28, the Bank of England had to intervene in the long-dated government bond market. These are obligations of the U.K. known as gilts. This was a bit of a surprise since they had previously announced they were going to start selling gilts in October, to shrink their balance sheet, tighten monetary conditions and suppress inflation.

Whoops.

The gilt market was in a major meltdown. Probably one of the worst the U.K. has experienced, and that is saying something. So, they waded into the market and stabilised it. The good news is that it worked (for now). The bad news is the reason the market was imploding is because pension funds were getting margin calls.

Huh?

Ok, so here we are again. But now the stodgy old defined benefit pension funds are getting margin calls from banks just like a recklessly overleveraged hedge fund or investment bank in… oh, pick any of the events from the past 35 years.

How on earth could this happen, you might wonder. The answers are in the historical evolution of thinking in monetary and fiscal policy circles. And this is important to the ‘normals’ that are not insulated from the consequences of these decisions.

Fun fact: by buying gilts in the open market, the Old Lady of Threadneedle Street bailed out its employee pension fund

CONSEQUENCES

In the last note, we covered the impact of inflation with respect to the goods and services individuals need to buy to stay alive. But there are further consequences. Keeping official interest rates very low and buying securities to support markets affects asset prices. The method to achieve the ‘good’ inflation target of 2% is problematic. One: because a central bank can’t control how the money they are trying to create is going to be spent and two: the premise of this goal is faulty – why would anyone want the things they need, to go up in price by 2% a year? It makes no sense.

The following explanation will address problem one. Problem two is something likely never to be written about here because it is tremendously complicated and baffling in its own right.

Though much of this will be in U.S. terms, there are similar things occurring in Canada. We’re using U.S. data because it is more extensive and detailed.

HOUSING AFFORDABILITY

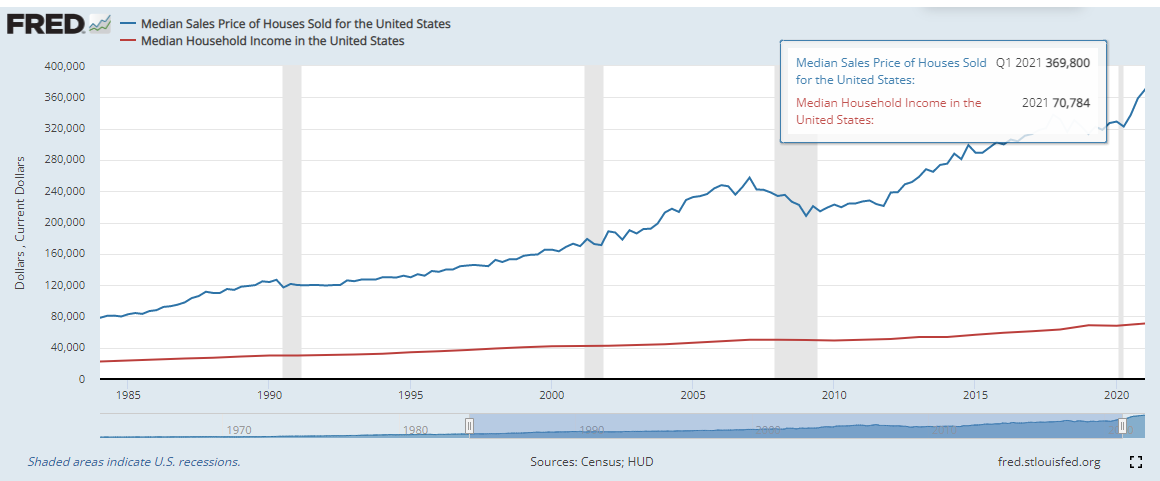

If money is cheap (low rates) and available, (both from the treasury and the central bank) it will find places to go to make more money. This next bit is about housing affordability. The following chart goes back prior to Greenspan’s reign at the Fed.

The first data point, in 1984 (good book) the median house price in the U.S. was $78,200 and the median household income $22,415. That meant a house cost 3.4 times more than a household would make in a year. By 2007, those numbers were $257,400 and $50,233 respectively, or 5.1 times.

During and after the financial crisis of 2007-2009, when the Fed started buying assets, as well as cutting rates, and just prior to the 2020 pandemic those numbers were $329,000 and $68,010 or 4.8 times. Now, post-pandemic policy response, that ratio is 5.9 times. Short version: since Greenspan started firing up his ‘toolbox’, the median household needs to earn 1.7 times more money to buy a median-priced house.

Good work.

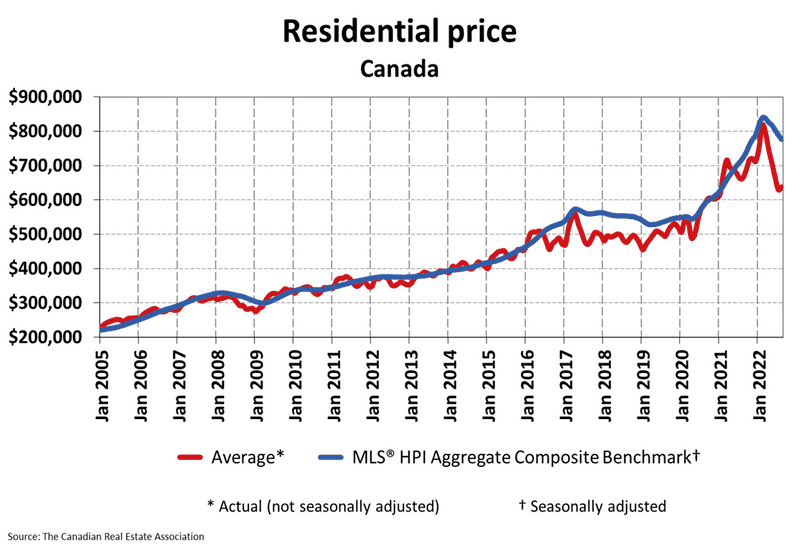

It’s a similar story in Canada with less data points and worse charts. This is the average house price in Canada since 2005.

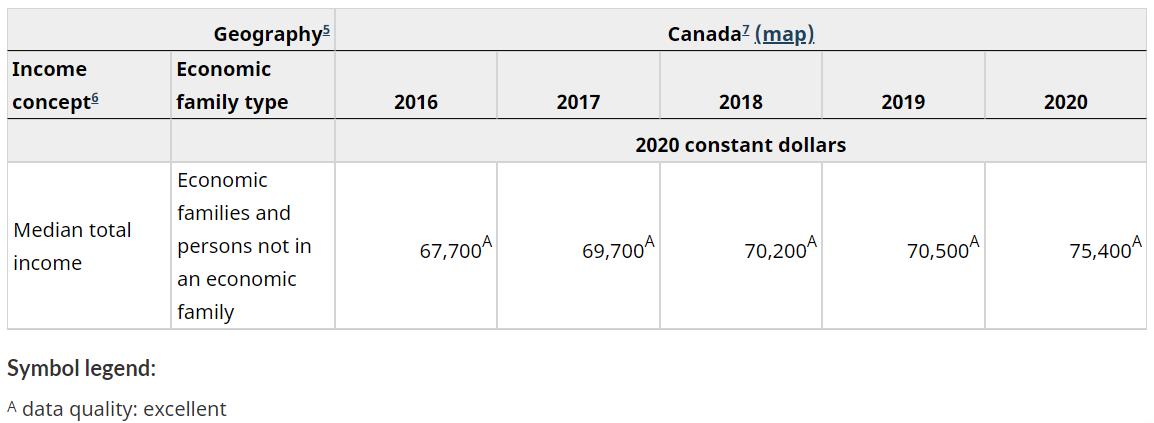

Below is the median household total income in Canada going back to 2016 in constant dollars. Note: medians are better than averages due to the extremes and the U.S. charts were in nominal, not real dollars.

|

In January 2007, the average house price was around $300,000 and that is most likely a high number due to the impact of prices in Vancouver and Toronto on the mean. We don’t have the income numbers from then, but if we use the 2016 median household income the ratio is 4.4. In 2022, (once again no income numbers from Statistics Canada, so we’ll use 2020) the average house price is around $650,000 versus $75,400 income or a ratio of 8.6.

It’s not clear as to what the goal is here. Food costs more. Housing costs more. Lower income earners are paying the highest price for all of this. Where’s their bailout?

SUMMING UP

All these things further complicate the management of investors’ savings. That is what we do. From imploding pension funds to food prices skyrocketing the consequences are endless, circular and interacting in complex ways that will only become apparent years from now.

In the meantime, this is a good way to remember Loretta Lynn, who passed on from this earth last week. It’s not her most famous song, but the cool thing about this is Nancy Sinatra made this song famous. And Loretta covered it shortly after. But neither of them wrote it. – lots of metaphors here.

You keep lyin’ when you oughta be truthin’

And you keep losing when you oughta not bet

You keep samin’ when you oughta be a’changin’

Now what’s right is right but you ain’t been right yet

These boots are made for walkin’

And that’s just what they’ll do

One of these days these boots are gonna walk all over you

These Boots are Made for Walkin’ – Lee Hazlewood

Once again, art can apply to anything including often dry subjects like central banking and fiscal policy.

Over to Victoria, who would agree that walkin’ can be useful to reduce stress and inflammation, both of which are not good. Maybe some walkin’ could reduce stress, inflammation and inflation. Invest in boots?

HEALTH IS WEALTH

Inflammation – Part 2

Last month, I wrote about inflammation and how nutrition can impact it. It was far from an extensive explanation, but some of the most important nutritional considerations were covered.

While the things we put in our bodies play a major role, so do the things we do to our bodies. Our lifestyle can have a significant impact on inflammation as well. Most of us know that ‘puffy’ feeling we experience when we are tired physically or emotionally. That is our body working hard to protect and heal itself, which can cause inflammation. A lack of sleep can make us more susceptible to weight gain or developing illnesses, such as type 2 diabetes.

While stress and weight gain can cause inflammation, they are rarely isolated aggravators. In other words, not sleeping enough impacts our mood and stress levels. Meanwhile, when we are under-slept, we often make poor food choices. Our hormones are also affected when we are tired. This combination compounds the likelihood of developing illnesses and, over time, will certainly impact our quality of life.

There is a lot we can do to help our bodies and minds stay healthy, especially when we consider how connected they are. The connection between stress and sleep is direct. For example, the quality and quantity of our sleep is reduced significantly when we are stressed. Managing stress through meditation, exercise and breathing are techniques we can use to help control it. Supplements, like magnesium and herbal teas, can also help calm nerves and improve sleep. Our ability to prevent and manage illness is impacted by the choices we make with our diet and what we practice in our daily lives.

Moving forward, stay away from fried, processed foods. Instead, try a more a Mediterranean-based diet, widely researched and known to include disease fighting and anti-inflammatory properties.

Avoid smoking and limit alcohol consumption. Cut out refined sugar, and don’t char your food. This may sound like obvious and repetitive advice heard from doctors, health-conscious friends and even our mothers, but they are simple rules that we are all wise to follow. Take the time to understand what you are putting in your body.

Like most health conditions, inflammation can be controlled by healthy nutrition and lifestyle choices. If we are falling short in these areas, our best route to success is through step-by-step improvements. Remember, it takes time to change our habits. Being informed, having a plan, knowing who and what make you happy, will increase the likelihood of lasting and healthy changes.

Be wise, be healthy. You’re worth it.

‘To sustain it, you must maintain it’

Victoria Bannister

ICM Health Ambassador

Have a question? Contact us here.

Challenging the status quo of the Canadian investment industry.